Ad

Ad

FADA Three-Wheeler Retail Sales Report January 2026: Sales at 1,27,134 Units, Passenger Segment Drives Growth

Key Highlights

Total three-wheeler sales stood at 1,27,134 units.

Overall sales declined 0.50% MoM but grew 18.80% YoY.

Passenger three-wheelers posted 18.18% growth.

Goods three-wheelers surged 26.62% month-on-month.

Bajaj Auto remained the market leader with 35.38% share.

FADA January 2026 three-wheeler sales report shows 1,27,134 units retailed. Passenger and goods segments recorded growth, while e-rickshaw (P) declined. Bajaj Auto led the OEM market share chart.

According to FADA Research, India’s three-wheeler retail market recorded 1,27,134 units in January 2026, compared to 1,27,772 units in December 2025 and 1,07,013 units in January 2025. While the market saw a marginal 0.50% dip on a monthly basis, it registered a healthy 18.80% year-on-year growth, reflecting stable demand in passenger and cargo mobility.

Also Read: FADA Three-Wheeler Retail Sales Report December 2025: Sales Slip 4.61% YoY to 1,27,772 Units

Overall Three-Wheeler Market Performance - January 2026

The three-wheeler segment remained steady in January 2026 despite minor monthly pressure. Growth was mainly supported by passenger carriers and goods vehicles, while some electric sub-segments showed mixed performance.

Segment-Wise Three-Wheeler Sales Breakdown - January 2026

Segment | Jan’26 Units | Dec’25 Units | Jan’25 Units | MoM Change (%) | YoY Change (%) |

Total Three-Wheelers | 1,27,134 | 1,27,772 | 1,07,013 | -0.50 | 18.80 |

E-Rickshaw (Passenger) | 44,456 | 57,478 | 38,822 | -22.66 | 14.51 |

E-Rickshaw with Cart (Goods) | 7,656 | 7,607 | 5,744 | 0.64 | 33.29 |

Three-Wheeler (Goods) | 14,199 | 11,214 | 12,047 | 26.62 | 17.86 |

Three-Wheeler (Passenger) | 60,701 | 51,363 | 50,313 | 18.18 | 20.65 |

Three-Wheeler (Personal) | 122 | 110 | 87 | 10.91 | 40.23 |

Segment Analysis

Passenger Three-Wheelers

Passenger three-wheelers recorded 60,701 units, showing an 18.18% monthly rise and 20.65% annual growth. Strong urban and semi-urban transport demand supported this category.

Goods Three-Wheelers

The goods three-wheelers segment sold 14,199 units, posting a sharp 26.62% growth over December 2025. On a yearly basis, it improved by 17.86%, indicating rising small cargo and last-mile delivery demand.

E-Rickshaw (Passenger)

Passenger e-rickshaws retailed 44,456 units, declining 22.66% compared to December. However, the segment still grew 14.51% year-on-year, showing continued EV acceptance.

E-Rickshaw with Cart

Goods e-rickshaws recorded 7,656 units, with a marginal 0.64% growth month-on-month and strong 33.29% YoY growth.

Personal Three-Wheelers

The personal category remained small at 122 units, though it posted healthy annual growth of 40.23%.

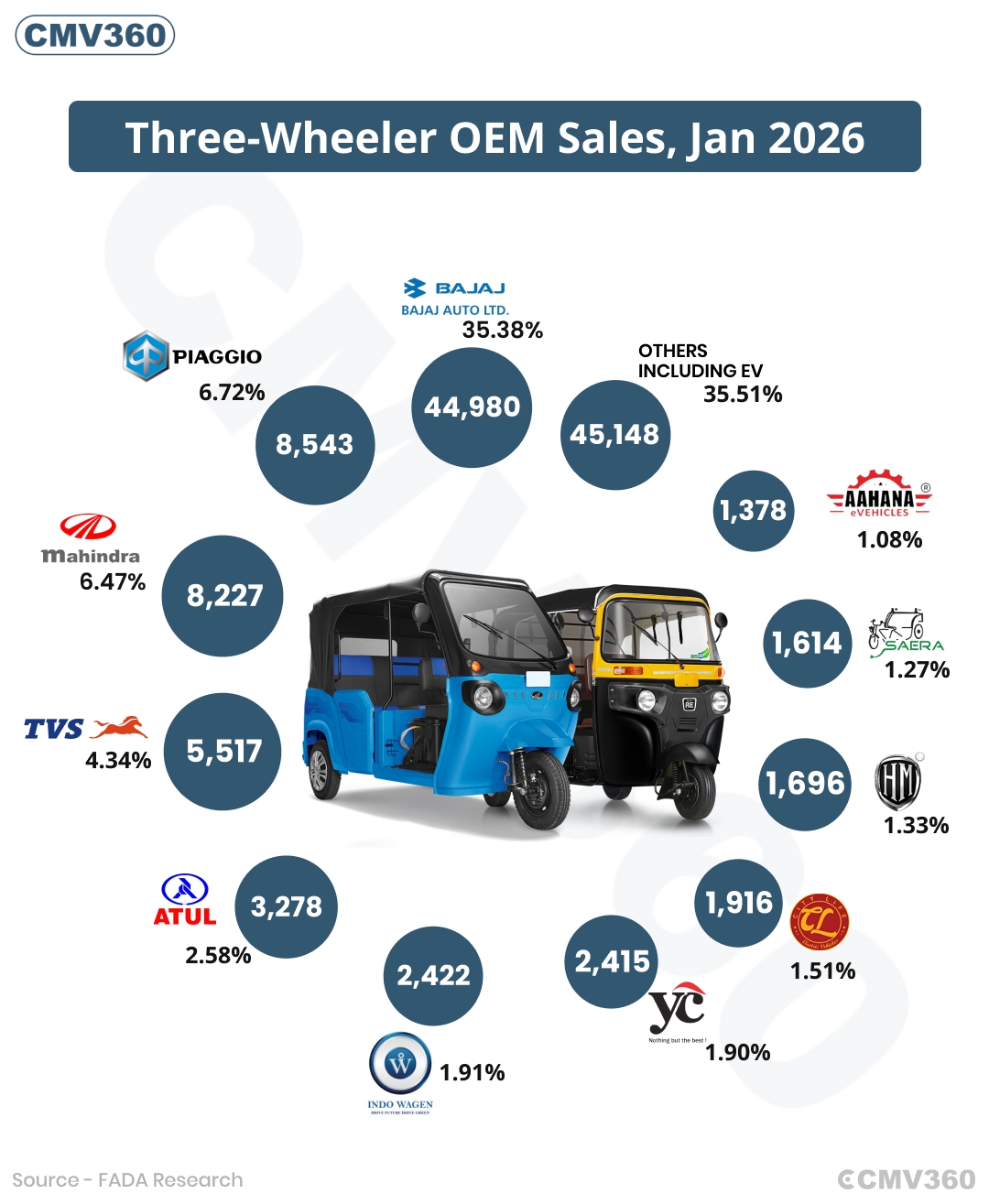

OEM-Wise Three-Wheeler Market Share - January 2026

OEM | Jan’26 Units | Market Share (%) | Jan’25 Units | Market Share (%) |

Bajaj Auto Ltd | 44,980 | 35.38% | 39,492 | 36.90% |

Piaggio Vehicles Pvt Ltd | 8,543 | 6.72% | 7,906 | 7.39% |

Mahindra & Mahindra Ltd | 8,227 | 6.47% | 6,931 | 6.48% |

Mahindra Last Mile Mobility Ltd | 8,049 | 6.33% | 6,894 | 6.44% |

Mahindra & Mahindra Ltd (Others) | 178 | 0.14% | 37 | 0.03% |

TVS Motor Company Ltd | 5,517 | 4.34% | 2,704 | 2.53% |

Atul Auto Ltd | 3,278 | 2.58% | 2,748 | 2.57% |

Zeniak Innovation India Ltd | 2,422 | 1.91% | 817 | 0.76% |

YC Electric Vehicle | 2,415 | 1.90% | 3,880 | 3.63% |

Dilli Electric Auto Pvt Ltd | 1,916 | 1.51% | 1,925 | 1.80% |

Hooghly Motors Pvt Ltd | 1,696 | 1.33% | 379 | 0.35% |

Saera Electric Auto Pvt Ltd | 1,614 | 1.27% | 2,271 | 2.12% |

Aahana Commerce Pvt Ltd | 1,378 | 1.08% | 391 | 0.37% |

Others (Including EVs) | 45,148 | 35.51% | 37,569 | 35.11% |

Total | 1,27,134 | 100% | 1,07,013 | 100% |

OEM Performance Insights - January 2026 (Brand-Wise)

Bajaj Auto Ltd

Bajaj Auto led the market with 44,980 units, securing a strong 35.38% market share. The brand maintained leadership due to its solid presence in both passenger and goods three-wheelers.

Piaggio Vehicles Pvt Ltd

Piaggio retailed 8,543 units, capturing a 6.72% market share. The company continued steady demand, especially through its Ape range in cargo and passenger segments.

Mahindra & Mahindra Ltd

Mahindra & Mahindra sold 8,227 units, holding a 6.47% share. The brand performed consistently across diesel, CNG, and electric three-wheelers.

Mahindra Last Mile Mobility Ltd: Mahindra Last Mile Mobility recorded 8,049 units, accounting for a 6.33% share. Its electric portfolio remained a key contributor in passenger and cargo EV categories.

Mahindra & Mahindra Ltd (Others): This division reported 178 units, with a 0.14% market share, reflecting limited but niche participation.

TVS Motor Company Ltd

TVS retailed 5,517 units, achieving a 4.34% share. Growth was supported by expanding electric three-wheeler offerings.

Atul Auto Ltd

Atul Auto sold 3,278 units, securing a 2.58% market share. The brand continued stable performance in rural and semi-urban markets.

Zeniak Innovation India Ltd

Zeniak recorded 2,422 units, capturing a 1.91% share, reflecting growing acceptance of its electric three-wheelers.

YC Electric Vehicle

YC Electric retailed 2,415 units, holding a 1.90% market share, maintaining its presence in the affordable EV segment.

Dilli Electric Auto Pvt Ltd

Dilli Electric Auto reported 1,916 units, contributing 1.51% share in the electric rickshaw space.

Hooghly Motors Pvt Ltd

Hooghly Motors sold 1,696 units, achieving a 1.33% market share, driven by regional EV demand.

Saera Electric Auto Pvt Ltd

Saera Electric recorded 1,614 units, accounting for a 1.27% share, maintaining steady participation in the EV segment.

Aahana Commerce Pvt Ltd

Aahana Commerce retailed 1,378 units, securing a 1.08% market share, reflecting improving EV demand.

Others (Including EV Brands)

Other OEMs together sold 45,148 units, contributing 35.51% of the total market share, indicating a highly competitive and fragmented three-wheeler market.

Data Notes & Disclaimer

The above numbers do not include figures from Telangana (TS).

Vehicle retail data has been collated as of 07.02.2026 in collaboration with the Ministry of Road Transport & Highways, Government of India.

Data has been gathered from 1,403 out of 1,462 RTOs across India.

“Others” include OEMs accounting for less than 1% market share.

Source: FADA Research.

Market Outlook

January 2026 reflects stability in India’s three-wheeler retail market. While overall volumes remained nearly flat month-on-month, passenger and goods segments supported growth. Electric mobility continues to expand despite short-term fluctuations in e-rickshaw volumes. With improved financing access, policy support, and rising demand for last-mile connectivity, the three-wheeler segment is expected to maintain steady momentum in the coming months.

Also Read: FADA Retail CV Sales January 2026: 1,07,486 Units Sold, Tata Motors Leads the Market

CMV360 Says

India’s three-wheeler retail market recorded a balanced performance in January 2026 with 1,27,134 units sold. Passenger and goods segments drove growth, while electric categories showed mixed trends. Bajaj Auto retained clear leadership, and EV-focused brands strengthened their presence. The data signals steady recovery and long-term potential for both ICE and electric three-wheelers in India’s evolving mobility landscape.

News

FADA Retail CV Sales January 2026: 1,07,486 Units Sold, Tata Motors Leads the Market

FADA January 2026 CV sales reach 1,07,486 units. Tata Motors leads market share as LCV, MCV, and HCV segments post steady growth driven by infrastructure and logistics de...

11-Feb-26 05:26 AM

Read Full NewsCMV360 Three Wheelers Auto Excellence Awards 2026 Winners

CMV360 Three Wheelers Auto Excellence Awards 2026 honoured top passenger, cargo and electric three-wheelers with a credible jury recognising innovation, safety, efficienc...

10-Feb-26 12:23 PM

Read Full NewsCMV360 Auto Excellence Awards 2026: Winners & Jury Details

CMV360 Auto Excellence Awards 2026 honoured top trucks and buses in India, celebrating innovation, safety, electric mobility, and performance with winners selected by an ...

10-Feb-26 09:58 AM

Read Full NewsMurugappa Group’s Next EV Move: E-Rickshaws on the Way After ₹3,000 Cr Investment

TI Clean Mobility plans e-rickshaw entry with ₹3,000 crore investment, expanding EV presence across India with a strong focus on North and East regions....

10-Feb-26 07:22 AM

Read Full NewsSWITCH Mobility Deploys 272 Electric Buses in Delhi Under CESL Tender

SWITCH Mobility deploys 272 electric buses in Delhi under CESL tender, strengthening clean public transport, improving air quality, and supporting the city’s electric mob...

10-Feb-26 06:48 AM

Read Full NewsBajaj Auto Launches WEGO P9018 Electric Three-Wheeler with 296 Km Range at ₹4.41 Lakh

Bajaj Auto launches WEGO P9018 electric three-wheeler with 296 km range, 17.7 kWh battery, five-year warranty, and ₹4.41 lakh price, setting new benchmarks in India’s e-r...

09-Feb-26 01:19 PM

Read Full NewsAd

Ad

Latest Articles

Top 5 Concrete Transit Mixers Price in India – 2026

09-Feb-2026

Tata Trucks Price & Best Models 2026

03-Feb-2026

Top 5 Electric Buses Leading India’s Green Revolution in 2026

30-Jan-2026

ICV vs HCV Trucks: Which Is More Profitable in 2026?

27-Jan-2026

Top 10 Electric Trucks in India 2026: Price, Range, & Payload

22-Jan-2026

Diesel vs CNG vs Electric Trucks in India 2026: Choosing the Right Truck for Your Business Needs

21-Jan-2026

View All articles