Ad

Ad

Electric Three-Wheeler Sales Report – December 2025: Zeniak Innovation, Hooghly Motors & Neptune Green Lead the Market

Key Highlights

Zeniak Innovation led e-rickshaw sales with strong monthly growth.

Hooghly Motors and YC Electric remained key volume contributors.

Vani Electric and Jajodia Commodities posted sharp growth rates.

Neptune Green topped e-cart sales in December 2025.

Several OEMs faced month-on-month pressure despite long-term demand.

India’s electric three-wheeler market closed December 2025 on a mixed but action-packed note, with clear leaders emerging across both e-rickshaw (passenger) and e-cart (cargo) segments. The latest Vahan Dashboard data (as of January 2, 2026) shows how demand patterns shifted sharply toward the year-end, highlighting strong month-on-month surges for several OEMs, while others faced visible year-on-year and month-on-month pressure.

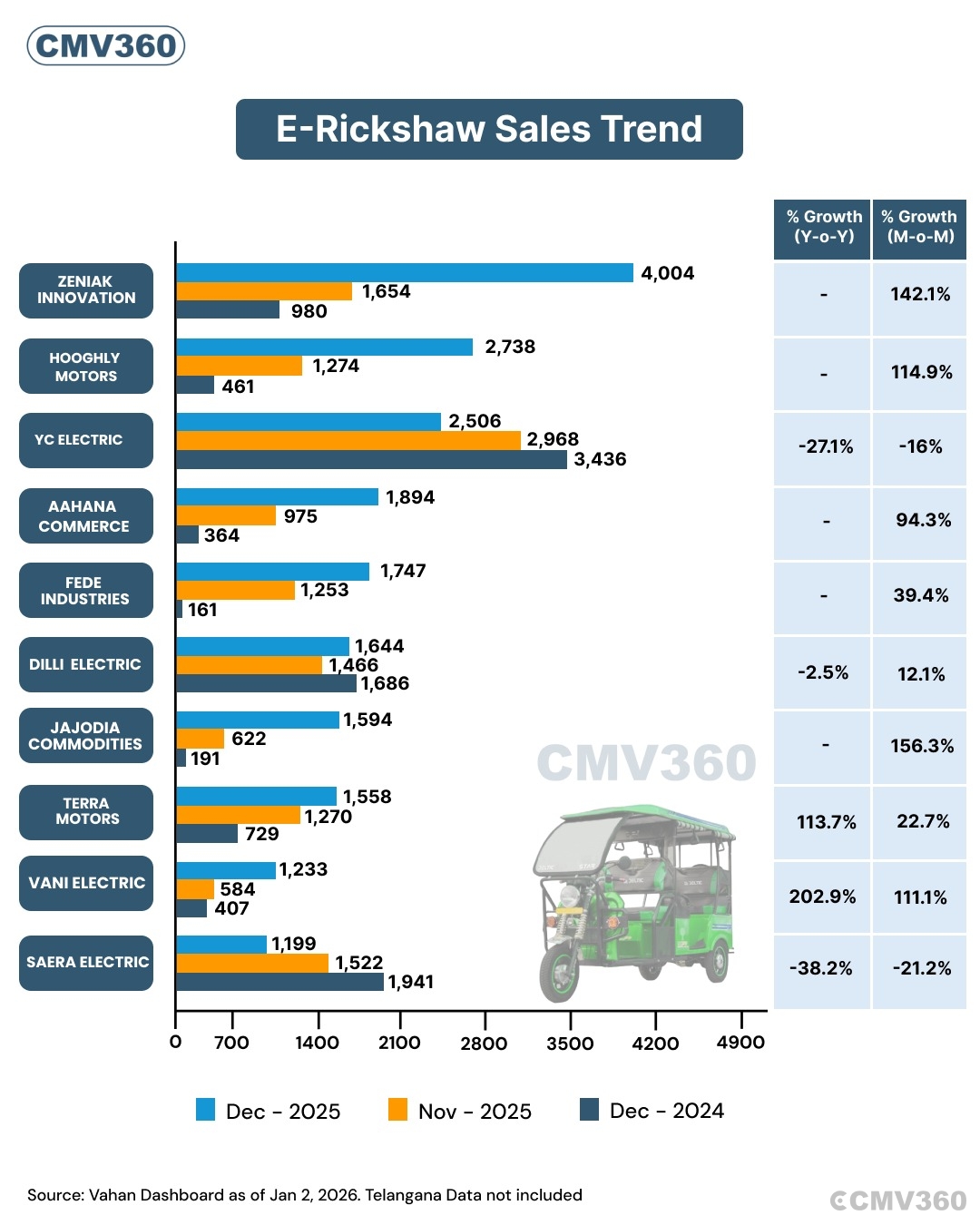

E-Rickshaw Sales Trend by OEM: December 2025 Performance

The Indian e-rickshaw market, a key driver of last-mile passenger mobility, showed a mixed yet dynamic trend in December 2025. As per the Vahan Dashboard data (as of January 2, 2026), several OEMs recorded strong monthly growth, while a few faced year-on-year and month-on-month declines.

Note: Telangana data is not included.

E-Rickshaw Sales by OEM – December 2025

OEM / Brand | Dec-25 Sales | Nov-25 Sales | Dec-24 Sales | YoY Growth (%) | MoM Growth (%) |

Zeniak Innovation | 4,004 | 1,654 | 980 | – | 142.1% |

Hooghly Motors | 2,738 | 1,274 | 461 | – | 114.9% |

YC Electric | 3,436 | 2,968 | 2,506 | -27.1% | -16.0% |

Aahana Commerce | 1,894 | 975 | 364 | – | 94.3% |

Fede Industries | 1,747 | 1,253 | 161 | – | 39.4% |

Dilli Electric | 1,686 | 1,466 | 1,644 | -2.5% | 12.1% |

Jajodia Commodities | 1,594 | 622 | 191 | – | 156.3% |

Terra Motors | 1,558 | 1,270 | 729 | 113.7% | 22.7% |

Vani Electric | 1,233 | 584 | 407 | 202.9% | 111.1% |

Saera Electric | 1,941 | 1,522 | 1,199 | -38.2% | -21.2% |

Source: Vahan Dashboard (as of January 2, 2026)

Note: Telangana registration data is not included.

E-Rickshaw OEMs in December 2025

Zeniak Innovation

Zeniak Innovation emerged as the market leader in December 2025 with 4,004 e-rickshaws registered. The company showed a sharp month-on-month growth of 142.1%, rising strongly from November levels. This performance places Zeniak at the top among all OEMs for the month.

Hooghly Motors

Hooghly Motors reported 2,738 units in December 2025. The brand recorded a solid 114.9% month-on-month growth, reflecting rising acceptance and stronger market penetration toward the end of the year.

YC Electric

YC Electric remained one of the key players with 3,436 units registered in December. However, the company saw a 27.1% year-on-year decline and a 16% month-on-month drop, indicating some slowdown despite healthy volumes.

Aahana Commerce

Aahana Commerce registered 1,894 units in December 2025. The brand posted a strong 94.3% month-on-month growth, showing renewed demand momentum.

Fede Industries

Fede Industries recorded 1,747 units during the month. It achieved a 39.4% month-on-month increase, indicating steady growth compared to November.

Dilli Electric

Dilli Electric sold 1,686 units in December. While the company saw a 2.5% year-on-year decline, it managed a 12.1% rise month-on-month, suggesting short-term recovery.

Jajodia Commodities

Jajodia Commodities delivered 1,594 units in December 2025 and registered a very strong 156.3% month-on-month growth, making it one of the fastest movers of the month.

Terra Motors

Terra Motors reported 1,558 registrations, with a notable 113.7% year-on-year growth and a 22.7% increase month-on-month, highlighting consistent long-term expansion.

Vani Electric

Vani Electric recorded 1,233 units in December. The company showed exceptional growth with 202.9% year-on-year and 111.1% month-on-month increase, marking one of the best growth performances in the segment.

Saera Electric

Saera Electric registered 1,941 units in December 2025. However, it faced a 38.2% year-on-year decline and a 21.2% drop month-on-month, pointing to reduced demand compared to earlier periods.

Overall Market Insight

The December 2025 e-rickshaw sales trend reflects a market driven by sharp monthly growth for several emerging and mid-sized OEMs, while some established players witnessed volume pressure. Zeniak Innovation, Hooghly Motors, and YC Electric remained the top contributors by volume, with brands like Vani Electric, Terra Motors, and Jajodia Commodities standing out for their strong growth rates.

With demand for affordable and clean last-mile mobility continuing across urban and semi-urban areas, the e-rickshaw segment is expected to remain competitive and growth-oriented in the coming months.

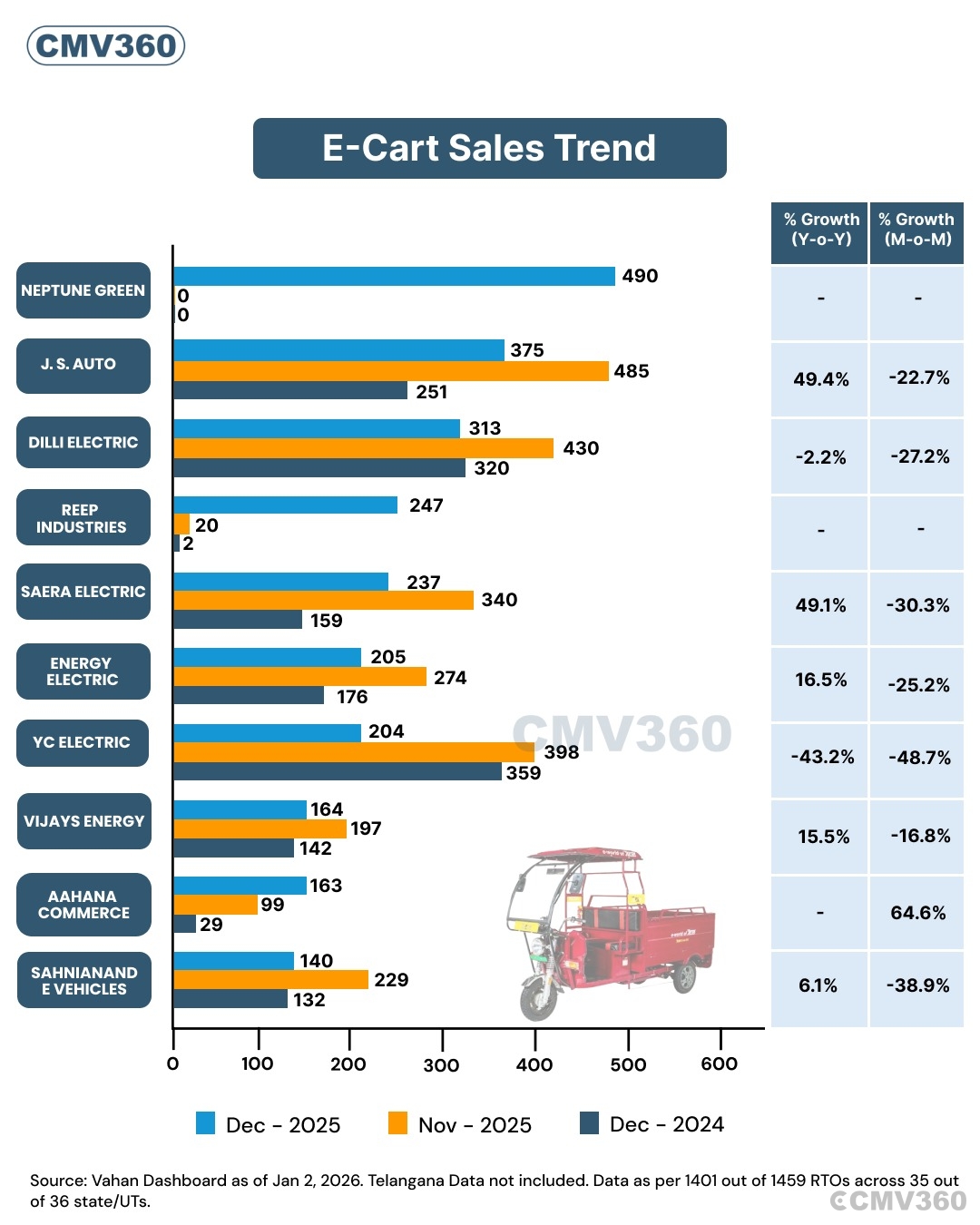

E-Cart Sales Trend by OEM: December 2025 Performance Overview

The Indian e-cart segment, mainly used for goods transport and last-mile delivery, showed a mixed performance in December 2025. According to the Vahan Dashboard data as of January 2, 2026, some OEMs recorded strong leadership in volumes, while several others faced month-on-month and year-on-year pressure.

Telangana data is not included. Data coverage includes 1,401 out of 1,459 RTOs across 35 of 36 states and UTs.

E-Cart Sales by OEM – December 2025

OEM / Brand | Dec-25 Sales | Nov-25 Sales | Dec-24 Sales | YoY Growth (%) | MoM Growth (%) |

Neptune Green | 490 | 0 | 0 | – | – |

J.S. Auto | 375 | 485 | 251 | 49.4% | -22.7% |

Dilli Electric | 313 | 430 | 320 | -2.2% | -27.2% |

Reep Industries | 247 | 20 | 2 | – | – |

Saera Electric | 237 | 340 | 159 | 49.1% | -30.3% |

Energy Electric | 205 | 274 | 176 | 16.5% | -25.2% |

YC Electric | 204 | 398 | 359 | -43.2% | -48.7% |

Vuays Energy | 164 | 197 | 142 | 15.5% | -16.8% |

Aahana Commerce | 163 | 99 | 29 | – | 64.6% |

SahniAnand E-Vehicles | 140 | 229 | 132 | 6.1% | -38.9% |

Source: Vahan Dashboard (as of January 2, 2026)

Note: Telangana data not included; data based on 1,401 of 1,459 RTOs across 35 of 36 states/UTs.

E-Cart OEMs in December 2025

Neptune Green Leads the Market

Neptune Green emerged as the largest e-cart OEM in December 2025, registering 490 units. The company reported no registrations in November 2025 and December 2024, making it the clear volume leader for the month.

J.S. Auto

J.S. Auto secured the second position with 375 units sold in December. The brand recorded a 49.4% year-on-year growth, although it saw a 22.7% month-on-month decline, indicating softer demand compared to November.

Dilli Electric

Dilli Electric followed closely with 313 units in December 2025. The company experienced a 2.2% year-on-year decline and a 27.2% drop month-on-month, reflecting reduced short-term momentum.

Reep Industries

Reep Industries reported 247 e-carts in December 2025. The brand had very low registrations in earlier periods, highlighting fresh activity during the month.

Saera Electric

Saera Electric sold 237 units in December. Despite a strong 49.1% year-on-year growth, the company recorded a 30.3% decline month-on-month, suggesting weaker recent demand.

Energy Electric

Energy Electric registered 205 units. The OEM posted a 16.5% year-on-year growth, but sales fell 25.2% compared to November 2025.

YC Electric

YC Electric recorded 204 units in December. However, the brand saw a sharp 43.2% year-on-year decline and a 48.7% month-on-month drop, marking one of the steepest contractions in the segment.

Vuays Energy

Vuays Energy sold 164 units in December 2025. It achieved a 15.5% year-on-year growth, though sales declined 16.8% month-on-month.

Aahana Commerce

Aahana Commerce registered 163 units in December. The brand showed a strong 64.6% month-on-month growth, indicating rising traction toward year-end.

SahniAnand E-Vehicles

SahniAnand E-Vehicles closed December with 140 units. The OEM recorded a 6.1% year-on-year growth, but sales dropped 38.9% compared to November.

Overall Market Insight

The December 2025 e-cart sales trend shows that while Neptune Green, J.S. Auto, and Dilli Electric led the market in volumes, many OEMs faced month-on-month pressure. At the same time, select brands such as Saera Electric, Energy Electric, and Aahana Commerce maintained positive long-term growth signals. The segment continues to evolve as demand for electric cargo and delivery vehicles expands across urban and semi-urban India.

Also Read: Electric Three-Wheeler Goods Sales Report (December 2025): Mahindra, Bajaj, Omega Lead

CMV360 Says

December 2025 highlighted the evolving nature of India’s electric three-wheeler market. Strong month-on-month growth by emerging OEMs reshaped the e-rickshaw segment, while the e-cart space saw fresh leadership alongside visible short-term pressure for several brands. With rising demand for affordable passenger mobility and electric cargo transport, the market remains competitive and opportunity-driven, supported by expanding adoption across urban and semi-urban regions.

News

Ashok Leyland Reports 19,309 CV Sales in Feb 2026, Registers Strong 25.9% YoY Growth

Ashok Leyland reports 19,309 CV sales in February 2026 with strong domestic growth of 32% and overall 25.9% YoY increase despite export decline....

02-Mar-26 11:36 AM

Read Full NewsGreenCell Deploys 75 Electric Buses in Puducherry to Boost Zero-Emission Transport

GreenCell Mobility deploys 75 electric buses in Puducherry to boost zero-emission public transport, improve connectivity, and strengthen sustainable urban mobility infras...

02-Mar-26 09:44 AM

Read Full NewsVE Commercial Vehicles Sales February 2026: 9,986 Units Sold, 23.4% Growth

VECV reports 9,986 unit sales in February 2026, marking 23.4% growth. Eicher domestic sales rise strongly, while Volvo Trucks and Buses record steady performance in the p...

02-Mar-26 07:24 AM

Read Full NewsTata Motors Records 42,940 Commercial Vehicle Sales in February 2026

Tata Motors sold 42,940 commercial vehicles in February 2026, reporting 32% year-on-year growth driven by strong domestic demand and steady export performance across key ...

02-Mar-26 06:15 AM

Read Full NewsMahindra & Mahindra Ltd. Reports 17% Growth in Domestic CV & 3-Wheeler Sales in February 2026

Mahindra records 17% domestic CV and 3W growth and 11% export rise in February 2026 with total sales reaching 97,177 units....

02-Mar-26 05:17 AM

Read Full NewsIndonesia Pauses Massive Import Order From Tata, Mahindra

Indonesia suspends $1.5 billion Tata and Mahindra vehicle import plan amid political and industry concerns....

27-Feb-26 02:13 PM

Read Full NewsAd

Ad

Latest Articles

Best Tata Magic Buses in India 2026

25-Feb-2026

Mahindra Commercial Vehicles in India 2026

24-Feb-2026

Diesel vs Electric Trucks in India 2026: Detailed Comparison of Cost, TCO, Subsidies, Charging & Best Choice for Fleets

21-Feb-2026

Top 10 Buses in India 2026

19-Feb-2026

Top 10 Tata Mini Truck Price List in India 2026

18-Feb-2026

Best Tata Electric Trucks in India 2026

16-Feb-2026

View All articles