Ad

Ad

Electric Three-Wheeler Sales Report – January 2026: Zeniak Innovation, J.S. Auto & YC Electric Drive Market Momentum

Key Highlights:

Zeniak Innovation led e-rickshaw sales despite MoM decline.

Strong YoY growth seen among emerging e-rickshaw OEMs.

Most OEMs faced MoM pressure after December highs.

J.S. Auto topped e-cart sales with solid MoM recovery.

E-cart segment showed mixed trends with selective growth.

India’s electric three-wheeler market entered 2026 with a clear shift in momentum, reflecting both resilience and short-term pressure across passenger and cargo segments. January 2026 data from the Vahan Dashboard (as of February 2, 2026) shows that while demand for clean and affordable last-mile mobility remains strong, sales cooled month-on-month after the high December base. The e-rickshaw segment saw dominant leadership from a few fast-growing OEMs, alongside sharp year-on-year expansion for emerging players and visible MoM declines across most brands. At the same time, the e-cart segment delivered a mixed performance, with select OEMs posting strong monthly recoveries and others continuing to face annual volume pressure. Together, these trends highlight a competitive and evolving electric three-wheeler market as India moves deeper into 2026.

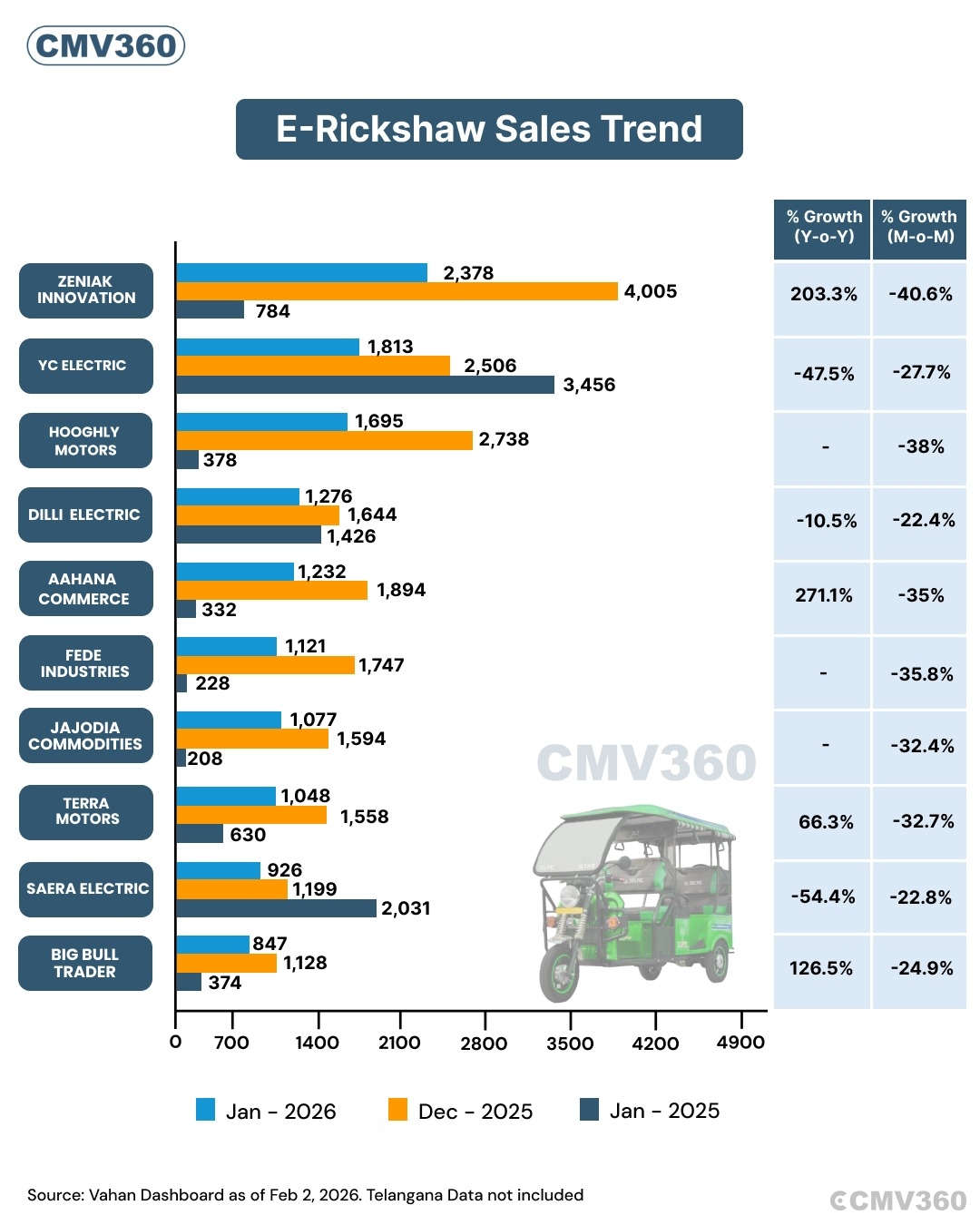

E-Rickshaw Sales Trend by OEM: January 2026 Performance

India’s e-rickshaw market continued to show strong movement at the start of 2026, driven by rising demand for affordable and clean last-mile mobility. As per Vahan Dashboard data (as of February 2, 2026), January 2026 sales highlighted clear leaders, sharp year-on-year growth for some OEMs, and month-on-month pressure across most players.

Note: Telangana data is not included.

E-Rickshaw Sales by OEM – January 2026

OEM / Brand | Jan 2026 Sales (Units) | Dec 2025 Sales (Units) | Jan 2025 Sales (Units) | YoY Growth (%) | MoM Growth (%) |

Zeniak Innovation | 4,005 | 2,378 | 784 | 203.3% | -40.6% |

YC Electric | 3,456 | 2,506 | 1,813 | -47.5% | -27.7% |

Hooghly Motors | 2,738 | 1,695 | 378 | — | -38.0% |

Dilli Electric | 1,644 | 1,276 | 1,426 | -10.5% | -22.4% |

Aahana Commerce | 1,894 | 1,232 | 332 | 271.1% | -35.0% |

Fede Industries | 1,747 | 1,121 | 228 | — | -35.8% |

Jajodia Commodities | 1,594 | 1,077 | 208 | — | -32.4% |

Terra Motors | 1,558 | 1,048 | 630 | 66.3% | -32.7% |

Saera Electric | 1,199 | 926 | 2,031 | -54.4% | -22.8% |

Big Bull Trader | 1,128 | 847 | 374 | 126.5% | -24.9% |

Source: Vahan Dashboard (as of Feb 2, 2026)

Note: Telangana data not included

Top E-Rickshaw OEMs in January 2026

Zeniak Innovation

Zeniak Innovation led the market in January 2026 with 4,005 e-rickshaws registered, making it the top-selling OEM for the month. The company recorded a strong 203.3% year-on-year growth, showing massive expansion compared to January 2025. However, sales declined 40.6% month-on-month from December levels.

YC Electric

YC Electric registered 3,456 units in January 2026, maintaining its position among the top three OEMs. Despite healthy volumes, the brand saw a 47.5% year-on-year decline and a 27.7% month-on-month drop, indicating softer demand compared to both last year and December 2025.

Hooghly Motors

Hooghly Motors reported 2,738 registrations in January. While year-on-year growth data was not available, the company faced a 38% decline month-on-month, suggesting a slowdown after strong December performance.

Dilli Electric

Dilli Electric sold 1,644 e-rickshaws during January 2026. The OEM recorded a 10.5% year-on-year decline and a 22.4% drop month-on-month, reflecting moderate pressure on volumes.

Aahana Commerce

Aahana Commerce emerged as one of the fastest-growing players with 1,894 units registered. The brand posted a remarkable 271.1% year-on-year growth, although sales fell 35% compared to December 2025.

Fede Industries

Fede Industries clocked 1,747 registrations in January 2026. Month-on-month sales declined by 35.8%, while year-on-year growth data was not specified.

Jajodia Commodities

Jajodia Commodities recorded 1,594 units in January. The OEM experienced a 32.4% month-on-month decline, with year-on-year growth figures not available.

Terra Motors

Terra Motors registered 1,558 e-rickshaws during the month. The company achieved a 66.3% year-on-year growth, but sales dropped 32.7% month-on-month, showing long-term expansion despite short-term softness.

Saera Electric

Saera Electric reported 1,199 units in January 2026. The brand saw a 54.4% year-on-year decline and a 22.8% fall month-on-month, indicating reduced demand.

Big Bull Trader

Big Bull Trader closed January with 1,128 registrations. The OEM posted a 126.5% year-on-year growth, while volumes declined 24.9% compared to December.

Overall Market Insight

In January 2026, e-rickshaw sales were clearly led by Zeniak Innovation, YC Electric, and Hooghly Motors. While several OEMs recorded strong year-on-year growth, especially emerging players, month-on-month sales declined across almost all brands, reflecting seasonal softness after December highs. Despite short-term pressure, the segment remains competitive and growth-focused as demand for electric last-mile transport continues across India.

Also Read: E-3W Goods L5 Sales Trend: Mahindra, Bajaj, and Omega Seiki Lead Market Momentum

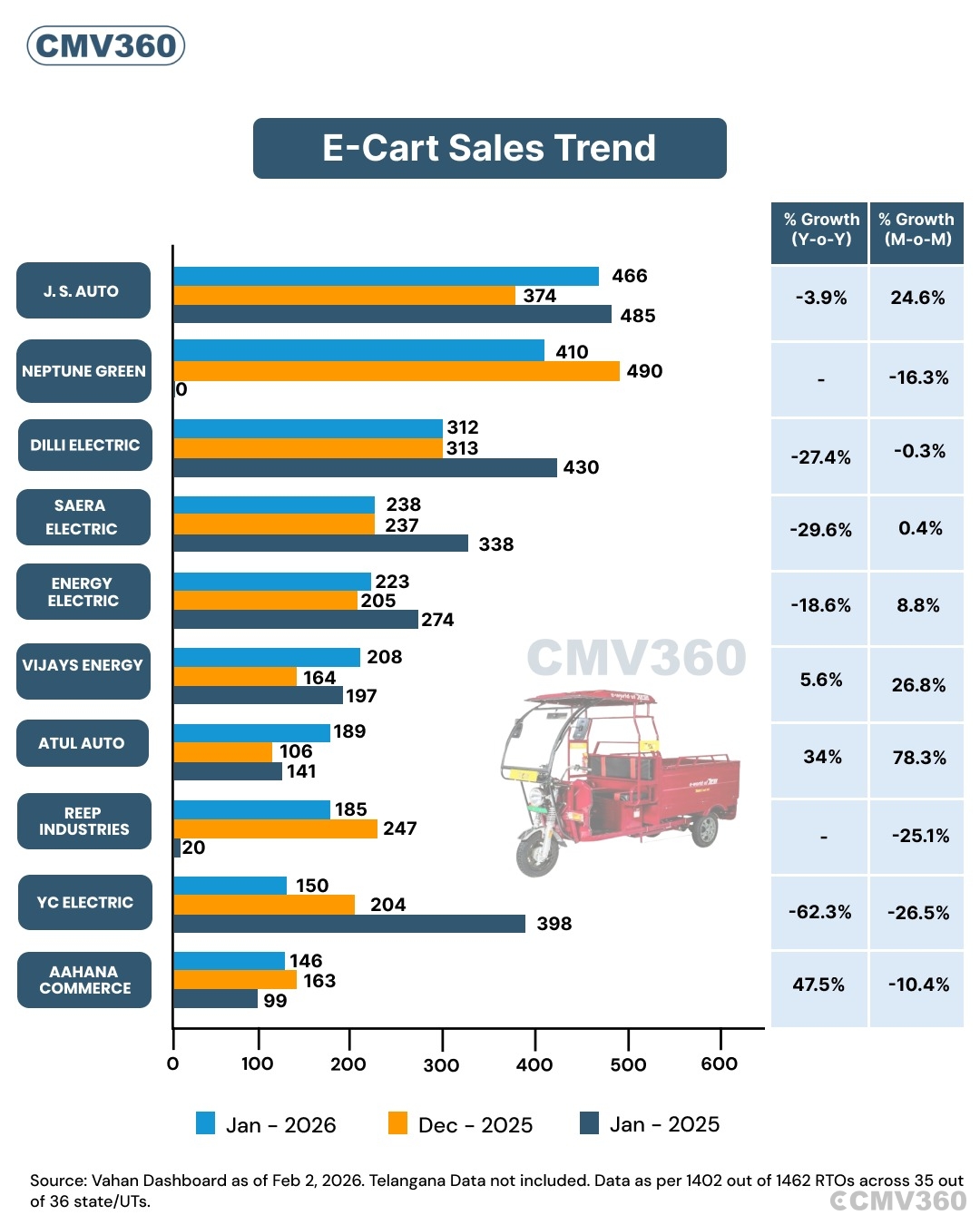

E-Cart Sales Trend by OEM: January 2026 Performance Overview

The Indian e-cart segment, mainly used for goods transport and last-mile delivery, recorded a mixed performance in January 2026. As per Vahan Dashboard data (as of February 2, 2026), a few OEMs showed strong month-on-month growth, while several brands faced pressure on a year-on-year basis.

Telangana data is not included. The data covers 1,402 out of 1,462 RTOs, across 35 of 36 states and UTs.

E-Cart Sales by OEM – January 2026

OEM / Brand | Jan-26 Sales | Dec-25 Sales | Jan-25 Sales | YoY Growth (%) | MoM Growth (%) |

J.S. Auto | 466 | 374 | 485 | -3.9% | 24.6% |

Neptune Green | 410 | 490 | 0 | – | -16.3% |

Dilli Electric | 312 | 313 | 430 | -27.4% | -0.3% |

Saera Electric | 238 | 237 | 338 | -29.6% | 0.4% |

Energy Electric | 223 | 205 | 274 | -18.6% | 8.8% |

Vuays Energy | 208 | 197 | 164 | 5.6% | 26.8% |

Atul Auto | 189 | 106 | 141 | 34.0% | 78.3% |

Reep Industries | 185 | 247 | 20 | – | -25.1% |

YC Electric | 150 | 204 | 398 | -62.3% | -26.5% |

Aahana Commerce | 146 | 163 | 99 | 47.5% | -10.4% |

Source: Vahan Dashboard (as of February 2, 2026) Note: Telangana data not included; data based on 1,402 of 1,462 RTOs across 35 of 36 states/UTs.

E-Cart OEMs in January 2026

J.S. Auto Leads the Market

J.S. Auto emerged as the largest e-cart OEM in January 2026, registering 466 units. While the brand saw a 3.9% year-on-year decline, it posted a strong 24.6% month-on-month growth, indicating a solid recovery from December.

Neptune Green

Neptune Green recorded 410 units in January. Sales declined compared to 490 units in December 2025, resulting in a 16.3% MoM drop. Year-on-year growth data was not available due to zero registrations last year.

Dilli Electric

Dilli Electric sold 312 units, remaining almost flat compared to December. However, the OEM reported a 27.4% YoY decline, reflecting lower demand compared to January 2025.

Saera Electric

Saera Electric registered 238 units, showing stable month-on-month movement. Despite this, sales were down 29.6% year-on-year, indicating pressure on annual performance.

Energy Electric

Energy Electric recorded 223 units in January 2026. The brand showed a positive 8.8% MoM growth, though it remained 18.6% lower than last year’s levels.

Vuays Energy

Vuays Energy sold 208 units, posting a 5.6% YoY growth and a healthy 26.8% MoM increase, making it one of the better-performing OEMs during the month.

Atul Auto

Atul Auto reported 189 units, marking a strong 34% year-on-year growth and an impressive 78.3% month-on-month rise, indicating sharp momentum improvement.

Reep Industries

Reep Industries registered 185 units, down from December levels, leading to a 25.1% MoM decline. Year-on-year comparison remains limited due to low base figures last year.

YC Electric

YC Electric recorded 150 units in January 2026. The OEM faced a steep 62.3% YoY decline along with a 26.5% MoM drop, marking one of the weakest performances in the segment.

Aahana Commerce

Aahana Commerce sold 146 units, showing a strong 47.5% year-on-year growth, though sales declined 10.4% month-on-month.

Overall Market Insight

The January 2026 e-cart sales trend shows that J.S. Auto and Neptune Green led the market in volumes, while brands like Atul Auto and Vuays Energy stood out with strong growth momentum. At the same time, several OEMs continued to face year-on-year pressure. The segment remains dynamic as electric cargo vehicles gain wider acceptance across urban and semi-urban India.

Also Read: Electric Passenger Three-Wheeler (E-3W L5) Sales Rise in January 2026, Bajaj Auto Leads the Market

CMV360 says

Overall, January 2026 highlighted a transitional phase for India’s electric three-wheeler market. While e-rickshaw and e-cart sales eased month-on-month after December peaks, several OEMs continued to post strong year-on-year growth, signalling long-term expansion. Market leadership remained concentrated, but rising competition and improving adoption of electric last-mile vehicles suggest steady growth ahead despite short-term seasonal softness.

News

Electric Passenger Three-Wheeler (E-3W L5) Sales Rise in January 2026, Bajaj Auto Leads the Market

Electric passenger three-wheeler sales grew strongly in January 2026. Bajaj Auto led the market, followed by Mahindra and TVS, while Omega Seiki recorded the highest grow...

04-Feb-26 10:02 AM

Read Full NewsIndia’s Electric Bus Sales Decline in January 2026: OEM-wise Performance and Market Share

India’s electric bus sales fell to 391 units in January 2026. JBM Electric led the market, followed by Switch Mobility, as selective OEMs showed monthly growth....

03-Feb-26 12:32 PM

Read Full NewsE-3W Goods L5 Sales Trend: Mahindra, Bajaj, and Omega Seiki Lead Market Momentum

India’s E-3W goods L5 sales in January 2026 show Mahindra leading, Bajaj recovering, and Omega Seiki gaining momentum, reflecting steady demand and rising competition....

03-Feb-26 12:19 PM

Read Full NewsBudget 2026–27 May Strongly Support Trucks and Commercial Vehicles Through Infrastructure Push

Budget 2026–27 supports commercial vehicles through higher infrastructure spending, freight corridors, mining growth, and electric bus deployment, creating strong long-te...

02-Feb-26 01:09 PM

Read Full NewsBudget 2026-27: 4,000 Electric Buses Planned for East India to Boost Industry and Tourism

Union Budget 2026-27 proposes 4,000 electric buses for eastern states under Purvodaya, linking clean transport with industrial growth, tourism development, and improved p...

02-Feb-26 11:10 AM

Read Full NewsAshok Leyland January Sales Report 2026: 38% YoY Growth, 19,500 Units Sold

Ashok Leyland reports strong CV sales in January 2026 with 19,500 units sold, driven by robust domestic demand and steady export growth across M&HCV and LCV segments....

02-Feb-26 10:06 AM

Read Full NewsAd

Ad

Latest Articles

Tata Trucks Price & Best Models 2026

03-Feb-2026

Top 5 Electric Buses Leading India’s Green Revolution in 2026

30-Jan-2026

ICV vs HCV Trucks: Which Is More Profitable in 2026?

27-Jan-2026

Top 10 Electric Trucks in India 2026: Price, Range, & Payload

22-Jan-2026

Diesel vs CNG vs Electric Trucks in India 2026: Choosing the Right Truck for Your Business Needs

21-Jan-2026

Electric Commercial Vehicles in India 2026: Complete Guide to Electric Trucks, Buses, and Three Wheelers with Prices

19-Jan-2026

View All articles