Ad

Ad

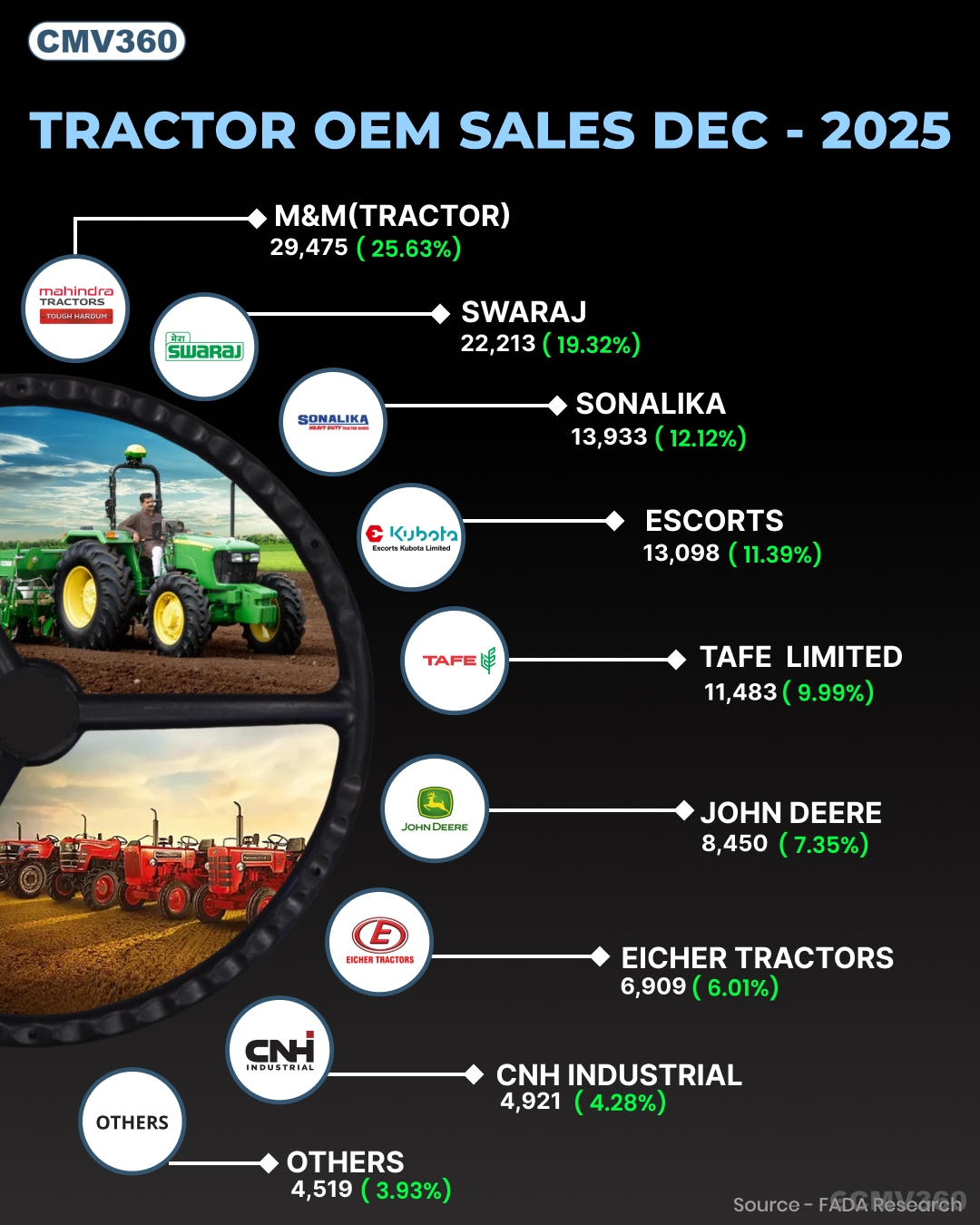

FADA Tractor Retail Market Share December 2025: Mahindra Group Dominates as Sales Cross 1.15 Lakh Units

Key Highlights

Total tractor retail sales crossed 1.15 lakh units.

Mahindra Group retained clear market leadership.

Escorts Kubota recorded strong market share growth.

John Deere and CNH Industrial improved performance.

Smaller OEMs saw a decline in combined market share.

India’s tractor retail market recorded a strong performance in December 2025, with total sales reaching 1,15,001 units, compared to 99,306 units in December 2024, as per FADA Research data. The latest figures highlight steady demand from the farming sector and clear leadership by the Mahindra Group across both its tractor divisions.

Overall Tractor Retail Performance – December 2025

The Indian tractor industry closed December 2025 on a positive note, registering a healthy year-on-year growth in retail volumes. Increased farm activity, timely agricultural operations, and steady rural demand supported higher tractor purchases across regions.

Tractor Retail Sales & Market Share – December 2025

OEM / Brand | Dec’25 Sales (Units) | Market Share Dec’25 | Dec’24 Sales (Units) | Market Share Dec’24 |

Mahindra & Mahindra (Tractor) | 29,475 | 25.63% | 24,295 | 24.46% |

Mahindra & Mahindra (Swaraj) | 22,213 | 19.32% | 18,232 | 18.36% |

International Tractors Ltd | 13,933 | 12.12% | 12,781 | 12.87% |

Escorts Kubota Ltd | 13,098 | 11.39% | 9,257 | 9.32% |

TAFE Ltd | 11,483 | 9.99% | 11,562 | 11.64% |

John Deere India | 8,450 | 7.35% | 6,321 | 6.37% |

Eicher Tractors | 6,909 | 6.01% | 6,972 | 7.02% |

CNH Industrial (India) | 4,921 | 4.28% | 4,054 | 4.08% |

Others | 4,519 | 3.93% | 5,832 | 5.87% |

Total | 1,15,001 | 100% | 99,306 | 100% |

Brand-Wise Tractor Market Share Analysis

Mahindra & Mahindra (Tractor Division)

Mahindra continued to lead the Indian tractor market by a wide margin. The company sold 29,475 units in December 2025, up from 24,295 units in December 2024. Its market share increased to 25.63%, strengthening its position as the country’s largest tractor manufacturer. The brand’s wide dealer network and strong farmer trust remained key growth drivers.

Mahindra & Mahindra (Swaraj Division)

Swaraj retained its strong second position with 22,213 units sold, compared to 18,232 units last year. The division improved its market share to 19.32% from 18.36%, reflecting consistent demand for its reliable and easy-to-maintain tractors.

International Tractors Limited (Sonalika)

International Tractors Limited recorded 13,933 units in December 2025, slightly higher than 12,781 units in December 2024. Despite the volume growth, its market share declined marginally to 12.12% from 12.87%, indicating stronger competition from other brands.

Escorts Kubota Limited (Agri Machinery Group)

Escorts Kubota showed notable improvement, selling 13,098 units, a sharp rise from 9,257 units a year ago. Its market share increased to 11.39% from 9.32%, supported by growing acceptance of its modern tractor range and technology-focused offerings.

TAFE Limited

TAFE sold 11,483 units in December 2025, slightly lower than 11,562 units in December 2024. The company’s market share declined to 9.99% from 11.64%, reflecting slower growth compared to competitors despite stable volumes.

John Deere India (Tractor Division)

John Deere posted strong growth with 8,450 units sold, up from 6,321 units last year. Its market share improved to 7.35% from 6.37%, driven by steady demand for premium and feature-rich tractors.

Eicher Tractors

Eicher Tractors reported 6,909 units, marginally lower than 6,972 units in December 2024. Its market share dropped to 6.01% from 7.02%, showing increased pressure in the mid-range tractor segment.

CNH Industrial (India) Pvt Ltd

CNH Industrial recorded 4,921 units, up from 4,054 units last year. The company improved its market share to 4.28% from 4.08%, supported by demand for New Holland tractors among progressive farmers.

Other Manufacturers

Other tractor manufacturers together accounted for 4,519 units, compared to 5,832 units in December 2024. Their combined market share reduced to 3.93% from 5.87%, indicating the growing dominance of leading OEMs. This category includes brands with less than 1% individual market share.

Key Takeaway from December 2025 Tractor Market

The December 2025 tractor retail data clearly shows consolidation at the top, with Mahindra and Swaraj continuing to dominate the market. Brands like Escorts Kubota, John Deere, and CNH Industrial strengthened their positions, while overall industry volumes showed healthy growth compared to last year. The data reflects sustained confidence in India’s agricultural economy and steady mechanisation trends.

Also Read: Maharashtra Waives Stamp Duty on Farm Loans Up to ₹2 Lakh, Bringing Big Relief to Farmers

CMV360 Says

India’s tractor retail market showed solid year-on-year growth in December 2025, crossing 1.15 lakh units. Mahindra Group strengthened its leadership through both the Mahindra and Swaraj brands. Escorts Kubota, John Deere, and CNH Industrial gained market share, reflecting rising demand for modern and efficient tractors. Overall, the data indicate steady rural demand, higher mechanisation, and growing confidence in the agricultural economy.

News

Sonalika February FY26 Sales Reach Record 12,890 Units

Sonalika reports record February FY26 sales of 12,890 units, driven by rural demand, policy support, and strong response to its Gold Series tractors across domestic and e...

02-Mar-26 01:15 PM

Read Full NewsMahindra & Mahindra Ltd to Exit Japan Agri Equipment JV Amid Rising Losses

Mahindra will liquidate its Japan agri equipment JV amid losses. Production ends by FY2027 as the company shifts focus to profitable global farm markets....

02-Mar-26 12:28 PM

Read Full NewsMahindra & Mahindra Ltd. Tractor Sales Jump 35% to 32,153 Units in February 2026

Mahindra reports 34% rise in Feb 2026 tractor sales. Domestic sales jump 35%, exports grow 20%, and YTD sales increase 24% year-on-year....

02-Mar-26 07:04 AM

Read Full NewsVST Tillers Tractors Ltd Sells 3,963 Power Tillers and 472 Tractors in February 2026

VST reports 36% growth in February 2026 sales. Power tillers and tractors record strong year-on-year and YTD growth figures....

02-Mar-26 05:01 AM

Read Full NewsEscorts Kubota Limited Reports 20.4% Growth with 10,339 Tractors Sold in February 2026

Escorts Kubota sold 10,339 tractors in February 2026, reporting 20.4% growth driven by strong domestic demand and steady April–February performance....

02-Mar-26 04:32 AM

Read Full NewsSwaraj Tractors Unveils the All-New Swaraj 843 XT Tractor for Modern Farmers

Swaraj launches 843 XT tractor with higher power, strong hydraulics, advanced gears, and 2WD & 4WD options for modern farmers seeking performance, comfort, and efficiency...

25-Feb-26 04:31 AM

Read Full NewsAd

Ad

Latest Articles

Diesel Tractor vs Electric Tractor in India (2026)

23-Feb-2026

Top 10 Mileage Tractors in India 2026: Price, Specs

18-Feb-2026

Krishi Darshan Expo 2026 Hisar: 6 Big Reasons Farmers Should Not Miss This Mega Agri Fair

16-Feb-2026

What to Look at Before Buying a New Tractor in India 2026

13-Feb-2026

Spring Sugarcane Cultivation: How Farmers Can Get Better Yields and Higher Profits

12-Feb-2026

Single and Double Clutch in Tractors: Which One Is the Right Choice for Your Farming Needs?

02-Feb-2026

View All Articles

As featured on:

Registered Office Address

Delente Technologies Pvt. Ltd.

M3M Cosmopolitan, 12th Cosmopolitan,

Golf Course Ext Rd, Sector 66, Gurugram, Haryana

pincode - 122002