Ad

Ad

Electric Three-Wheeler Sales Report – November 2025: YC Electric, Zeniak Innovation & J.S. Auto Lead the Market

Key Highlights:

YC Electric leads both e-rickshaw and e-cart sales.

Zeniak Innovation posts fastest e-rickshaw growth.

J.S. Auto tops e-cart segment with strong gains.

Saera and Dilli Electric show mixed performance.

Energy Electric reports steady growth across both categories.

India’s electric three-wheeler market continued to show strong and mixed trends in November 2025 across both the e-rickshaw and e-cart segments. Fresh Vahan data (excluding Telangana) reveals clear leaders, sharp growth for some OEMs, and notable slowdowns for others. Here’s a simple and easy-to-understand breakdown of how each brand performed.

Also Read: Electric Three-Wheeler Sales Report - September 2025: YC Electric and Dilli Electric Dominate

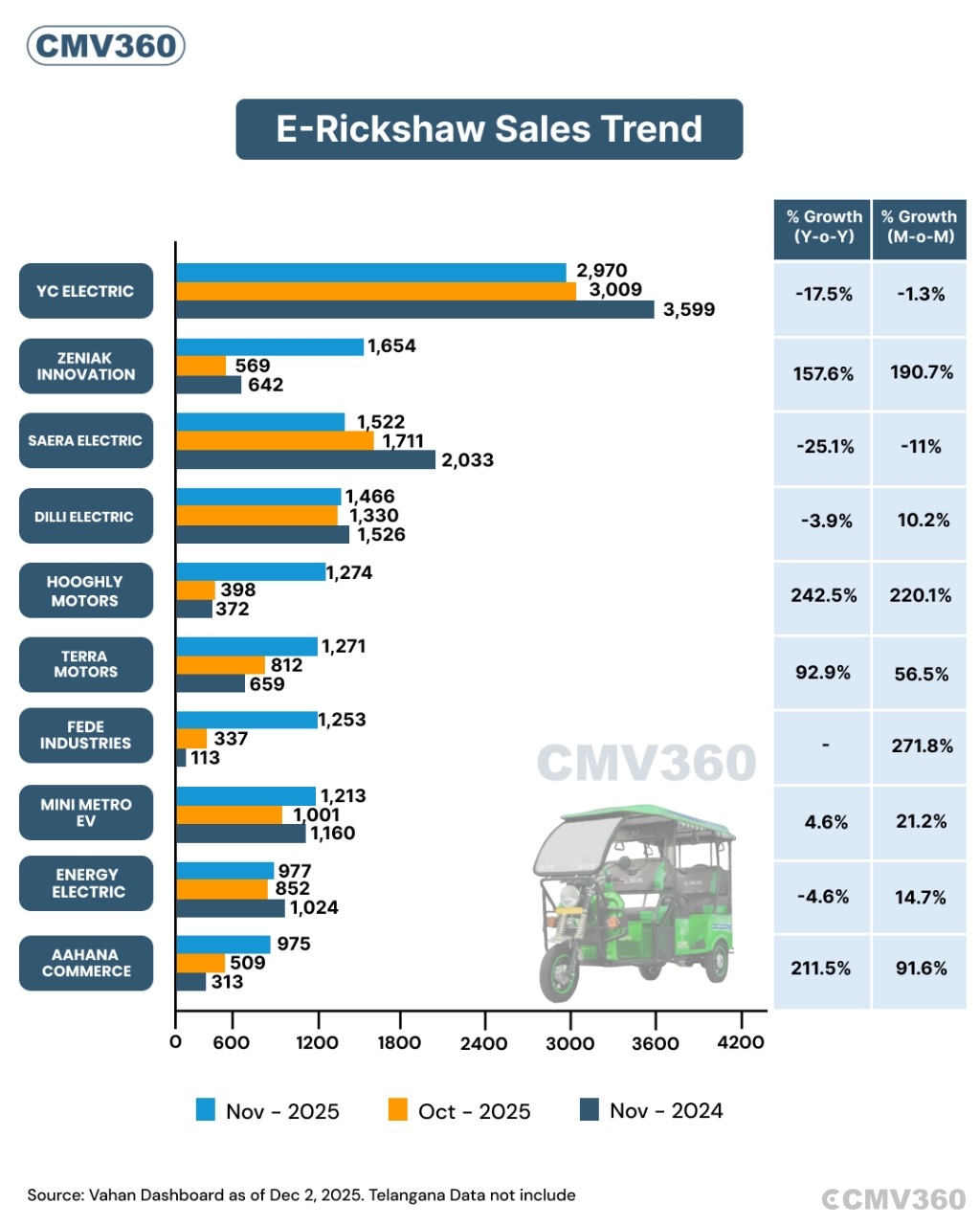

E-Rickshaw Sales Trend – November 2025

The e-rickshaw segment, mainly used for last-mile passenger mobility, saw mixed performance in November 2025. While some brands registered strong growth, others reported a decline.

E-Rickshaw Sales – November 2025

OEM | Nov-25 | Oct-25 | Nov-24 | Y-o-Y Growth | M-o-M Growth |

YC Electric | 2,970 | 3,009 | 3,599 | -17.5% | -1.3% |

Zeniak Innovation | 1,654 | 569 | 642 | 157.6% | 190.7% |

Saera Electric | 1,522 | 1,711 | 2,033 | -25.1% | -11% |

Dilli Electric | 1,466 | 1,330 | 1,526 | -3.9% | 10.2% |

Hooghly Motors | 1,274 | 398 | 372 | 242.5% | 220.1% |

Terra Motors | 1,271 | 812 | 659 | 92.9% | 56.5% |

Fede Industries | 1,253 | 337 | 113 | – | 271.8% |

Mini Metro EV | 1,213 | 1,001 | 1,160 | 4.6% | 21.2% |

Energy Electric | 977 | 852 | 1,024 | -4.6% | 14.7% |

Aahana Commerce | 975 | 509 | 313 | 211.5% | 91.6% |

YC Electric

YC Electric led the e-rickshaw segment with 2,970 units. However, the brand saw a 17.5% drop year-on-year and a slight 1.3% dip month-on-month. Even with the decline, YC Electric continues to be the top player by volume.

Zeniak Innovation

Zeniak Innovation posted an impressive rise with 1,654 units, marking a 157.6% growth Y-o-Y and an even stronger 190.7% M-o-M surge. This makes it one of the fastest-growing brands in the segment.

Saera Electric

Saera Electric registered 1,522 units, witnessing a 25.1% fall Y-o-Y and an 11% drop M-o-M. The decline shows weaker demand compared to last year.

Dilli Electric

Dilli Electric recorded 1,466 units in November, down 3.9% Y-o-Y, but showing a 10.2% M-o-M improvement, hinting at a slight recovery.

Hooghly Motors

Hooghly Motors delivered a strong performance with 1,274 units, growing 242.5% Y-o-Y and 220.1% M-o-M, one of the highest jumps in this month’s list.

Terra Motors

Terra Motors sold 1,271 units, rising 92.9% Y-o-Y and 56.5% M-o-M, showing solid upward momentum.

Fede Industries

Fede Industries saw a huge jump to 1,253 units, showing 271.8% M-o-M growth, making it a strong emerging player.

Mini Metro EV

Mini Metro sold 1,213 units, posting a 4.6% Y-o-Y and 21.2% M-o-M increase.

Energy Electric

Energy Electric registered 977 units, with a slight 4.6% dip Y-o-Y, but a positive 14.7% growth M-o-M.

Aahana Commerce

Aahana Commerce achieved 975 units, marking a strong 211.5% Y-o-Y and 91.6% M-o-M rise.

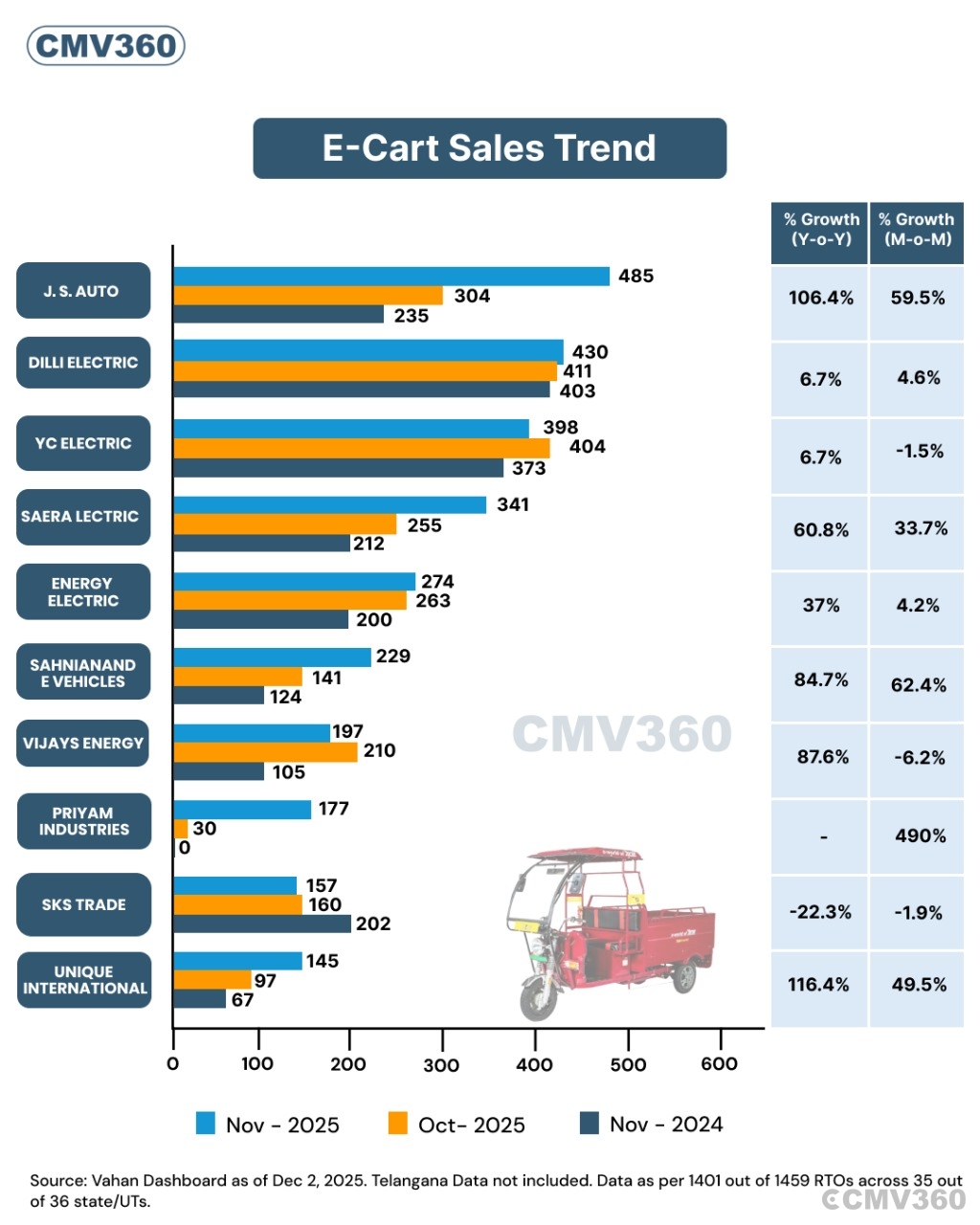

E-Cart Sales Trend – November 2025

The e-cart segment, used mainly for goods transport and delivery services, displayed strong growth across most brands in November 2025.

E-Cart Sales – November 2025

OEM | Nov-25 | Oct-25 | Nov-24 | Y-o-Y Growth | M-o-M Growth |

J.S. Auto | 485 | 304 | 235 | 106.4% | 59.5% |

Dilli Electric | 430 | 411 | 403 | 6.7% | 4.6% |

YC Electric | 398 | 404 | 373 | 6.7% | -1.5% |

Saera Electric | 341 | 255 | 212 | 60.8% | 33.7% |

Energy Electric | 274 | 263 | 200 | 37% | 4.2% |

SahniAnand E-Vehicles | 229 | 141 | 124 | 84.7% | 62.4% |

VJAVS Energy | 197 | 210 | 105 | 87.6% | -6.2% |

Priyam Industries | 177 | 30 | 0 | – | 490% |

SKS Trade | 157 | 160 | 202 | -22.3% | -1.9% |

Unique International | 145 | 97 | 67 | 116.4% | 49.5% |

J.S. Auto

J.S. Auto led the segment with 485 units, showing a robust 106.4% Y-o-Y growth and 59.5% M-o-M rise.

Dilli Electric

Dilli Electric came second with 430 units, growing 6.7% Y-o-Y and 4.6% M-o-M, maintaining steady progress.

YC Electric

YC Electric sold 398 units, marking a 6.7% Y-o-Y increase, though slightly down by 1.5% M-o-M.

Saera Electric

Saera Electric recorded 341 units, up 60.8% Y-o-Y and 33.7% M-o-M, showing strong demand for its e-carts.

Energy Electric

Energy Electric sold 274 units, growing 37% Y-o-Y and 4.2% M-o-M, indicating steady performance.

SahniAnand E-Vehicles

The company posted 229 units, up 84.7% Y-o-Y and 62.4% M-o-M, marking a significant improvement.

VJAVS Energy

VJAVS Energy recorded 197 units, showing 87.6% growth Y-o-Y, though slightly down 6.2% M-o-M.

Priyam Industries

Priyam Industries jumped to 177 units, showing a massive 490% M-o-M growth, indicating rapid scale-up from previous months.

SKS Trade

SKS Trade registered 157 units, down 22.3% Y-o-Y and 1.9% M-o-M, marking a slowdown.

Unique International

Unique International recorded 145 units, up 116.4% Y-o-Y and 49.5% M-o-M, showing a strong recovery.

CMV360 Says

The November 2025 data reflects a changing landscape in India’s electric three-wheeler market, where both challenges and new opportunities are shaping the sector. In the e-rickshaw category, established leaders such as YC Electric and Saera Electric faced noticeable declines, while new and fast-growing players like Zeniak Innovation and Hooghly Motors recorded strong gains. This shift suggests increasing competition and evolving customer preferences in the passenger mobility segment.

In contrast, the e-cart segment continued to show healthy momentum, driven by rising demand for efficient and eco-friendly goods transportation. Brands like J.S. Auto and Dilli Electric delivered strong performances, highlighting the sector’s growing importance in last-mile logistics and commercial mobility.

Overall, the sales trends indicate a clear market transition. While emerging brands rise in the e-rickshaw segment, the e-cart segment is becoming a major pillar of growth within India’s electric mobility landscape. As the country accelerates toward cleaner and more affordable transportation solutions, electric three-wheelers—especially e-carts—are expected to play a vital role in supporting sustainable urban and rural mobility.

News

CMV360 Weekly Wrap-Up | 19–23 Jan 2026: Tata’s Biggest Truck Launch, Electric Bus Expansion, Clean Mobility Push, Farm Policy Changes & Market Relief

Key highlights from 19–23 Jan 2026: major truck launches, electric bus expansion, clean mobility progress, new tractor introductions, farmer policy changes, and market tr...

24-Jan-26 08:56 AM

Read Full NewsAshok Leyland Revives TAURUS and HIPPO with Next-Generation Heavy-Duty Technology

Ashok Leyland brings back TAURUS and HIPPO trucks with next-gen technology, powerful engines, and improved durability to meet India’s growing mining and infrastructure tr...

22-Jan-26 12:26 PM

Read Full NewsFinnfund Invests $15 Million in Transvolt Mobility to Boost Electric Heavy Vehicles in India

Finnfund invests USD 15 million in Transvolt Mobility to expand electric buses and trucks in India, supporting clean transport, job creation, and India’s sustainable mobi...

22-Jan-26 04:52 AM

Read Full NewsMahindra Launches Refreshed Bolero Camper and Bolero Pik-Up with New Features and Comfort Upgrades

Mahindra refreshes Bolero Camper and Pik-Up with bold styling, iMAXX telematics, air conditioning, and improved comfort, reinforcing its leadership in India’s pickup segm...

21-Jan-26 01:01 PM

Read Full NewsFresh Bus and Exponent Energy Partner to Deploy Rapid-Charging Electric Intercity Buses in India

Fresh Bus and Exponent Energy partner to deploy rapid-charging electric intercity buses, enabling long-distance travel with 15-minute charging and high-power infrastructu...

21-Jan-26 10:07 AM

Read Full NewsGreenCell Mobility Secures $89 Million to Rapidly Expand Electric Bus Network Across India

GreenCell Mobility raises $89 million to expand its electric bus fleet across India, boosting clean public transport, charging infrastructure, and zero-emission mobility ...

21-Jan-26 07:12 AM

Read Full NewsAd

Ad

Latest Articles

Top 10 Electric Trucks in India 2026: Price, Range, & Payload

22-Jan-2026

Diesel vs CNG vs Electric Trucks in India 2026: Choosing the Right Truck for Your Business Needs

21-Jan-2026

Electric Commercial Vehicles in India 2026: Complete Guide to Electric Trucks, Buses, and Three Wheelers with Prices

19-Jan-2026

Top 5 High-Mileage Trucks in India 2026

16-Jan-2026

Top 10 CNG Trucks in India 2026: Best CNG Models

12-Jan-2026

Popular Bus Brands in India 2026

08-Jan-2026

View All articles