Ad

Ad

FADA Three-Wheeler Retail Sales Report December 2025: Sales Slip 4.61% YoY to 1,27,772 Units

Key Highlights

Total three-wheeler sales stood at 1,27,772 units.

The overall market declined 4.61% month-on-month.

Passenger e-rickshaws led sales with strong growth.

Bajaj Auto remained the top OEM by market share.

EV-focused brands continued gaining market presence.

India’s three-wheeler retail market saw a mild slowdown in December 2025, with total sales reaching 1,27,772 units, according to FADA Research. This marks a 4.61% year-on-year decline compared to December 2024, mainly due to lower sales in passenger and goods ICE segments. However, electric three-wheelers, especially e-rickshaws, continued to show strong acceptance and growth.

Overall Three-Wheeler Market Performance – December 2025

In December 2025, the three-wheeler segment recorded 1,27,772 units, down from 1,33,951 units in November 2025 and 93,879 units in December 2024. Despite the monthly and yearly pressure, the market remains supported by rising EV penetration and steady demand for last-mile mobility solutions.

Segment-Wise Three-Wheeler Sales Breakdown – December 2025

Segment | Dec’25 Units | Nov’25 Units | Dec’24 Units | MoM Change (%) | YoY Change (%) |

Total Three-Wheelers | 1,27,772 | 1,33,951 | 93,879 | -4.61 | 36.10 |

E-Rickshaw (Passenger) | 57,478 | 48,839 | 40,834 | +17.69 | +40.76 |

E-Rickshaw with Cart (Goods) | 7,607 | 8,160 | 5,824 | -6.78 | +30.61 |

Three-Wheeler (Goods) | 11,214 | 13,355 | 9,127 | -16.03 | +22.87 |

Three-Wheeler (Passenger) | 51,363 | 63,451 | 38,026 | -19.05 | +35.07 |

Three-Wheeler (Personal) | 110 | 146 | 68 | -24.66 | +61.76 |

Segment-Wise Three-Wheeler Sales Breakdown

E-Rickshaw (Passenger) Leads EV Growth

Passenger e-rickshaws emerged as the strongest segment, selling 57,478 units. This category registered a 17.69% growth and showed a solid 40.76% rise over last year, highlighting the continued shift toward affordable electric mobility in urban and semi-urban areas.

E-Rickshaw with Cart (Goods)

Goods-carrying e-rickshaws recorded 7,607 units. Although sales dipped by 6.78%, the segment still delivered a healthy 30.61% year-on-year growth, driven by demand from small traders and local delivery operators.

Three-Wheeler Goods Segment Under Pressure

The conventional goods three-wheeler segment sold 11,214 units, declining by 16.03%. On a yearly basis, it still managed a 22.87% increase, showing that long-term demand remains intact despite short-term softness.

Passenger Three-Wheelers See Decline

Passenger three-wheelers reported 51,363 units, registering a 19.05% drop. However, this segment still recorded a 35.07% improvement over December 2024, indicating a strong annual recovery.

Personal Three-Wheelers Remain Niche

The personal-use three-wheeler category remained very small with 110 units, witnessing a 24.66% decline, though it posted a sharp 61.76% year-on-year growth due to a low base.

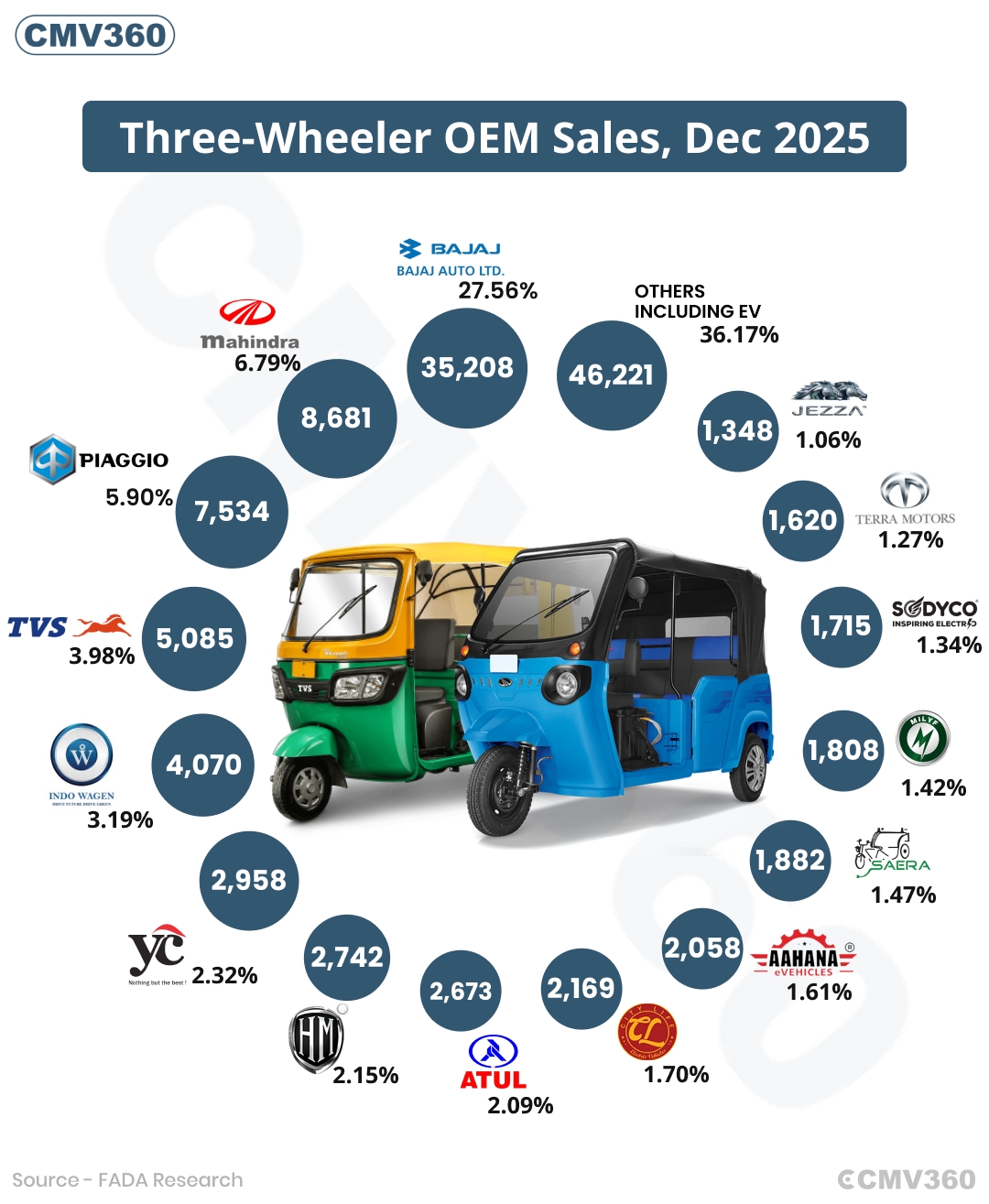

OEM-Wise Three-Wheeler Market Share – December 2025 (Brand-Wise)

OEM / Brand | Dec’25 Units | Market Share (%) | Dec’24 Units | Market Share (%) |

Bajaj Auto Ltd | 35,208 | 27.56 | 28,995 | 30.89 |

Mahindra & Mahindra Ltd | 8,681 | 6.79 | 6,152 | 6.55 |

Mahindra Last Mile Mobility Ltd | 8,418 | 6.59 | 6,124 | 6.52 |

Mahindra & Mahindra Ltd (Others) | 263 | 0.21 | 28 | 0.03 |

Piaggio Vehicles Pvt Ltd | 7,534 | 5.90 | 6,469 | 6.89 |

TVS Motor Company Ltd | 5,085 | 3.98 | 1,909 | 2.03 |

Zeniak Innovation India Ltd | 4,070 | 3.19 | 1,013 | 1.08 |

YC Electric Vehicle | 2,958 | 2.32 | 3,800 | 4.05 |

Hooghly Motors Pvt Ltd | 2,742 | 2.15 | 461 | 0.49 |

Atul Auto Ltd | 2,673 | 2.09 | 2,232 | 2.38 |

Dilli Electric Auto Pvt Ltd | 2,169 | 1.70 | 2,061 | 2.20 |

Aahana Commerce Pvt Ltd | 2,058 | 1.61 | 393 | 0.42 |

Saera Electric Auto Pvt Ltd | 1,882 | 1.47 | 2,102 | 2.24 |

Fede Industries Pvt Ltd | 1,808 | 1.42 | 177 | 0.19 |

Jajodia Commodities Pvt Ltd | 1,715 | 1.34 | 208 | 0.22 |

Terra Motors India Pvt Ltd | 1,620 | 1.27 | 736 | 0.78 |

Vani Electric Vehicles Pvt Ltd | 1,348 | 1.06 | 480 | 0.51 |

Others (Including EVs) | 46,221 | 36.17 | 36,691 | 39.08 |

Total | 1,27,772 | 100.00 | 93,879 | 100.00 |

OEM-Wise Three-Wheeler Market Share – December 2025 (Brand-Wise)

Bajaj Auto Ltd

Bajaj Auto remained the market leader in December 2025 with 35,208 units sold, securing a 27.56% market share. Despite a lower share compared to December 2024, Bajaj continued to dominate due to its strong presence in both passenger and goods three-wheelers, backed by a wide dealer network and reliable product lineup.

Mahindra & Mahindra Limited

Mahindra & Mahindra reported 8,681 units, accounting for a 6.79% market share. The brand maintained steady growth with its diesel, CNG, and electric three-wheelers, which are widely used for commercial transport and last-mile mobility across urban and rural regions.

Mahindra Last Mile Mobility Ltd: Mahindra Last Mile Mobility sold 8,418 units in December 2025, holding a 6.59% share. The company’s electric-focused portfolio continues to gain popularity, especially in passenger e-rickshaws and small cargo carriers, supporting Mahindra’s strong EV push.

Mahindra & Mahindra Limited (Others): A smaller Mahindra division recorded 263 units, contributing 0.21% market share. Though volumes remain low, this category includes niche and region-specific three-wheeler offerings.

Piaggio Vehicles Pvt Ltd

Piaggio sold 7,534 units, capturing a 5.90% market share. While its share declined compared to last year, the Ape range continues to perform steadily in both passenger and goods segments, supported by Piaggio’s strong brand recall.

TVS Motor Company Ltd

TVS Motor registered 5,085 units in December 2025, with a 3.98% market share. The brand showed strong year-on-year improvement, driven by growing demand for its electric three-wheelers and an expanding dealership network.

Zeniak Innovation India Ltd

Zeniak Innovation recorded 4,070 units, achieving a 3.19% market share. The company showed sharp growth compared to last year, highlighting increasing acceptance of its electric three-wheelers in commercial applications.

YC Electric Vehicle

YC Electric sold 2,958 units, accounting for a 2.32% share. Although volumes declined year-on-year, the brand continues to remain relevant in the affordable passenger e-rickshaw segment.

Hooghly Motors Pvt Ltd

Hooghly Motors reported 2,742 units, holding a 2.15% market share. The company reported strong growth, driven by increasing demand for electric three-wheelers in the eastern and northern markets.

Atul Auto Ltd

Atul Auto retailed 2,673 units in December 2025, with a 2.09% market share. The brand maintained steady demand, especially in rural and semi-urban areas where durability and low maintenance are key buying factors.

Dilli Electric Auto Pvt Ltd

Dilli Electric Auto recorded 2,169 units, capturing a 1.70% market share. The company continued to perform steadily in the budget electric rickshaw space, serving daily urban mobility needs.

Aahana Commerce Pvt Ltd

Aahana Commerce sold 2,058 units, accounting for a 1.61% market share. The brand showed notable improvement compared to last year, reflecting growing demand for low-cost electric three-wheelers.

Saera Electric Auto Pvt Ltd

Saera Electric registered 1,882 units, with a 1.47% share. While volumes were slightly lower than last year, Saera continues to be a familiar name in the electric rickshaw market.

Fede Industries Pvt Ltd

Fede Industries reported 1,808 units, holding a 1.42% market share. The company recorded strong year-on-year growth, driven by expanding distribution and competitive EV offerings.

Jajodia Commodities Pvt Ltd

Jajodia Commodities sold 1,715 units, securing a 1.34% share. The brand showed sharp growth from a low base, indicating rising acceptance of its electric three-wheelers.

Terra Motors India Pvt Ltd

Terra Motors recorded 1,620 units, with a 1.27% market share. The company continued its steady expansion in the electric auto segment with improved product visibility.

Vani Electric Vehicles Pvt Ltd

Vani Electric Vehicles sold 1,348 units, accounting for a 1.06% share. The brand maintained consistent demand in select regional markets.

Others (Including EV Brands)

Other OEMs, including several emerging electric vehicle manufacturers, together sold 46,221 units, contributing a significant 36.17% market share, highlighting the highly fragmented yet rapidly growing nature of India’s three-wheeler EV market.

Market Outlook

December 2025 highlighted a mixed trend for India’s three-wheeler market. While overall volumes dipped slightly, electric segments continued to outperform, driven by low running costs and strong last-mile demand. With expanding EV infrastructure and policy support, the three-wheeler segment is expected to regain momentum in the coming months.

Also Read: FADA Retail CV Sales December 2025: 83,666 Units Sold, Tata Motors Leads Market

CMV360 Says

India’s three-wheeler retail market saw a slight slowdown in December 2025, with total sales at 1,27,772 units. While overall volumes declined month-on-month, electric three-wheelers continued to support the market. Passenger e-rickshaws remained the largest and fastest-growing segment. Bajaj Auto retained market leadership, while Mahindra Group, TVS Motor, and several emerging EV brands showed steady growth, highlighting the sector’s gradual shift toward electric mobility.

News

Ashok Leyland Reports 19,309 CV Sales in Feb 2026, Registers Strong 25.9% YoY Growth

Ashok Leyland reports 19,309 CV sales in February 2026 with strong domestic growth of 32% and overall 25.9% YoY increase despite export decline....

02-Mar-26 11:36 AM

Read Full NewsGreenCell Deploys 75 Electric Buses in Puducherry to Boost Zero-Emission Transport

GreenCell Mobility deploys 75 electric buses in Puducherry to boost zero-emission public transport, improve connectivity, and strengthen sustainable urban mobility infras...

02-Mar-26 09:44 AM

Read Full NewsVE Commercial Vehicles Sales February 2026: 9,986 Units Sold, 23.4% Growth

VECV reports 9,986 unit sales in February 2026, marking 23.4% growth. Eicher domestic sales rise strongly, while Volvo Trucks and Buses record steady performance in the p...

02-Mar-26 07:24 AM

Read Full NewsTata Motors Records 42,940 Commercial Vehicle Sales in February 2026

Tata Motors sold 42,940 commercial vehicles in February 2026, reporting 32% year-on-year growth driven by strong domestic demand and steady export performance across key ...

02-Mar-26 06:15 AM

Read Full NewsMahindra & Mahindra Ltd. Reports 17% Growth in Domestic CV & 3-Wheeler Sales in February 2026

Mahindra records 17% domestic CV and 3W growth and 11% export rise in February 2026 with total sales reaching 97,177 units....

02-Mar-26 05:17 AM

Read Full NewsIndonesia Pauses Massive Import Order From Tata, Mahindra

Indonesia suspends $1.5 billion Tata and Mahindra vehicle import plan amid political and industry concerns....

27-Feb-26 02:13 PM

Read Full NewsAd

Ad

Latest Articles

Best Tata Magic Buses in India 2026

25-Feb-2026

Mahindra Commercial Vehicles in India 2026

24-Feb-2026

Diesel vs Electric Trucks in India 2026: Detailed Comparison of Cost, TCO, Subsidies, Charging & Best Choice for Fleets

21-Feb-2026

Top 10 Buses in India 2026

19-Feb-2026

Top 10 Tata Mini Truck Price List in India 2026

18-Feb-2026

Best Tata Electric Trucks in India 2026

16-Feb-2026

View All articles