Ad

Ad

FADA Retail CV Sales December 2025: 83,666 Units Sold, Tata Motors Leads Market

Key Highlights

Total CV retail sales stood at 83,666 units in December 2025.

The LCV segment remained the highest contributor despite a YoY decline.

The MCV segment recorded the strongest growth over the earlier period.

Tata Motors led the market with over 35% share.

Electric and niche OEMs showed gradual volume improvement.

India’s commercial vehicle (CV) retail market recorded 83,666 units in December 2025, according to FADA Research. While overall sales showed a 9.65% year-on-year decline, demand remained steady across key segments, supported by logistics movement, fleet replacement, and infrastructure activity.

Overall CV Market Performance – December 2025

Total CV retail sales stood at 83,666 units, compared to 92,604 units in December 2024 and 67,145 units earlier, indicating mixed market sentiment with pressure on year-on-year growth but stability in core demand.

Category-Wise CV Sales Performance – December 2025

Category | Retail Sales Dec’25 (Units) | Retail Sales Dec’24 (Units) | Retail Sales (Earlier Period) | YoY Change vs Dec’24 | Change vs Earlier Period |

Total CV | 83,666 | 92,604 | 67,145 | -9.65% | +24.60% |

LCV | 49,251 | 56,637 | 40,222 | -13.04% | +22.45% |

MCV | 6,411 | 7,234 | 4,215 | -11.38% | +52.10% |

HCV | 27,941 | 28,659 | 22,637 | -2.51% | +23.43% |

Others | 63 | 74 | 71 | -14.86% | -11.27% |

Light Commercial Vehicles (LCV)

The LCV segment remained the largest contributor with 49,251 units sold. However, sales declined 13.04% YoY, reflecting cautious buying in last-mile and small fleet operations. Despite this, the segment posted 22.45% growth over the previous base period, showing underlying demand strength.

Medium Commercial Vehicles (MCV)

MCV sales reached 6,411 units, down 11.38% YoY. Compared to earlier volumes, the segment registered a strong 52.10% growth, supported by industrial and institutional usage.

Heavy Commercial Vehicles (HCV)

HCVs recorded 27,941 units, marking a marginal 2.51% decline YoY. The segment still showed 23.43% growth over the earlier period, driven by freight, mining, and infrastructure projects.

Others

The “Others” category stood at 63 units, showing a 14.86% YoY decline and a 11.27% drop over the base period, as niche and low-volume OEMs faced demand pressure.

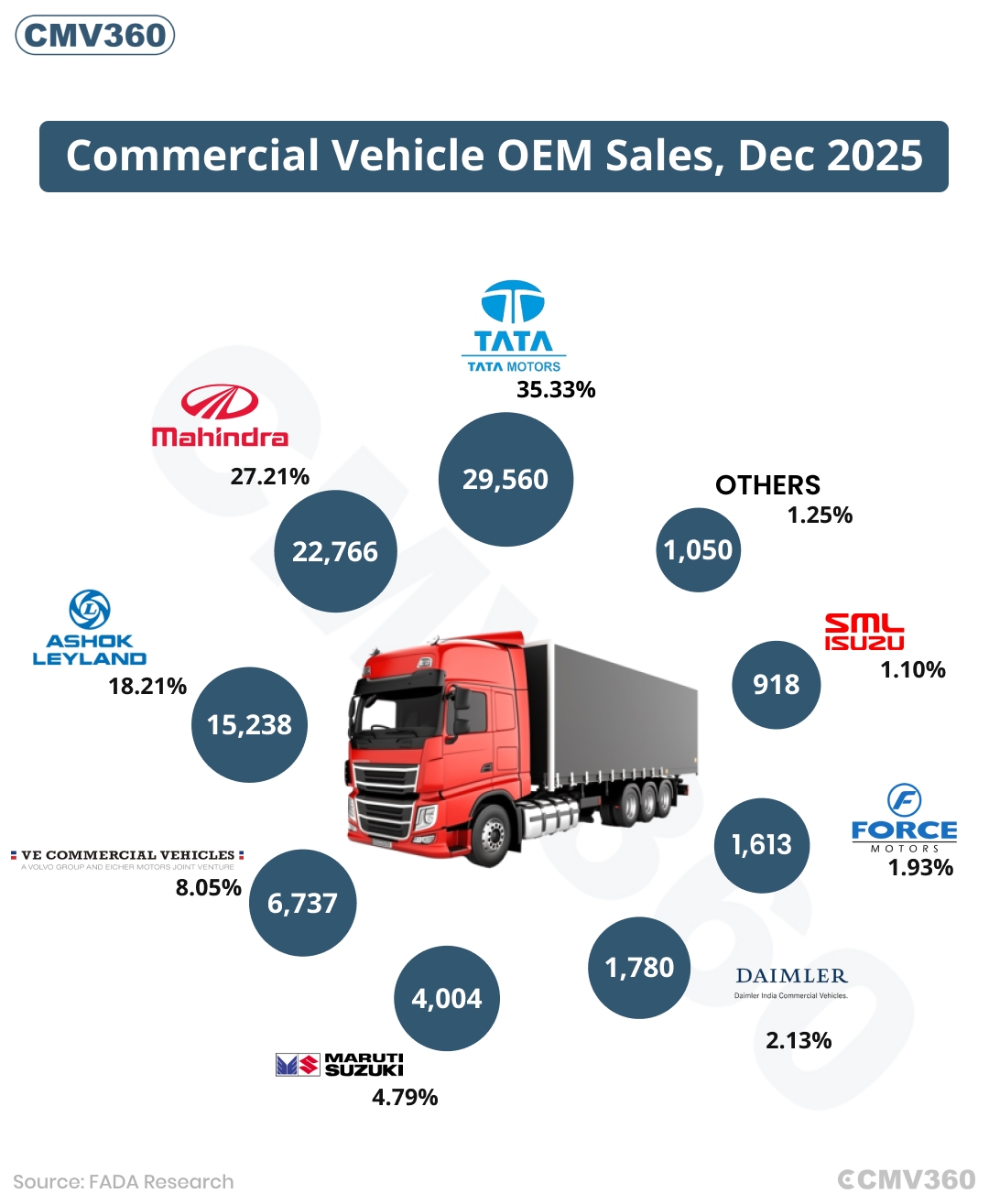

OEM-Wise Market Share – December 2025

OEM / Brand | Retail Sales (Units) | Market Share Dec’25 | Retail Sales Dec’24 | Market Share Dec’24 |

Tata Motors Ltd | 29,560 | 35.33% | 24,327 | 36.23% |

Mahindra & Mahindra Ltd | 22,766 | 27.21% | 18,917 | 28.17% |

Mahindra & Mahindra Ltd (2nd Entry) | 21,504 | 25.70% | 17,516 | 26.09% |

Mahindra Last Mile Mobility Ltd | 1,262 | 1.51% | 1,401 | 2.09% |

Ashok Leyland Ltd | 15,238 | 18.21% | 11,745 | 17.49% |

Ashok Leyland Ltd (2nd Entry) | 14,918 | 17.83% | 11,648 | 17.35% |

Switch Mobility Automotive Ltd | 320 | 0.38% | 97 | 0.14% |

VE Commercial Vehicles Ltd | 6,737 | 8.05% | 4,594 | 6.84% |

VE Commercial Vehicles Ltd (2nd Entry) | 6,656 | 7.96% | 4,529 | 6.75% |

VE Commercial Vehicles Ltd (Volvo Buses Division) | 81 | 0.10% | 65 | 0.10% |

Maruti Suzuki India Ltd | 4,004 | 4.79% | 3,550 | 5.29% |

Force Motors Ltd | 1,613 | 1.93% | 1,280 | 1.91% |

Daimler India Commercial Vehicles Pvt. Ltd | 1,780 | 2.13% | 1,600 | 2.38% |

SML Isuzu Ltd | 918 | 1.10% | 644 | 0.96% |

Others | 1,050 | 1.25% | 488 | 0.73% |

Total | 83,666 | 100.00% | 67,145 | 100.00% |

OEM-Wise Market Share – December 2025

Tata Motors Ltd

Tata Motors emerged as the market leader in December 2025 with retail sales of 29,560 units, capturing a 35.33% market share. Although slightly lower than 36.23% in December 2024, the company maintained its top position due to strong demand across both light and heavy commercial vehicle segments and its wide nationwide dealership network.

Mahindra & Mahindra Ltd

Mahindra & Mahindra reported 22,766 units in December 2025, securing a 27.21% market share, compared to 28.17% last year. The brand continued to perform well in pickups and small commercial vehicles, supported by steady rural and fleet demand.

Mahindra & Mahindra Ltd (Second Entry): Under its second reporting entry, Mahindra & Mahindra sold 21,504 units, accounting for a 25.70% market share, slightly lower than 26.09% in December 2024. This reflects consistent demand across multiple CV sub-segments within Mahindra’s portfolio.

Mahindra Last Mile Mobility Ltd: Mahindra Last Mile Mobility recorded 1,262 units, with its market share declining to 1.51% from 2.09% last year. The softer performance indicates moderated demand in the last-mile mobility and electric small commercial vehicle space.

Ashok Leyland Ltd

Ashok Leyland posted retail sales of 15,238 units, achieving an 18.21% market share, up from 17.49% in December 2024. The company benefited from steady demand in medium and heavy trucks, along with bus segment orders.

Ashok Leyland Ltd (Second Entry): In its second entry, Ashok Leyland recorded 14,918 units with a 17.83% market share, compared to 17.35% last year, reflecting stable growth across institutional and fleet-based sales.

Switch Mobility Automotive Ltd: Switch Mobility sold 320 units in December 2025, holding a 0.38% market share, up from 0.14% in December 2024. The improvement highlights rising adoption of electric buses, particularly in urban public transport projects.

VE Commercial Vehicles Ltd (VECV)

VE Commercial Vehicles reported 6,737 units, capturing an 8.05% market share, compared to 6.84% last year. The brand continued to strengthen its position through its Eicher truck and Eicher bus portfolio.

VE Commercial Vehicles Ltd (Second Entry): Under its second entry, VECV sold 6,656 units, accounting for a 7.96% market share, up from 6.75% in December 2024, indicating stable and balanced growth across vehicle categories.

VE Commercial Vehicles Ltd (Volvo Buses Division): The Volvo Buses division of VECV retailed 81 units, maintaining a 0.10% market share, unchanged from last year, reflecting its niche presence in the premium bus segment.

Maruti Suzuki India Ltd

Maruti Suzuki recorded 4,004 units in December 2025, with a 4.79% market share, slightly lower than 5.29% in December 2024. Demand remained steady for its Super Carry model in the small commercial vehicle category.

Force Motors Ltd

Force Motors sold 1,613 units, achieving a 1.93% market share, marginally higher than 1.91% last year. The growth was supported by demand for passenger carriers and utility vehicles.

Daimler India Commercial Vehicles Pvt. Ltd

Daimler India Commercial Vehicles reported 1,780 units, holding a 2.13% market share, down from 2.38% in December 2024, as competitive pricing and cautious fleet purchases impacted volumes.

SML Isuzu Ltd

SML Isuzu recorded 918 units in December 2025, with a 1.10% market share, improving slightly from 0.96% last year, supported by steady demand in the light and intermediate truck segments.

Other OEMs

Other manufacturers together accounted for 1,050 units, translating to a 1.25% market share, up from 0.73% in December 2024, reflecting the gradual expansion of niche and regional commercial vehicle players.

Market Outlook

Retail CV sales in December 2025 indicate a cautious but stable market. While year-on-year numbers declined, growth over earlier periods highlights ongoing demand from logistics, infrastructure, and freight movement. Tata Motors and Mahindra continue to dominate, while electric and alternative mobility players are gradually expanding their footprint. With infrastructure spending and fleet upgrades expected to continue, the CV market outlook remains steady heading into 2026.

Also Read: Aptiv Secures First ADAS Contract for Indian Commercial Vehicles Ahead of 2027 Safety Norms

CMV360 Says

India’s commercial vehicle retail market closed December 2025 with 83,666 units, reflecting short-term pressure but stable long-term demand. LCVs continued to dominate volumes, while MCV and HCV segments showed strong growth over earlier periods. Tata Motors retained clear leadership, followed by Mahindra and Ashok Leyland. Rising infrastructure activity, freight movement, and gradual adoption of electric mobility are expected to support a steady market outlook moving into 2026.

News

Ashok Leyland Reports 19,309 CV Sales in Feb 2026, Registers Strong 25.9% YoY Growth

Ashok Leyland reports 19,309 CV sales in February 2026 with strong domestic growth of 32% and overall 25.9% YoY increase despite export decline....

02-Mar-26 11:36 AM

Read Full NewsGreenCell Deploys 75 Electric Buses in Puducherry to Boost Zero-Emission Transport

GreenCell Mobility deploys 75 electric buses in Puducherry to boost zero-emission public transport, improve connectivity, and strengthen sustainable urban mobility infras...

02-Mar-26 09:44 AM

Read Full NewsVE Commercial Vehicles Sales February 2026: 9,986 Units Sold, 23.4% Growth

VECV reports 9,986 unit sales in February 2026, marking 23.4% growth. Eicher domestic sales rise strongly, while Volvo Trucks and Buses record steady performance in the p...

02-Mar-26 07:24 AM

Read Full NewsTata Motors Records 42,940 Commercial Vehicle Sales in February 2026

Tata Motors sold 42,940 commercial vehicles in February 2026, reporting 32% year-on-year growth driven by strong domestic demand and steady export performance across key ...

02-Mar-26 06:15 AM

Read Full NewsMahindra & Mahindra Ltd. Reports 17% Growth in Domestic CV & 3-Wheeler Sales in February 2026

Mahindra records 17% domestic CV and 3W growth and 11% export rise in February 2026 with total sales reaching 97,177 units....

02-Mar-26 05:17 AM

Read Full NewsIndonesia Pauses Massive Import Order From Tata, Mahindra

Indonesia suspends $1.5 billion Tata and Mahindra vehicle import plan amid political and industry concerns....

27-Feb-26 02:13 PM

Read Full NewsAd

Ad

Latest Articles

Best Tata Magic Buses in India 2026

25-Feb-2026

Mahindra Commercial Vehicles in India 2026

24-Feb-2026

Diesel vs Electric Trucks in India 2026: Detailed Comparison of Cost, TCO, Subsidies, Charging & Best Choice for Fleets

21-Feb-2026

Top 10 Buses in India 2026

19-Feb-2026

Top 10 Tata Mini Truck Price List in India 2026

18-Feb-2026

Best Tata Electric Trucks in India 2026

16-Feb-2026

View All articles