Ad

Ad

FADA Retail CV Sales January 2026: 1,07,486 Units Sold, Tata Motors Leads the Market

Key Highlights

Total CV retail sales stood at 1,07,486 units in January 2026.

LCVs remained the largest contributing segment.

The MCV segment showed strong growth over the earlier period.

Tata Motors emerged as the market leader.

Electric and niche OEMs continued gradual expansion.

India’s commercial vehicle (CV) retail market recorded 1,07,486 units in January 2026, as per FADA Research, showing steady demand across segments. Growth was supported by logistics movement, infrastructure activity, and fleet replacement, despite mixed trends across categories.

Also Read: FADA Retail CV Sales December 2025: 83,666 Units Sold, Tata Motors Leads Market

Overall CV Market Performance - January 2026

The CV market registered 1,07,486 retail units, compared to 93,410 units in January 2025 and 83,666 units in the earlier period, reflecting sustained market momentum. Growth was driven mainly by infrastructure projects, freight demand, and replacement cycles across fleets.

Category-Wise CV Sales Performance - January 2026

Category | Jan’26 Retail Sales (Units) | Jan’25 Retail Sales (Units) | Earlier Period (Units) | Growth vs Earlier Period | YoY Growth vs Jan’25 |

Total CV | 1,07,486 | 93,410 | 83,666 | 28.47% | 15.07% |

LCV | 65,505 | 56,991 | 49,251 | 33.00% | 14.94% |

MCV | 7,648 | 6,434 | 6,411 | 19.29% | 18.87% |

HCV | 34,287 | 29,915 | 27,941 | 22.71% | 14.61% |

Others | 46 | 70 | 63 | -26.98% | -34.29% |

Category-Wise CV Sales Performance – January 2026

Light Commercial Vehicles (LCV)

The LCV segment recorded 65,505 units, up from 56,991 units in January 2025 and 49,251 units in the earlier period. The segment posted 33.00% growth over the earlier period and 14.94% year-on-year growth, supported by demand in last-mile delivery and small fleet operations.

Medium Commercial Vehicles (MCV)

MCV sales stood at 7,648 units, compared to 6,434 units last year and 6,411 units earlier. The segment registered 19.29% growth over the earlier period and 18.87% YoY growth, driven by industrial and institutional usage.

Heavy Commercial Vehicles (HCV)

HCVs recorded 34,287 units, up from 29,915 units in January 2025 and 27,941 units earlier. The segment saw 22.71% growth over the earlier period and 14.61% YoY growth, supported by mining, infrastructure, and long-haul freight demand.

Others

The “Others” category remained small at 46 units, compared to 70 units last year and 63 units earlier, reflecting limited volumes from niche OEMs.

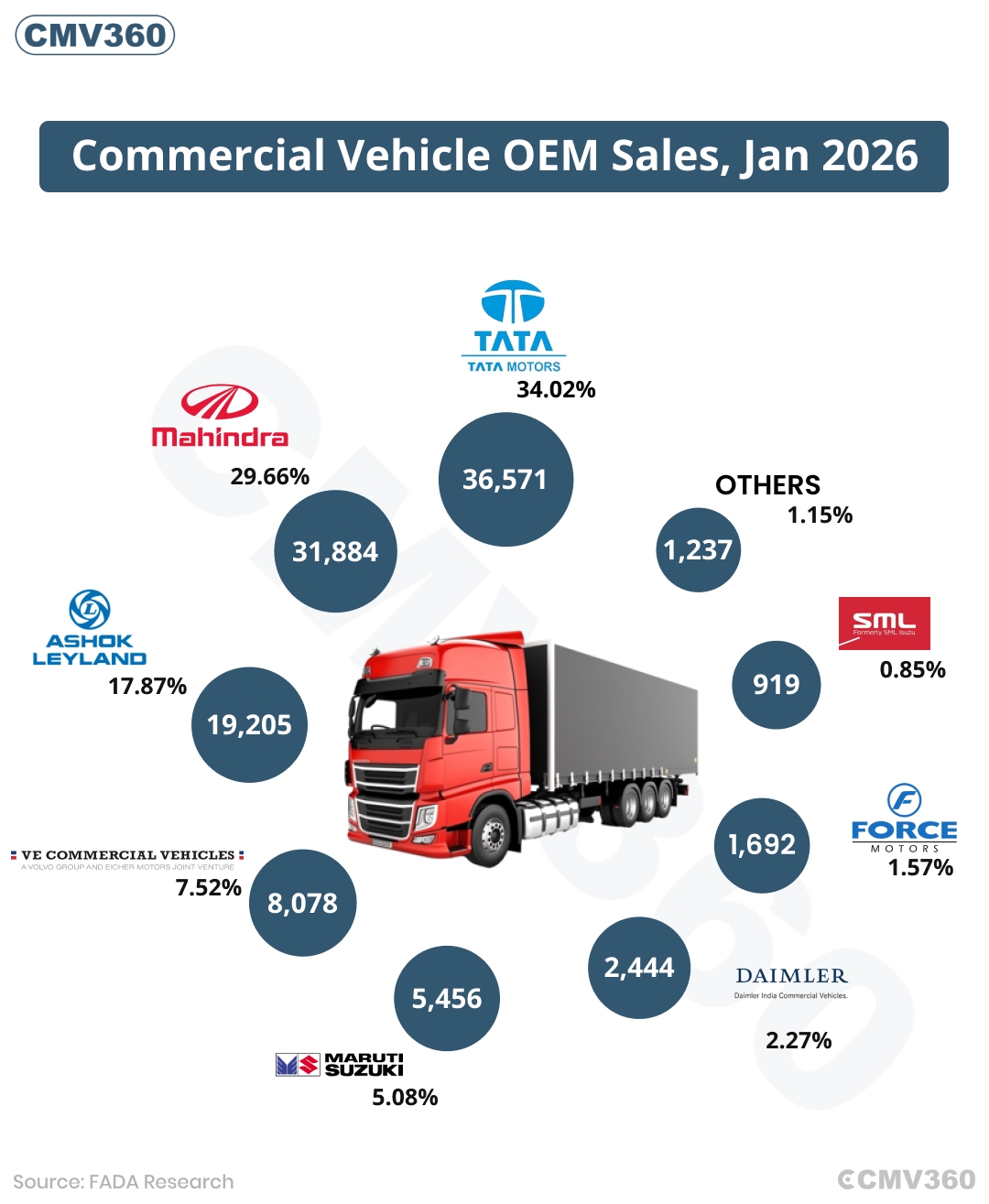

OEM-Wise Market Share - January 2026

OEM / Brand | Jan’26 Sales (Units) | Market Share Jan’26 | Jan’25 Sales (Units) | Market Share Jan’25 |

Tata Motors Ltd | 36,571 | 34.02% | 31,609 | 33.84% |

Mahindra & Mahindra Ltd | 31,884 | 29.66% | 27,550 | 29.49% |

Mahindra & Mahindra Ltd (2nd Entry) | 29,753 | 27.68% | 25,731 | 27.55% |

Mahindra Last Mile Mobility Ltd | 2,131 | 1.98% | 1,819 | 1.95% |

Ashok Leyland Ltd | 19,205 | 17.87% | 16,017 | 17.15% |

Ashok Leyland Ltd (2nd Entry) | 19,013 | 17.69% | 15,849 | 16.97% |

Switch Mobility Automotive Ltd | 192 | 0.18% | 168 | 0.18% |

VE Commercial Vehicles Ltd | 8,078 | 7.52% | 7,364 | 7.88% |

VE Commercial Vehicles Ltd (2nd Entry) | 8,019 | 7.46% | 7,316 | 7.83% |

VE Commercial Vehicles Ltd (Volvo Buses Division) | 59 | 0.05% | 48 | 0.05% |

Maruti Suzuki India Ltd | 5,456 | 5.08% | 5,238 | 5.61% |

Daimler India Commercial Vehicles Pvt. Ltd | 2,444 | 2.27% | 2,193 | 2.35% |

Force Motors Ltd | 1,692 | 1.57% | 1,844 | 1.97% |

SML Isuzu Ltd | 919 | 0.85% | 907 | 0.97% |

Others | 1,237 | 1.15% | 688 | 0.74% |

Total | 1,07,486 | 100.00% | 93,410 | 100.00% |

OEM-Wise Market Share - January 2026

Tata Motors Ltd

Tata Motors led the market with 36,571 units, capturing a 34.02% market share, up from 33.84% in January 2025. Strong performance across the LCV and HCV segments helped the company retain its leadership position.

Mahindra & Mahindra Ltd

Mahindra & Mahindra recorded 31,884 units, accounting for a 29.66% market share, compared to 29.49% last year. The brand continued to benefit from steady demand in pickups and small commercial vehicles.

Under its second reporting entry, Mahindra & Mahindra sold 29,753 units, holding a 27.68% market share, slightly higher than 27.55% in January 2025, indicating stable performance across multiple CV categories.

Mahindra Last Mile Mobility reported 2,131 units, with a 1.98% market share, marginally higher than 1.95% last year, reflecting consistent demand in last-mile and electric mobility solutions.

Ashok Leyland Ltd

Ashok Leyland posted 19,205 units, securing a 17.87% market share, up from 17.15% in January 2025, supported by demand in medium and heavy trucks.

In its second entry, Ashok Leyland recorded 19,013 units, with a 17.69% market share, compared to 16.97% last year, showing steady fleet and institutional demand.

Switch Mobility sold 192 units, maintaining a 0.18% market share, unchanged year-on-year, highlighting gradual adoption of electric buses.

VE Commercial Vehicles Ltd (VECV)

VE Commercial Vehicles reported 8,078 units, capturing a 7.52% market share, compared to 7.88% last year. Its second entry accounted for 8,019 units with a 7.46% share, while the Volvo Buses division recorded 59 units, maintaining a 0.05% market share, reflecting its niche presence.

Maruti Suzuki India Ltd

Maruti Suzuki sold 5,456 units, holding a 5.08% market share, slightly lower than 5.61% in January 2025, driven mainly by demand for the Super Carry in the SCV segment.

Daimler India Commercial Vehicles Pvt. Ltd

Daimler India Commercial Vehicles recorded 2,444 units, with a 2.27% market share, marginally lower than 2.35% last year, amid competitive market conditions.

Force Motors Ltd

Force Motors sold 1,692 units, accounting for a 1.57% market share, compared to 1.97% in January 2025, impacted by softer demand in utility and passenger carriers.

SML Isuzu Ltd

SML Isuzu recorded 919 units, with a 0.85% market share, slightly lower than 0.97% last year, reflecting stable but limited volumes.

Other OEMs

Other manufacturers together accounted for 1,237 units, translating to a 1.15% market share, up from 0.74% last year, indicating the gradual expansion of smaller and niche players.

Data Source and Coverage

The retail data has been compiled by FADA Research in collaboration with the Ministry of Road Transport & Highways, Government of India, covering 1,403 out of 1,462 RTOs as of 07 February 2026. Figures do not include data from Telangana. OEMs with less than 1% market share are grouped under “Others”.

Market Outlook

The commercial vehicle market in January 2026 reflects a stable and demand-driven environment. Growth across LCV, MCV, and HCV segments highlights continued momentum from infrastructure development, logistics expansion, and fleet upgrades. Tata Motors, Mahindra, and Ashok Leyland continue to dominate, while electric and niche OEMs are slowly strengthening their presence. With infrastructure spending expected to remain strong, the CV market outlook for 2026 remains positive.

Also Read: CMV360 Auto Excellence Awards 2026: Winners & Jury Details

CMV360 Says

India’s CV retail market began 2026 on a strong note with 1,07,486 units sold. LCVs led volumes, while MCV and HCV segments showed healthy growth. Tata Motors retained leadership, followed by Mahindra and Ashok Leyland. Supported by infrastructure activity and freight demand, the market is well-positioned for steady performance in the coming months.

News

FADA Three-Wheeler Retail Sales Report January 2026: Sales at 1,27,134 Units, Passenger Segment Drives Growth

FADA January 2026 three-wheeler sales were at 1,27,134 units. Passenger and goods segments grow, Bajaj Auto leads market share, EV brands expand presence across India’s m...

11-Feb-26 06:49 AM

Read Full NewsCMV360 Three Wheelers Auto Excellence Awards 2026 Winners

CMV360 Three Wheelers Auto Excellence Awards 2026 honoured top passenger, cargo and electric three-wheelers with a credible jury recognising innovation, safety, efficienc...

10-Feb-26 12:23 PM

Read Full NewsCMV360 Auto Excellence Awards 2026: Winners & Jury Details

CMV360 Auto Excellence Awards 2026 honoured top trucks and buses in India, celebrating innovation, safety, electric mobility, and performance with winners selected by an ...

10-Feb-26 09:58 AM

Read Full NewsMurugappa Group’s Next EV Move: E-Rickshaws on the Way After ₹3,000 Cr Investment

TI Clean Mobility plans e-rickshaw entry with ₹3,000 crore investment, expanding EV presence across India with a strong focus on North and East regions....

10-Feb-26 07:22 AM

Read Full NewsSWITCH Mobility Deploys 272 Electric Buses in Delhi Under CESL Tender

SWITCH Mobility deploys 272 electric buses in Delhi under CESL tender, strengthening clean public transport, improving air quality, and supporting the city’s electric mob...

10-Feb-26 06:48 AM

Read Full NewsBajaj Auto Launches WEGO P9018 Electric Three-Wheeler with 296 Km Range at ₹4.41 Lakh

Bajaj Auto launches WEGO P9018 electric three-wheeler with 296 km range, 17.7 kWh battery, five-year warranty, and ₹4.41 lakh price, setting new benchmarks in India’s e-r...

09-Feb-26 01:19 PM

Read Full NewsAd

Ad

Latest Articles

Top 5 Concrete Transit Mixers Price in India – 2026

09-Feb-2026

Tata Trucks Price & Best Models 2026

03-Feb-2026

Top 5 Electric Buses Leading India’s Green Revolution in 2026

30-Jan-2026

ICV vs HCV Trucks: Which Is More Profitable in 2026?

27-Jan-2026

Top 10 Electric Trucks in India 2026: Price, Range, & Payload

22-Jan-2026

Diesel vs CNG vs Electric Trucks in India 2026: Choosing the Right Truck for Your Business Needs

21-Jan-2026

View All articles