Ad

Ad

FADA Retail CV Sales November 2025 Report: 94,935 Units Sold, Tata Leads Market, Mahindra Close Behind

Key Highlights:

Total CV sales reached 94,935 units in Nov 2025.

Tata Motors led with 35.07% market share.

Mahindra followed closely at 29.73% share.

LCV remained the highest-selling category.

Electric mobility demand continued to rise.

India’s commercial vehicle market recorded 94,935 retail sales in November 2025, reflecting a 14.46% decline compared to 1,10,986 units in November 2024, but a 19.94% growth over 79,152 units sold in November 2023. This indicates a stable recovery in fleet replacement demand, logistics movement, and infrastructure activities across the country.

Also Read: FADA Retail CV Sales October 2025: 1,07,841 Units Sold, Mahindra Tops the Market, Tata Close Behind

Category-Wise Sales Table – November 2025

Category | Nov 2025 | Nov 2024 | Nov 2023 | YoY Change vs 2024 | YoY Change vs 2023 |

Total CV | 94,935 | 1,10,986 | 79,152 | -14.46% | +19.94% |

LCV | 58,968 | 75,959 | 49,743 | -22.37% | +18.55% |

MCV | 7,234 | 7,246 | 4,978 | -0.17% | +45.32% |

HCV | 28,659 | 27,750 | 24,367 | +3.28% | +17.61% |

Others | 74 | 31 | 64 | +138.71% | +15.63% |

The Light Commercial Vehicle segment accounted for the highest volume, while HCVs showed steady expansion driven by freight and infrastructure movement.

Category-Wise Performance Overview – November 2025

India recorded 94,935 total commercial vehicle (CV) retail sales in November 2025. This reflects a 14.46% decline from 1,10,986 units sold in November 2024, but a 19.94% rise over 79,152 units sold in November 2023. The market shows a mixed trend — slower than last year but still stronger than pre-recovery volumes seen in 2023.

The Light Commercial Vehicle (LCV) segment remained the largest contributor with 58,968 units sold. However, sales fell 22.37% compared to 75,959 units in November 2024. Still, the segment improved by 18.55% over 49,743 units sold in 2023, indicating steady demand for pickups and small commercial vehicles used in last-mile delivery, logistics, and rural transport.

The Medium Commercial Vehicle (MCV) segment recorded 7,234 units compared to 7,246 units last year, showing a very minimal decline of 0.17%. But compared to 4,978 units sold in November 2023, the segment witnessed a strong 45.32% rise, supported by interstate movement, institutional demand, and industrial applications.

The Heavy Commercial Vehicle (HCV) category registered 28,659 units, marginally higher than 27,750 units last year, posting a 3.28% year-on-year increase. Compared to 24,367 units in November 2023, HCV sales rose 17.61%, highlighting strong demand from freight, mining, infrastructure, and construction sectors.

The “Others” category, which includes niche OEMs and small-volume brands, saw 74 units in November 2025, improving sharply from 31 units last year — a 138.71% increase. Over 64 units recorded in November 2023, the segment also posted a 15.63% growth, showing expanding interest in alternative commercial applications and emerging manufacturers.

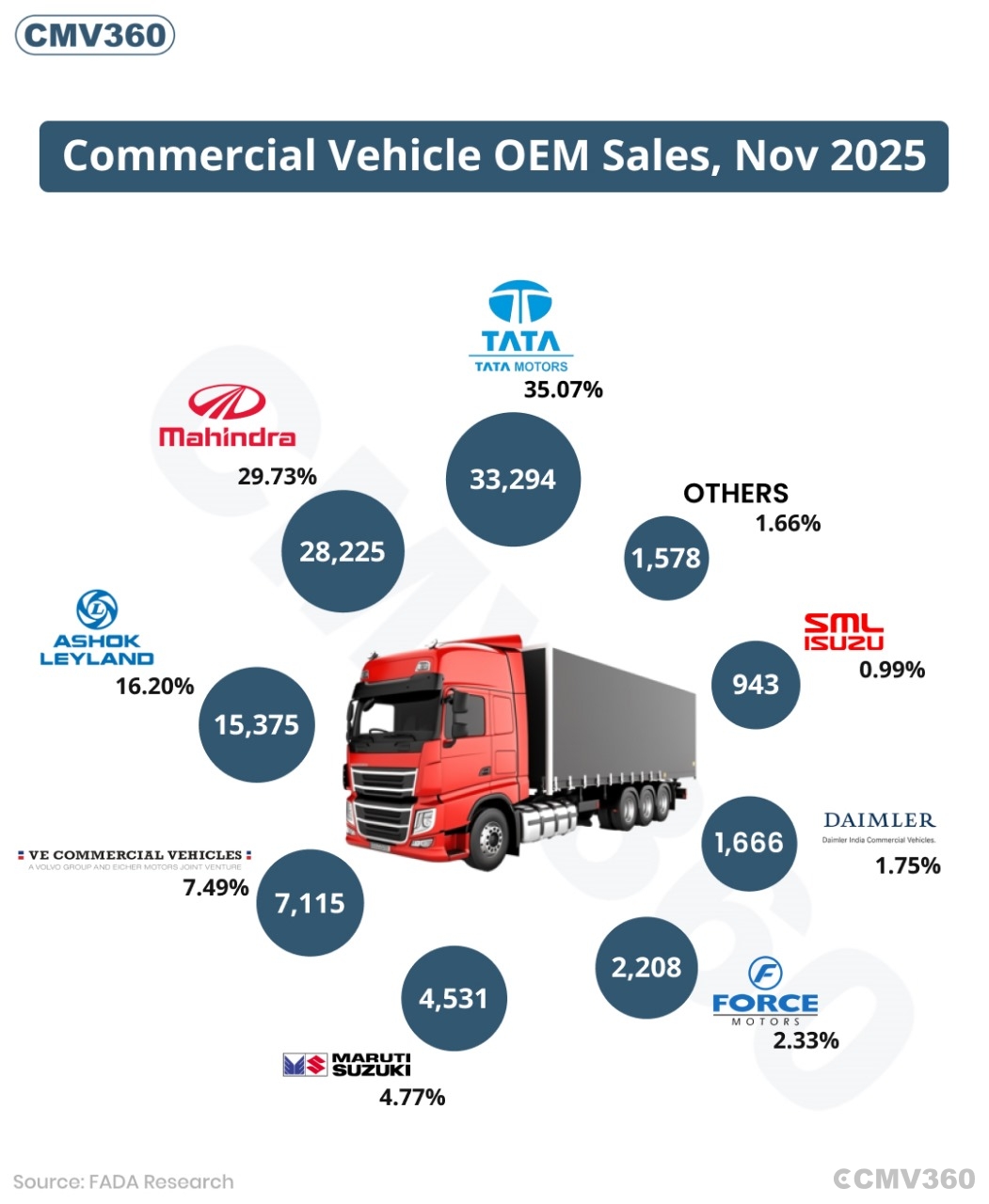

OEM-Wise Market Share Table – November 2025

OEM | Nov 2025 Sales | Market Share (%) | Nov 2024 Sales | Market Share (%) |

Tata Motors Ltd | 33,294 | 35.07% | 28,428 | 35.92% |

Mahindra & Mahindra Ltd | 28,225 | 29.73% | 23,324 | 29.47% |

Mahindra & Mahindra Ltd (Second Entry) | 26,010 | 27.40% | 21,637 | 27.34% |

Mahindra Last Mile Mobility Ltd | 2,215 | 2.33% | 1,687 | 2.13% |

Ashok Leyland Ltd | 15,375 | 16.20% | 12,907 | 16.31% |

Ashok Leyland Ltd (Second Entry) | 15,251 | 16.06% | 12,875 | 16.27% |

Switch Mobility Automotive Ltd | 124 | 0.13% | 32 | 0.04% |

VE Commercial Vehicles Ltd | 7,115 | 7.49% | 5,648 | 7.14% |

VE Commercial Vehicles Ltd (Second Entry) | 7,079 | 7.46% | 5,605 | 7.08% |

Volvo Buses Division (VECV) | 36 | 0.04% | 43 | 0.05% |

Maruti Suzuki India Ltd | 4,531 | 4.77% | 3,746 | 4.73% |

Force Motors Ltd | 2,208 | 2.33% | 1,769 | 2.23% |

Daimler India Commercial Vehicles | 1,666 | 1.75% | 1,611 | 2.04% |

SML Isuzu Ltd | 943 | 0.99% | 862 | 1.09% |

Others | 1,578 | 1.66% | 857 | 1.08% |

Total | 94,935 | 100% | 79,152 | 100% |

Brand-Wise Retail Performance Overview

Tata Motors

Tata Motors led the market with 33,294 units and a 35.07% market share, slightly lower than last year’s 35.92%. The brand continues to enjoy strong demand in HCV and LCV categories due to its wide product portfolio and strong retail network.

Mahindra & Mahindra

Mahindra followed with 28,225 units and a 29.73% market share, compared to 23,324 units last year. Its consistent performance highlights its strength in pickups, small commercial vehicles, and fleet sales.

Mahindra & Mahindra (Second Entry): With 26,010 units sold and 27.40% share, this entry represents another strong segment in Mahindra’s portfolio, showing demand consistency over last year’s performance of 21,637 units.

Mahindra Last Mile Mobility: Mahindra’s electric and last-mile mobility division sold 2,215 units, slightly improving its share from 2.13% to 2.33%. Last-mile mobility solutions such as electric 3-wheelers continue gaining traction.

Ashok Leyland

Ashok Leyland posted 15,375 units at 16.20% share and an additional 15,251 units at 16.06% share. Both entries reflect its steady presence in truck, bus and institutional fleet markets.

Switch Mobility

Switch Mobility recorded 124 units, a big jump from 32 units last year, reflecting rising demand for electric buses in urban transport systems.

VE Commercial Vehicles (VECV)

VECV reported 7,115 units (7.49% share) and 7,079 units (7.46% share) under dual reporting, while its Volvo Bus division sold 36 units. The brand continues to maintain a stable position backed by its Eicher commercial vehicle portfolio.

Maruti Suzuki

Maruti Suzuki achieved 4,531 units and 4.77% share, improving slightly from 4.73% last year. Its Super Carry remains a popular small CV choice among fleet buyers.

Force Motors

Force Motors delivered 2,208 units (2.33%), rising from 1,769 units last year due to demand for passenger carriers in rural tourism and government fleet usage.

Daimler India Commercial Vehicles

Daimler registered 1,666 units, but its market share slipped from 2.04% to 1.75%. Competition in premium truck segments and price-sensitive demand restricted growth.

SML Isuzu

SML Isuzu sold 943 units, compared to 862 units last year. Although the count improved, its market share saw a slight reduction from 1.09% to 0.99%.

Other Players

Other OEMs collectively sold 1,578 units, accounting for 1.66% market share, up from 857 units last year. These include growing niche and regional brands with specialized fleet offerings.

Also Read: Andhra Pradesh Announces 1,000 Electric Buses and 5,000 EV Charging Stations

CMV360 Says

Retail CV demand in November 2025 reflects mixed trends, with year-on-year declines but positive momentum compared to 2023. Tata Motors and Mahindra continue their leadership, supported by robust LCV and HCV sales. Rising interest in electric mobility, steady infrastructure spending, and freight movement are expected to support continued growth.

With increasing fleet upgrades and stronger rural market traction, the commercial vehicle industry is likely to see a healthier outlook moving into early 2026.

News

CMV360 Weekly Wrap-Up | 19–23 Jan 2026: Tata’s Biggest Truck Launch, Electric Bus Expansion, Clean Mobility Push, Farm Policy Changes & Market Relief

Key highlights from 19–23 Jan 2026: major truck launches, electric bus expansion, clean mobility progress, new tractor introductions, farmer policy changes, and market tr...

24-Jan-26 08:56 AM

Read Full NewsAshok Leyland Revives TAURUS and HIPPO with Next-Generation Heavy-Duty Technology

Ashok Leyland brings back TAURUS and HIPPO trucks with next-gen technology, powerful engines, and improved durability to meet India’s growing mining and infrastructure tr...

22-Jan-26 12:26 PM

Read Full NewsFinnfund Invests $15 Million in Transvolt Mobility to Boost Electric Heavy Vehicles in India

Finnfund invests USD 15 million in Transvolt Mobility to expand electric buses and trucks in India, supporting clean transport, job creation, and India’s sustainable mobi...

22-Jan-26 04:52 AM

Read Full NewsMahindra Launches Refreshed Bolero Camper and Bolero Pik-Up with New Features and Comfort Upgrades

Mahindra refreshes Bolero Camper and Pik-Up with bold styling, iMAXX telematics, air conditioning, and improved comfort, reinforcing its leadership in India’s pickup segm...

21-Jan-26 01:01 PM

Read Full NewsFresh Bus and Exponent Energy Partner to Deploy Rapid-Charging Electric Intercity Buses in India

Fresh Bus and Exponent Energy partner to deploy rapid-charging electric intercity buses, enabling long-distance travel with 15-minute charging and high-power infrastructu...

21-Jan-26 10:07 AM

Read Full NewsGreenCell Mobility Secures $89 Million to Rapidly Expand Electric Bus Network Across India

GreenCell Mobility raises $89 million to expand its electric bus fleet across India, boosting clean public transport, charging infrastructure, and zero-emission mobility ...

21-Jan-26 07:12 AM

Read Full NewsAd

Ad

Latest Articles

Top 10 Electric Trucks in India 2026: Price, Range, & Payload

22-Jan-2026

Diesel vs CNG vs Electric Trucks in India 2026: Choosing the Right Truck for Your Business Needs

21-Jan-2026

Electric Commercial Vehicles in India 2026: Complete Guide to Electric Trucks, Buses, and Three Wheelers with Prices

19-Jan-2026

Top 5 High-Mileage Trucks in India 2026

16-Jan-2026

Top 10 CNG Trucks in India 2026: Best CNG Models

12-Jan-2026

Popular Bus Brands in India 2026

08-Jan-2026

View All articles