Ad

Ad

FADA Three-Wheeler Retail Sales Report October 2025: 1,29,517 Units Sold Across India

Key Highlights

Tata Motors leads with 41,245 units, marking 11.26% growth YoY.

Mahindra records 27,678 units, a strong 10.54% increase.

Ashok Leyland sees 9.52% growth with 16,780 units sold.

Daimler India, Force Motors, and SML Isuzu show steady performance.

Overall CV sector shows positive sales momentum as per FADA data.

India’s three-wheeler industry recorded a strong performance in October 2025, with total retail sales reaching 1,29,517 units, marking a 31% year-on-year (YoY) growth compared to 98,866 units in September 2025 and 1,22,848 units in October 2024. The growth reflects strong festive season demand and steady momentum in both passenger and goods carrier segments.

Also Read: FADA Three-Wheeler Retail Sales Report September 2025: 98,866 Units Sold Across India

Category-Wise Three-Wheeler Sales Performance

Category | Oct 2025 | Sept 2025 | Oct 2024 | MoM Change | YoY Change |

Total Three-Wheelers (3W) | 1,29,517 | 98,866 | 1,22,848 | +31.00% | +5.43% |

E-Rickshaw (Passenger) | 37,117 | 34,083 | 43,975 | +8.90% | -15.60% |

E-Rickshaw with Cart (Goods) | 6,979 | 6,031 | 5,891 | +15.72% | +18.47% |

Three-Wheeler (Goods Carrier) | 15,239 | 9,569 | 12,719 | +59.25% | +19.81% |

Three-Wheeler (Passenger Carrier) | 69,937 | 49,045 | 60,171 | +42.60% | +16.23% |

Three-Wheeler (Personal Use) | 245 | 138 | 92 | +77.54% | +166.30% |

Category Insights

Total Three-Wheelers (3W): October 2025 saw strong retail momentum with 1,29,517 units sold, driven by festive demand and improved rural transport activity. Compared to last month’s 98,866 units, the market expanded by 31%, showing healthy consumer sentiment.

E-Rickshaw (Passenger): The passenger e-rickshaw segment grew 8.90% month-on-month, reaching 37,117 units, though it registered a 15.60% YoY decline. The fall in yearly numbers suggests a shift towards newer, more durable ICE and hybrid options among buyers.

E-Rickshaw with Cart (Goods): Sales in this segment stood at 6,979 units, rising 15.72% MoM and 18.47% YoY. The segment continues to benefit from the growth of last-mile delivery and small-scale logistics businesses in urban areas.

Three-Wheeler (Goods Carrier): With 15,239 units sold, the goods carrier category posted the highest MoM growth of 59.25% and a YoY increase of 19.81%. The strong numbers indicate growing reliance on compact three-wheelers for intra-city logistics during the festive period.

Three-Wheeler (Passenger Carrier): Passenger carrier sales jumped 42.60% MoM to 69,937 units, marking a 16.23% YoY growth. High rural movement, festival travel, and urban commuting boosted this category’s performance.

Three-Wheeler (Personal Use): Though small in volume, this category grew the fastest, with 245 units sold — a 77.54% MoM and 166.30% YoY rise. The data highlights increasing adoption of personal-use three-wheelers for mobility independence in smaller towns.

Also Read: Electric Three-Wheeler Goods Sales Report (October 2025): Mahindra, Bajaj, and Omega Lead the Market

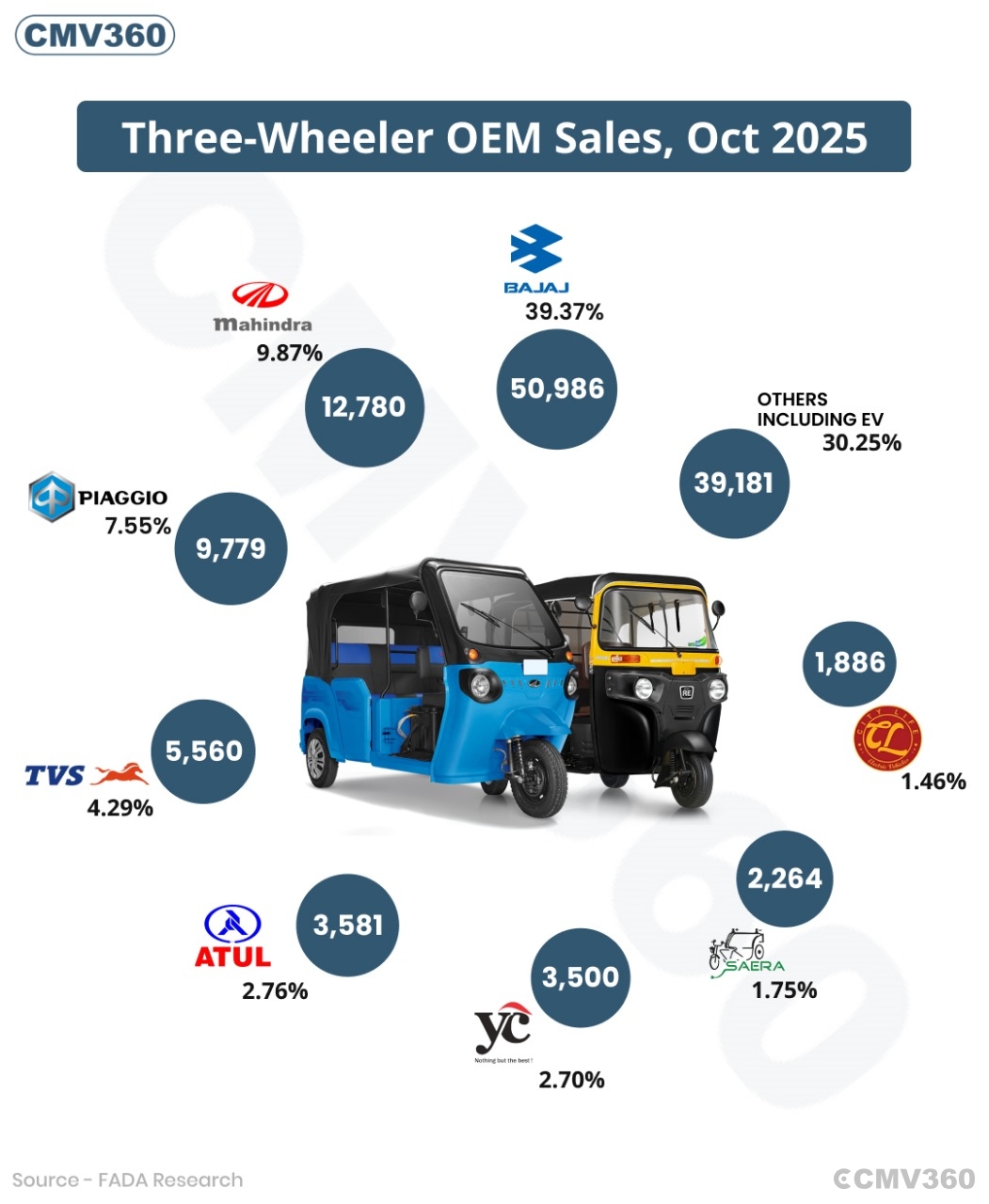

OEM-Wise Market Share – October 2025

OEM / Brand | Sales (Oct ’25) | Market Share (Oct ’25) | Sales (Oct ’24) | Market Share (Oct ’24) |

Bajaj Auto Ltd | 50,986 | 39.37% | 47,983 | 39.06% |

Mahindra & Mahindra Ltd | 12,780 | 9.87% | 8,288 | 6.75% |

Mahindra Last Mile Mobility Ltd | 12,775 | 9.86% | 8,250 | 6.72% |

Mahindra & Mahindra Ltd (Others) | 5 | 0.00% | 38 | 0.03% |

Piaggio Vehicles Pvt Ltd | 9,779 | 7.55% | 9,043 | 7.36% |

TVS Motor Company Ltd | 5,560 | 4.29% | 2,451 | 2.00% |

Atul Auto Ltd | 3,581 | 2.76% | 3,212 | 2.61% |

YC Electric Vehicle | 3,500 | 2.70% | 4,600 | 3.74% |

Saera Electric Auto Pvt Ltd | 2,264 | 1.75% | 2,484 | 2.02% |

Dilli Electric Auto Pvt Ltd | 1,886 | 1.46% | 2,388 | 1.94% |

Others (Including EVs) | 39,181 | 30.25% | 42,399 | 34.51% |

Total | 1,29,517 | 100% | 1,22,848 | 100% |

Source: FADA Research (Data compiled till 04.11.2025 from 1,400 out of 1,458 RTOs, in collaboration with the Ministry of Road Transport & Highways, Government of India. Telangana data not included.)

Brand-Wise Performance Overview

Bajaj Auto Ltd

Bajaj Auto remained the clear market leader in October 2025 with 50,986 units sold, securing a 39.37% market share. Compared to 47,983 units in October 2024, Bajaj recorded both MoM and YoY growth. The brand’s strong performance was led by popular passenger and goods models that continue to dominate India’s urban and rural mobility space.

Mahindra & Mahindra Ltd

Mahindra & Mahindra Ltd sold 12,780 units, achieving a 9.87% market share, up from 8,288 units (6.75%) last year. The rise shows the growing acceptance of Mahindra’s wide range of three-wheelers in diesel, CNG, and electric options, catering to both passenger and commercial users.

Mahindra Last Mile Mobility Ltd (MLMM): Mahindra Last Mile Mobility registered 12,775 units, taking 9.86% market share compared to 8,250 units (6.72%) in October 2024. MLMM’s strong focus on electric last-mile solutions and expanding urban presence helped boost sales significantly this month.

Mahindra & Mahindra (Others): This small division recorded 5 units in October 2025, down from 38 units last year. Although small in volume, this segment represents Mahindra’s niche and pilot projects in select markets.

Piaggio Vehicles Pvt Ltd

Piaggio achieved 9,779 units, holding a 7.55% share, slightly higher than 9,043 units (7.36%) in October 2024. The brand maintained steady sales through its trusted Ape range, which remains a popular choice in goods and passenger categories.

TVS Motor Company Ltd

TVS Motor recorded 5,560 units, achieving 4.29% market share, up sharply from 2,451 units (2.00%) in October 2024. The growth highlights strong customer demand for TVS’s new electric and ICE-based three-wheelers, particularly in Tier-II and Tier-III markets.

Atul Auto Ltd

Atul Auto sold 3,581 units, up from 3,212 units a year ago, achieving a 2.76% share. The brand continues to perform well in rural and semi-urban areas with its affordable and durable models.

YC Electric Vehicle

YC Electric sold 3,500 units, holding a 2.70% share, compared to 4,600 units (3.74%) in October 2024. Despite a slight decline, the company remains one of the leading players in the passenger e-rickshaw category.

Saera Electric Auto Pvt Ltd

Saera Electric retailed 2,264 units, securing a 1.75% market share, down from 2,484 units (2.02%) last year. The company continues to face tough competition in the e-rickshaw segment but remains focused on affordable electric mobility.

Dilli Electric Auto Pvt Ltd

Dilli Electric Auto sold 1,886 units, slightly lower than 2,388 units (1.94%) in October 2024. The brand continues to serve budget-friendly e-mobility needs in smaller cities and peri-urban regions.

Others (Including EVs)

Other OEMs together accounted for 39,181 units, representing 30.25% market share, compared to 42,399 units (34.51%) last year. This includes multiple smaller and emerging EV brands contributing to regional and niche market demand across India.

Also Read: FADA Retail CV Sales October 2025: 1,07,841 Units Sold, Mahindra Tops the Market, Tata Close Behind

CMV360 Says

India’s three-wheeler retail sales showed solid recovery in October 2025, driven by festive season demand, improved rural mobility, and higher sales in goods carrier and passenger segments. Bajaj Auto continues its dominance, while Mahindra Group and TVS Motor displayed strong growth. The electric segment remains competitive, led by YC, Saera, and Dilli Electric. With continued interest in last-mile logistics and EV adoption, the sector is expected to maintain positive growth momentum in the coming months.

News

Olectra Greentech Limited Appoints Dr Allabaksh Naikodi as Head - EV Systems to Strengthen Powertrain and Battery Technology

Olectra Greentech strengthens EV tech by appointing Dr. Allabaksh Naikodi as Head - EV Systems, enhancing powertrain, battery systems, and innovation across electric buse...

25-Feb-26 07:21 AM

Read Full NewsNoida International Airport Awards Major Ground Mobility Contract to Mann Fleet Partners Limited to Strengthen Passenger Connectivity

Noida International Airport appoints Mann Fleet for rental cars and shuttle services, boosting passenger connectivity across Delhi-NCR ahead of its operational launch....

25-Feb-26 06:03 AM

Read Full NewsBalkrishna Industries Limited Enters India’s On-Highway Tyre Market with CV Range

BKT launches two-wheeler and CV tyres in India, invests ₹3,500 crore under Vision 2030, and targets 5% market share with ₹23,000 crore revenue goal by FY30....

24-Feb-26 10:21 AM

Read Full NewsBharatBenz Strengthens West Bengal Presence with Raniganj Dealership, 5 More Touchpoints Planned for 2026

BharatBenz launches new 3S dealership in Raniganj, West Bengal, expanding service network to 11 workshops, with five more planned in 2026 to strengthen customer support....

23-Feb-26 10:37 AM

Read Full NewsTGSRTC Awards Olectra Unit 1,085 E-Bus Order Worth Rs 1,800 Crore for Telangana

TGSRTC awards Olectra unit EVEY a Rs 1,800 crore contract for 1,085 electric buses under a 12-year GCC model for intra-city services in Telangana....

23-Feb-26 10:19 AM

Read Full NewsCMV360 Weekly Wrap-Up | 16–20 Feb 2026: PM e-Bus Rollout, Electric Bus Approvals, Ashok Leyland Expansion, Tractor Export Revival, AI Farming Push, Ladli & Budget Highlights

CMV360 Weekly Wrap-Up | 16–20 Feb 2026 covers electric bus rollouts, tractor export updates, AI farming initiatives, state budgets, and key government schemes shaping Ind...

21-Feb-26 06:09 AM

Read Full NewsAd

Ad

Latest Articles

Best Tata Magic Buses in India 2026

25-Feb-2026

Mahindra Commercial Vehicles in India 2026

24-Feb-2026

Diesel vs Electric Trucks in India 2026: Detailed Comparison of Cost, TCO, Subsidies, Charging & Best Choice for Fleets

21-Feb-2026

Top 10 Buses in India 2026

19-Feb-2026

Top 10 Tata Mini Truck Price List in India 2026

18-Feb-2026

Best Tata Electric Trucks in India 2026

16-Feb-2026

View All articles