Ad

Ad

FADA Three-Wheeler Retail Sales Report November 2025: Market Grows 23.67% YoY, with 1,33,951 Units Sold

Key Highlights:

Total sales: 1,33,951 units.

Market up 23.67% YoY.

E-rickshaw segments show strong growth.

Bajaj leads with 33.08% share.

EV brands report major gains.

India’s three-wheeler market continued its strong upward momentum in November 2025, driven by the rising demand for electric rickshaws, passenger carriers, and cargo EVs. According to FADA data, a total of 1,33,951 units were retailed across the country, reflecting a 3.42% month-on-month growth and a robust 23.67% year-on-year increase compared to November 2024. This steady rise highlights the fast-growing shift toward electric mobility. Below is a simple and detailed breakdown of each three-wheeler category and brand performance.

Also Read: FADA Three-Wheeler Retail Sales Report September 2025: 98,866 Units Sold Across India

Category-Wise Three-Wheeler Sales – November 2025

Category | Nov’25 | Oct’25 | Nov’24 | MoM Change | YoY Change |

Total 3W | 1,33,951 | 1,29,517 | 1,08,317 | +3.42% | +23.67% |

E-Rickshaw (Passenger) | 48,839 | 37,117 | 40,369 | +31.58% | +20.98% |

E-Rickshaw With Cart (Goods) | 8,160 | 6,979 | 5,425 | +16.92% | +50.41% |

Three-Wheeler (Goods) | 13,355 | 15,239 | 10,960 | -12.36% | +21.85% |

Three-Wheeler (Passenger) | 63,451 | 69,937 | 51,482 | -9.27% | +23.25% |

Three-Wheeler (Personal) | 146 | 245 | 81 | -40.41% | +80.25% |

Market Trend Summary

Total Three-Wheeler Sales (1,33,951 Units): India sold 1,33,951 three-wheelers in November 2025. This is higher than the 1,29,517 units in October 2025 and much higher than the 1,08,317 units in November 2024. The overall growth shows that the market is improving strongly, especially in the electric mobility space. The segment also benefited from rising demand in urban cities and better financing availability.

E-Rickshaw (Passenger) – 48,839 Units: The passenger e-rickshaw segment recorded 48,839 units in November 2025. This is a strong 31.58% rise from last month and a 20.98% increase compared to last year. This category continues to dominate India’s last-mile mobility, especially in small towns and cities. The sharp MoM jump shows that electric vehicles are becoming the first choice for daily local transport due to lower running costs and better charging options.

E-Rickshaw With Cart (Goods) – 8,160 Units: Sales of goods-carrying e-rickshaws reached 8,160 units, which is a clear sign of rising acceptance in the delivery and logistics sector. The segment grew 16.92% MoM and an outstanding 50.41% YoY. Small businesses, kirana stores, and last-mile delivery companies are increasingly shifting to electric goods carriers due to their low maintenance and affordable ownership.

Three-Wheeler (Goods Carrier) – 13,355 Units: The goods carrier category sold 13,355 units, which is 12.36% lower MoM, but still 21.85% higher YoY. This means that although monthly sales slowed down, long-term demand remains strong. These vehicles are widely used for small-scale transportation, urban delivery, and commercial logistics.

Three-Wheeler (Passenger Carrier)– 63,451 Units: Passenger carriers registered 63,451 units, showing a 9.27% drop from October, but a healthy 23.25% rise from last year. Seasonal variations may have influenced the month-on-month dip, but the yearly growth shows strong demand in both cities and rural regions. These three-wheelers remain a dependable transport option for short and medium routes.

Three-Wheeler (Personal Use) – 146 Units: Although the segment is very small, 146 personal-use three-wheelers were sold in November. This is a 40.41% decline MoM, but an 80.25% jump YoY. A small but growing group of buyers is opting for personal electric three-wheelers for short-distance private travel, especially in narrow-lane cities.

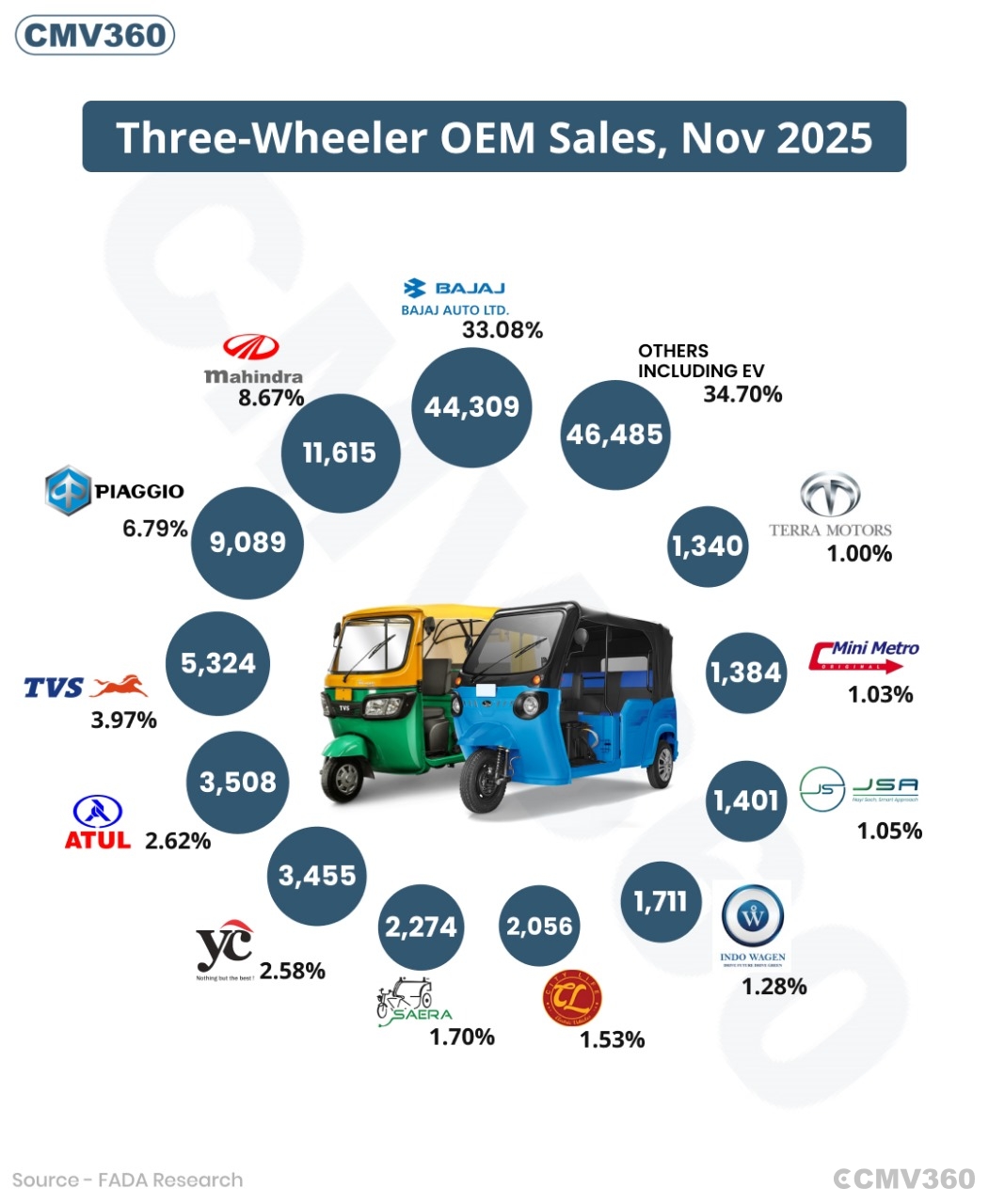

OEM-Wise Three-Wheeler Market Performance – November 2025

OEM | Nov’25 Units | Market Share | Nov’24 Units | Market Share |

Bajaj Auto Ltd | 44,309 | 33.08% | 39,062 | 36.06% |

Mahindra & Mahindra Ltd | 11,615 | 8.67% | 7,868 | 7.26% |

Mahindra Last Mile Mobility (MLMM) | 11,423 | 8.53% | 7,820 | 7.22% |

M&M (Others) | 192 | 0.14% | 48 | 0.04% |

Piaggio Vehicles | 9,089 | 6.79% | 8,840 | 8.16% |

TVS Motor | 5,324 | 3.97% | 2,139 | 1.97% |

Atul Auto | 3,508 | 2.62% | 2,509 | 2.32% |

YC Electric Vehicle | 3,455 | 2.58% | 3,977 | 3.67% |

Saera Electric | 2,274 | 1.70% | 2,261 | 2.09% |

Dilli Electric Auto | 2,056 | 1.53% | 2,044 | 1.89% |

Zeniak Innovation | 1,711 | 1.28% | 672 | 0.62% |

J.S. Auto | 1,401 | 1.05% | 969 | 0.89% |

Mini Metro EV | 1,384 | 1.03% | 1,227 | 1.13% |

Terra Motors | 1,340 | 1.00% | 672 | 0.62% |

Others (Including EVs) | 46,485 | 34.70% | 36,077 | 33.31% |

Total | 1,33,951 | 100% | 1,08,317 | 100% |

Brand Highlights – November 2025

Bajaj Auto Ltd – 44,309 Units (33.08%)

Bajaj Auto continued to dominate the Indian three-wheeler market with 44,309 retail sales. Though its market share slightly dropped compared to last year, Bajaj remains the clear market leader. Its strong network, reliable products, and wide presence in both passenger and goods segments keep it far ahead of competitors.

Mahindra & Mahindra Ltd – 11,615 Units (8.67%)

Mahindra saw a solid jump in sales, reaching 11,615 units. This is significantly higher than its sales last year. The company’s diesel, CNG, and electric three-wheelers are gaining popularity, especially in commercial transport and last-mile movement.

Mahindra Last Mile Mobility (MLMM) – 11,423 Units (8.53%): Mahindra’s dedicated electric mobility division, MLMM, recorded 11,423 units, showing strong customer acceptance. MLMM’s electric passenger rickshaws and goods carriers are becoming more common in urban and semi-urban areas due to their good range and dependable performance.

Mahindra (Others) – 192 Units (0.14%): A smaller Mahindra sub-division registered 192 units, which is small in volume but higher than last year. This includes limited regional products and niche-use three-wheelers.

Piaggio Vehicles – 9,089 Units (6.79%)

Piaggio sold 9,089 units, which is slightly lower in market share compared to last year. However, the company’s Ape series remains a strong player in both passenger and cargo categories. EV variants of the Ape series are also helping Piaggio maintain a stable presence.

TVS Motor Company – 5,324 Units (3.97%)

TVS showed excellent growth with 5,324 units, more than double its performance last year. The company is quickly rising in the EV three-wheeler market, thanks to its dependable electric auto models and growing dealer network.

Atul Auto Ltd – 3,508 Units (2.62%)

Atul Auto recorded 3,508 units, showing steady demand for its reliable and sturdy three-wheelers. The brand is especially popular in rural regions and small towns where durability matters the most.

YC Electric Vehicle – 3,455 Units (2.58%)

YC Electric sold 3,455 units, slightly lower than last year. The company remains strong in the passenger e-rickshaw market, offering affordable and low-maintenance EV models widely used by city drivers.

Saera Electric Auto – 2,274 Units (1.70%)

Saera delivered 2,274 units, almost the same as last year. The brand is known for producing electric rickshaws under multiple sub-brands and continues to attract budget-focused EV buyers.

Dilli Electric Auto – 2,056 Units (1.53%)

Dilli Electric sold 2,056 units, maintaining a stable market presence. Their electric rickshaws are widely used for short-distance rides in congested city areas due to affordability and easy service support.

Zeniak Innovation India – 1,711 Units (1.28%)

Zeniak posted strong YoY growth with 1,711 units, almost triple its sales from last year. The brand is expanding rapidly by offering powerful and long-range electric rickshaws for commercial use.

J.S. Auto – 1,401 Units (1.05%)

J.S. Auto retailed 1,401 units, showing steady acceptance among buyers looking for simple and durable three-wheeler models.

Mini Metro EV LLP – 1,384 Units (1.03%)

Mini Metro EV sold 1,384 units, performing nearly the same as last year. The brand focuses on affordable electric rickshaws for small-town and rural users.

Terra Motors India – 1,340 Units (1.00%)

Terra Motors recorded 1,340 units, showcasing strong YoY growth. The company is gaining popularity with its modern electric autos designed for both passenger and goods use.

Others (Including EVs) – 46,485 Units (34.70%)

A large number of smaller brands together sold 46,485 units, contributing a major share of the market. This category includes many emerging EV companies offering low-cost e-rickshaws, especially in Tier-2 and Tier-3 regions.

Data Source & Notes

Data from FADA Research, updated as of 03 December 2025

Compiled from 1,401 out of 1,459 RTOs

Telangana (TS) data not included

The “Others” category includes brands with less than 1% market share

CMV360 Says

India’s three-wheeler market closed November 2025 on a strong note with solid growth across key segments, especially electric passenger and cargo e-rickshaws. While some ICE categories saw month-on-month dips, overall demand remained high due to rising last-mile mobility needs and expanding EV adoption. Strong performances by Bajaj, Mahindra, TVS, and emerging EV players show that the segment is moving steadily toward cleaner and more efficient mobility solutions nationwide.

News

CMV360 Weekly Wrap-Up | 19–23 Jan 2026: Tata’s Biggest Truck Launch, Electric Bus Expansion, Clean Mobility Push, Farm Policy Changes & Market Relief

Key highlights from 19–23 Jan 2026: major truck launches, electric bus expansion, clean mobility progress, new tractor introductions, farmer policy changes, and market tr...

24-Jan-26 08:56 AM

Read Full NewsAshok Leyland Revives TAURUS and HIPPO with Next-Generation Heavy-Duty Technology

Ashok Leyland brings back TAURUS and HIPPO trucks with next-gen technology, powerful engines, and improved durability to meet India’s growing mining and infrastructure tr...

22-Jan-26 12:26 PM

Read Full NewsFinnfund Invests $15 Million in Transvolt Mobility to Boost Electric Heavy Vehicles in India

Finnfund invests USD 15 million in Transvolt Mobility to expand electric buses and trucks in India, supporting clean transport, job creation, and India’s sustainable mobi...

22-Jan-26 04:52 AM

Read Full NewsMahindra Launches Refreshed Bolero Camper and Bolero Pik-Up with New Features and Comfort Upgrades

Mahindra refreshes Bolero Camper and Pik-Up with bold styling, iMAXX telematics, air conditioning, and improved comfort, reinforcing its leadership in India’s pickup segm...

21-Jan-26 01:01 PM

Read Full NewsFresh Bus and Exponent Energy Partner to Deploy Rapid-Charging Electric Intercity Buses in India

Fresh Bus and Exponent Energy partner to deploy rapid-charging electric intercity buses, enabling long-distance travel with 15-minute charging and high-power infrastructu...

21-Jan-26 10:07 AM

Read Full NewsGreenCell Mobility Secures $89 Million to Rapidly Expand Electric Bus Network Across India

GreenCell Mobility raises $89 million to expand its electric bus fleet across India, boosting clean public transport, charging infrastructure, and zero-emission mobility ...

21-Jan-26 07:12 AM

Read Full NewsAd

Ad

Latest Articles

Top 10 Electric Trucks in India 2026: Price, Range, & Payload

22-Jan-2026

Diesel vs CNG vs Electric Trucks in India 2026: Choosing the Right Truck for Your Business Needs

21-Jan-2026

Electric Commercial Vehicles in India 2026: Complete Guide to Electric Trucks, Buses, and Three Wheelers with Prices

19-Jan-2026

Top 5 High-Mileage Trucks in India 2026

16-Jan-2026

Top 10 CNG Trucks in India 2026: Best CNG Models

12-Jan-2026

Popular Bus Brands in India 2026

08-Jan-2026

View All articles