Ad

Ad

FADA Sales Report March 2024: Commercial Vehicle Segment Shows Mixed Performance

Key Highlights:

• Commercial vehicle sales dropped by 6% year-on-year in March 2024.

• Despite the overall decline, there was a 3.31% increase in sales compared to the previous month.

• Certain segments like Light and Heavy Commercial Vehicles showed resilience amidst challenges.

• Major players like Tata Motors and Mahindra & Mahindra maintained their market dominance.

• The industry is optimistic for the upcoming year, focusing on new product launches and improved economic conditions.

FADA, the Federation of Automobile Dealers Association has shared the commercial vehicle sales data for March 2024. The CV segment, which dropped by 6% year on year, faced a complicated environment, balancing election-related buying slowdowns with robust demand in specialized sectors such as coal and cement transportation.

In FY'24, the Indian Auto Retail industry grew by 10% YoY. The 2W, 3W, PV, Tractor, and CV segments saw growth rates of 9%, 49%, 8.45%, 8%, and 5%, respectively. The 3W, PV, and Tractor categories set new records.

Commercial Vehicle Growth

For FY 2024, the CV segment increased by 4.82%, demonstrating strategic market adaptability, thanks to improved vehicle supply and planning, as well as major purchases prompted by government contracts and bulk deals. According to the latest FADA Sales Report, combined CV sales reached 91,289 units in March 2024 compared to 88,367 units sold in February 2024. This shows there is an increase of 3.31% in MOM sales.

Commercial Vehicle Segment-wise Sales in March’24

LCV Segment

The Light Commercial Vehicle (LCV) segment experienced a growth of 1.52% in retail sales. A total of 49,332 units were sold in March 2024, compared to 48,594 units in February 2023.

MCV Segment

The Medium Commercial Vehicle (MCV) category experienced a decline of 2.01%, selling 6,324 units in March 2024 compared to 6,454 units in February 2023.

HCV Segment

The Light Commercial Vehicle (LCV) segment experienced a growth of 7.51% in retail sales for March 2024. A total of 30,394 units were sold in March 2024, compared to 28,271 units in February 2023.

Others Segment

All remaining segments of the CV category collectively sold 5,239 units in March 2024, showing a significant sales growth of 3.78% from 5,048 units in February 2023.

Also Read: FADA Sales Report: Commercial Vehicle Segment Shows Mixed Performance

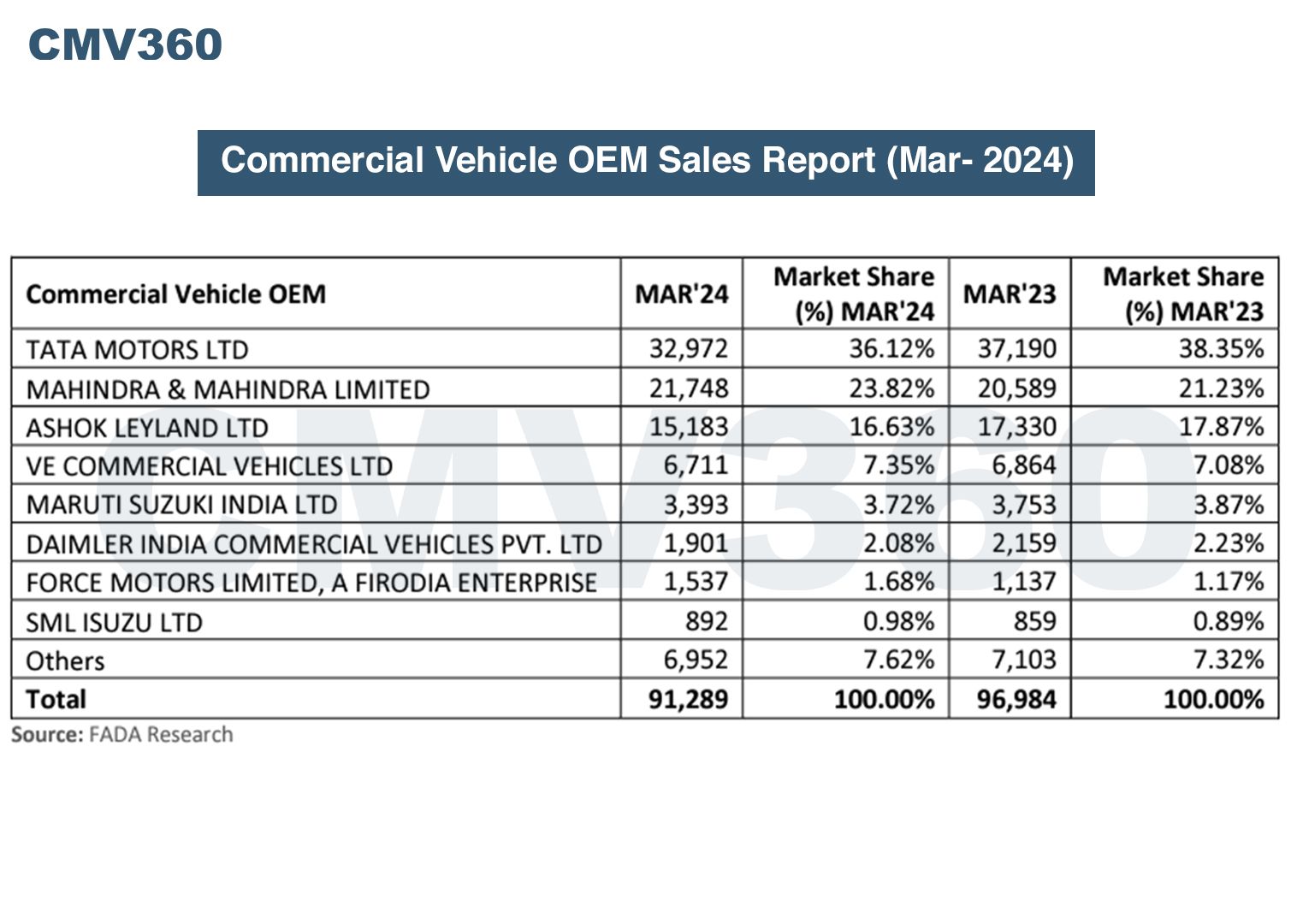

OEM Wise CV Sales Analysis

In March 2024, TATA MOTORS LTD sold 32,972 units, holding a 36.12% market share. Whereas in March 2023, the company sold 37,190 units.

MAHINDRA & MAHINDRA LIMITED sold 21,748 units, with a market share of 23.82%. Whereas in March 2023, the company sold 20,589 units.

ASHOK LEYLAND LTD sold 15,183 units in March 2024, capturing 16.63% market share. Whereas in March 2023, the company sold 17,330 units.

VE COMMERCIAL VEHICLES LTD sold 6,711 units, accounting for 7.35% market share. Whereas in March 2023, the company sold 6,864 units.

MARUTI SUZUKI INDIA LTD sold 3,393 units, having a market share of 3.72%. Whereas in March 2023, the company sold 3,753 units.

DAIMLER INDIA COMMERCIAL VEHICLES PVT. LTD sold 1,901 units, holding 2.08% market share. Whereas in March 2023, the company sold 2,159 units.

FORCE MOTORS LIMITED sold 1,537 units, with a market share of 1.68%. Whereas in March 2023, the company sold 1,137 units.

SML ISUZU LTD sold 892 units, representing 0.98% market share. Whereas in March 2023, the company sold 859 units.

Others collectively sold 6,952 units, with a combined market share of 7.62%. Whereas in March 2023, the company sold 7,103 units.

Urban Challenges and Sector Resilience: The automotive sector uses holidays, festival, new product releases, and a move toward electric mobility to navigate towards recovery and growth in the face of declining urban consumer sentiment and election concerns.

FY'25 Outlook: The industry is optimistic about FY'25, focusing on new product launches, particularly in EVs, and leveraging economic growth, favorable government policies, and an expected good monsoon to fuel demand, despite challenges such as competition and the need for strategic market engagement.

CMV360 Says

The FADA Sales Report for March 2024 paints a mixed picture for the commercial vehicle (CV) segment, with a 6% year-on-year decline but a 3.31% month-on-month increase. While facing challenges such as election-related slowdowns, the sector demonstrated resilience, especially in segments like LCV and HCV.

Key players like Tata Motors and Mahindra & Mahindra maintained their market dominance. Looking ahead, the industry remains optimistic for FY'25, focusing on new product launches, EVs, and favorable economic conditions despite competition and market engagement hurdles.

News

Celebrating Excellence at the CMV360 Awards 2026: Honouring the Best of India’s Commercial Vehicle Industry

CMV360 Awards 2026 honours top trucks, buses, tractors, three-wheelers and infra equipment with expert jury evaluation and customer choice awards on 6 February in Gurugra...

05-Feb-26 07:15 PM

Read Full NewsAshok Leyland and PT Pindad Partner for Electric Buses and Defence Vehicles

Ashok Leyland signs MoU with PT Pindad to develop electric buses and defence vehicles, supporting Indonesia’s sustainable mobility goals and defence modernisation through...

05-Feb-26 05:08 AM

Read Full NewsLeafyBus Partners with Eicher to Deploy 100 Electric Intercity Sleeper Buses in India

LeafyBus partners with Eicher to deploy 100 electric sleeper buses on major Indian routes, boosting clean intercity travel with a phased rollout starting in March 2026....

05-Feb-26 04:29 AM

Read Full NewsElectric Three-Wheeler Sales Report – January 2026: Zeniak Innovation, J.S. Auto & YC Electric Drive Market Momentum

January 2026 electric three-wheeler sales show mixed trends, with strong YoY growth for select OEMs and MoM pressure across e-rickshaw and e-cart segments in India....

04-Feb-26 11:11 AM

Read Full NewsElectric Passenger Three-Wheeler (E-3W L5) Sales Rise in January 2026, Bajaj Auto Leads the Market

Electric passenger three-wheeler sales grew strongly in January 2026. Bajaj Auto led the market, followed by Mahindra and TVS, while Omega Seiki recorded the highest grow...

04-Feb-26 10:02 AM

Read Full NewsIndia’s Electric Bus Sales Decline in January 2026: OEM-wise Performance and Market Share

India’s electric bus sales fell to 391 units in January 2026. JBM Electric led the market, followed by Switch Mobility, as selective OEMs showed monthly growth....

03-Feb-26 12:32 PM

Read Full NewsAd

Ad

Latest Articles

Tata Trucks Price & Best Models 2026

03-Feb-2026

Top 5 Electric Buses Leading India’s Green Revolution in 2026

30-Jan-2026

ICV vs HCV Trucks: Which Is More Profitable in 2026?

27-Jan-2026

Top 10 Electric Trucks in India 2026: Price, Range, & Payload

22-Jan-2026

Diesel vs CNG vs Electric Trucks in India 2026: Choosing the Right Truck for Your Business Needs

21-Jan-2026

Electric Commercial Vehicles in India 2026: Complete Guide to Electric Trucks, Buses, and Three Wheelers with Prices

19-Jan-2026

View All articles