Ad

Ad

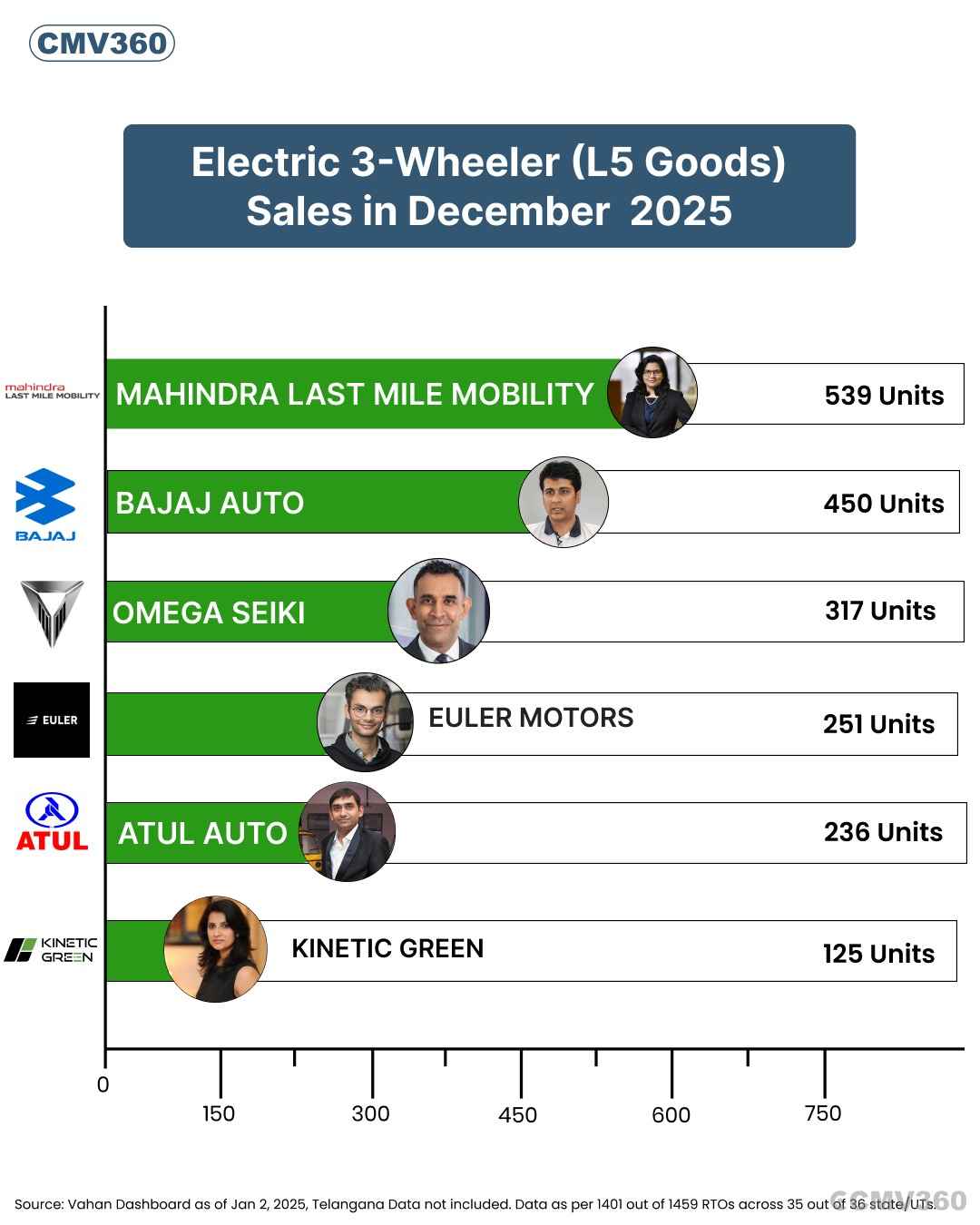

Electric Three-Wheeler Goods Sales Report (December 2025): Mahindra, Bajaj, Omega Lead

Key Highlights

Mahindra Last Mile Mobility leads December 2025 with 539 units.

Bajaj Auto records strong 22.3% year-on-year growth.

Omega Seiki posts the highest MoM growth at 153.6%.

Euler Motors maintains steady growth with positive YoY and MoM.

Overall E-3W goods demand remains stable despite MoM dips.

India’s electric three-wheeler (E-3W) goods L5 segment recorded steady activity in December 2025, with Mahindra Last Mile Mobility, Bajaj Auto, and Omega Seiki emerging as the top contributors. The latest OEM-wise sales trend highlights mixed month-on-month movement but clear year-on-year growth for key players.

Also Read: Electric Three-Wheeler Goods Sales Report (November 2025): Mahindra, Bajaj, and Atul Lead the Market

E-3W Goods L5 Sales Overview – December 2025

The chart shows registrations for December 2025, compared with November 2025 and December 2024, giving a clear view of both YoY and MoM performance. Sales data reflect registrations from 1401 out of 1459 RTOs across 35 out of 36 states/UTs, with Telangana data excluded.

Electric Three-Wheeler Goods L5 Sales – December 2025

OEM | Dec-25 Units | Nov-25 Units | Dec-24 Units | YoY Growth | MoM Growth |

Mahindra Last Mile Mobility | 539 | 604 | 435 | 23.9% | -10.8% |

Bajaj Auto | 450 | 546 | 368 | 22.3% | -17.6% |

Omega Seiki | 317 | 125 | 282 | 12.4% | 153.6% |

Euler Motors | 251 | 235 | 216 | 16.2% | 6.8% |

Atul Auto | 236 | 323 | 61 | – | -26.9% |

Green Evolve | 125 | 113 | 20 | – | 10.6% |

Source: Vahan Dashboard (as of Jan 2, 2026). Telangana data not included. Data covers 1401 of 1459 RTOs across 35 of 36 States/UTs.

OEM-Wise Electric 3W Goods Sales Performance

Mahindra Last Mile Mobility

Mahindra remained the market leader in December 2025 with 539 units registered. The brand posted a strong 23.9% year-on-year growth, highlighting consistent demand. However, sales declined 10.8% month-on-month compared to November.

Bajaj Auto

Bajaj Auto recorded 450 units in December 2025. The company achieved 22.3% YoY growth, but registrations fell 17.6% MoM, indicating a short-term slowdown after strong November volumes.

Omega Seiki

Omega Seiki stood out with 317 units in December. The brand reported 12.4% YoY growth and a sharp 153.6% MoM rise, making it one of the fastest-growing players for the month.

Euler Motors

Euler Motors registered 251 units, delivering 16.2% YoY growth along with a positive 6.8% MoM increase, reflecting stable and improving momentum.

Atul Auto

Atul Auto posted 236 units in December 2025. While year-on-year comparison is not available, the company saw a 26.9% MoM decline, suggesting softer demand during the month.

Green Evolve

Green Evolve recorded 125 units, showing a 10.6% MoM growth. YoY growth figures were not specified, but the brand showed gradual improvement.

Market Insight

In December 2025, the electric three-wheeler goods market was clearly led by Mahindra Last Mile Mobility, Bajaj Auto, and Omega Seiki. While Mahindra and Bajaj continued to dominate in volumes, Omega Seiki and Euler Motors showed notable momentum gains. Overall, the data reflects growing competition and steady adoption of electric cargo three-wheelers across India.

CMV360 Says

December 2025 highlights a balanced E-3W goods market, where leadership remained stable, but growth momentum shifted toward emerging players. With improving infrastructure and rising demand for last-mile electric cargo solutions, the segment is expected to stay competitive in the coming months.

News

Ashok Leyland Reports 19,309 CV Sales in Feb 2026, Registers Strong 25.9% YoY Growth

Ashok Leyland reports 19,309 CV sales in February 2026 with strong domestic growth of 32% and overall 25.9% YoY increase despite export decline....

02-Mar-26 11:36 AM

Read Full NewsGreenCell Deploys 75 Electric Buses in Puducherry to Boost Zero-Emission Transport

GreenCell Mobility deploys 75 electric buses in Puducherry to boost zero-emission public transport, improve connectivity, and strengthen sustainable urban mobility infras...

02-Mar-26 09:44 AM

Read Full NewsVE Commercial Vehicles Sales February 2026: 9,986 Units Sold, 23.4% Growth

VECV reports 9,986 unit sales in February 2026, marking 23.4% growth. Eicher domestic sales rise strongly, while Volvo Trucks and Buses record steady performance in the p...

02-Mar-26 07:24 AM

Read Full NewsTata Motors Records 42,940 Commercial Vehicle Sales in February 2026

Tata Motors sold 42,940 commercial vehicles in February 2026, reporting 32% year-on-year growth driven by strong domestic demand and steady export performance across key ...

02-Mar-26 06:15 AM

Read Full NewsMahindra & Mahindra Ltd. Reports 17% Growth in Domestic CV & 3-Wheeler Sales in February 2026

Mahindra records 17% domestic CV and 3W growth and 11% export rise in February 2026 with total sales reaching 97,177 units....

02-Mar-26 05:17 AM

Read Full NewsIndonesia Pauses Massive Import Order From Tata, Mahindra

Indonesia suspends $1.5 billion Tata and Mahindra vehicle import plan amid political and industry concerns....

27-Feb-26 02:13 PM

Read Full NewsAd

Ad

Latest Articles

Best Tata Magic Buses in India 2026

25-Feb-2026

Mahindra Commercial Vehicles in India 2026

24-Feb-2026

Diesel vs Electric Trucks in India 2026: Detailed Comparison of Cost, TCO, Subsidies, Charging & Best Choice for Fleets

21-Feb-2026

Top 10 Buses in India 2026

19-Feb-2026

Top 10 Tata Mini Truck Price List in India 2026

18-Feb-2026

Best Tata Electric Trucks in India 2026

16-Feb-2026

View All articles