Ad

Ad

FADA Sales Report August 2024: CV Segment Experienced decline of 6.05% YOY

Key Highlights:

- Commercial vehicle sales in August 2024 dropped by 6.05% year-over-year.

- Total CV sales were 73,253 units, down from 77,967 units in August 2023.

- Sales declined by 8.50% month-over-month from July 2024.

- Light Commercial Vehicles (LCVs) saw a 6.10% decrease year-over-year.

- Tata Motors held the largest market share at 33.88%, though it decreased from last year.

FADA, the Federation of Automobile Dealers Association, has shared the commercial vehicle sales data for August 2024. The CV segment experienced a decline of 6.05% year over year.

According to the latest FADA Sales Report, combined CV sales totalled 73,253 units in August 2024, down from 77,967 units in August 2023. Additionally, there was a decline of 8.50% in Month-on-Month (MoM) sales compared to July 2024, when 80,057 units were sold.

Commercial Vehicle Sales in August 2024: Category-Wise Breakdown

Light Commercial Vehicles (LCVs)

In August 2024, the LCV segment sold 42,496 units, down 6.26% from July 2024, which recorded 45,336 units. On a year-on-year basis, LCV sales declined by 6.10% compared to 45,257 units in August 2023.

Medium Commercial Vehicles (MCVs)

The MCV segment sold 6,137 units in August 2024, marking a 13.85% drop from July’s 7,124 units. Compared to August 2023, when 6,173 units were sold, the sales decreased slightly by 0.58%.

Heavy Commercial Vehicles (HCVs)

HCV sales stood at 21,221 units in August 2024, showing an 11.82% decline from the 24,066 units sold in July. Year-on-year, the segment dropped by 8.19% compared to 23,114 units sold in August 2023.

Others (Small Commercial Vehicles and Other Segments)

In this category, 3,399 units were sold in August 2024, down 3.74% from July 2024's 3,531 units. The year-on-year change was minimal, with a 0.70% decrease compared to 3,423 units sold in August 2023.

Each category has seen a sales drop, highlighting industry-wide challenges.

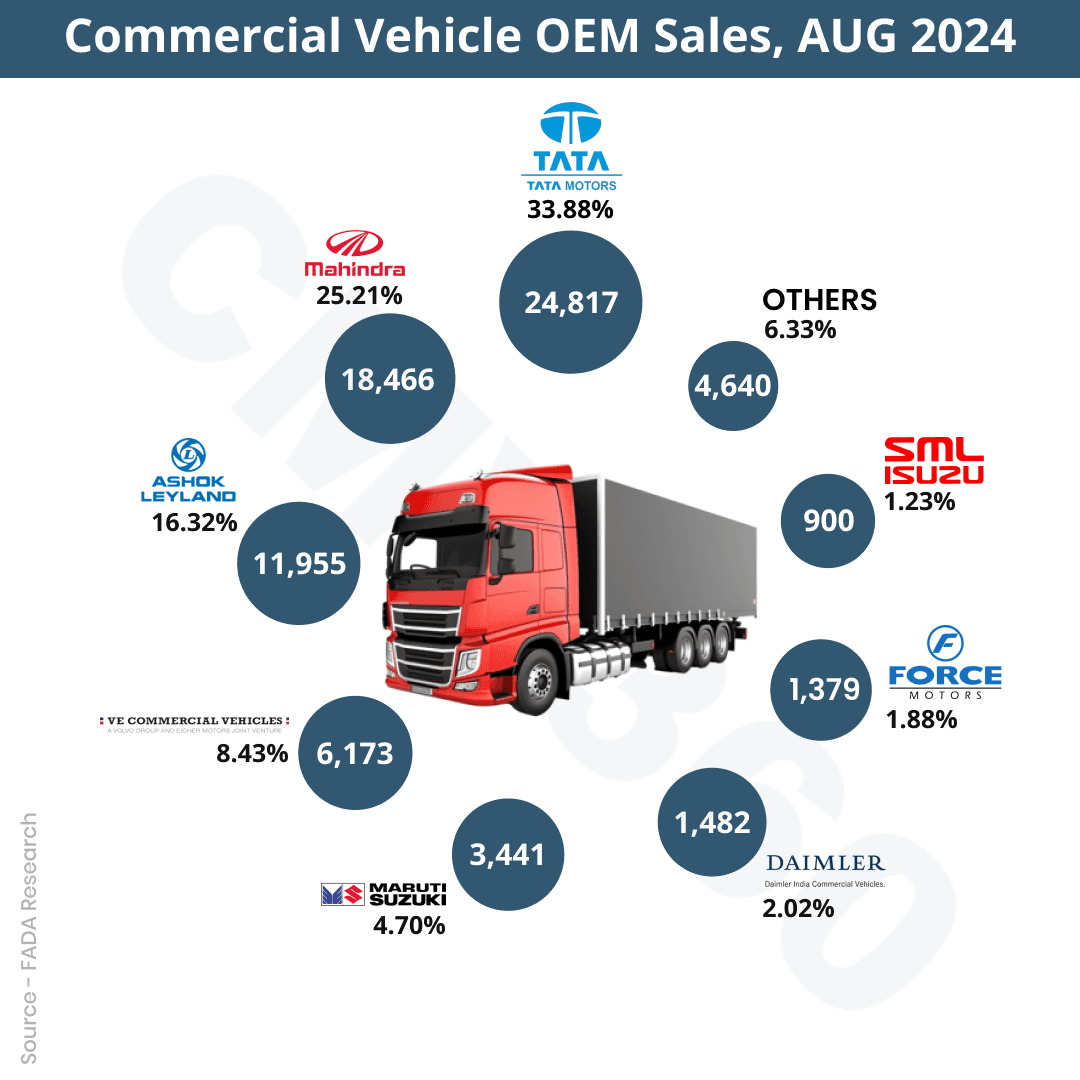

OEM Wise CV Sales Figures

In August 2024, Tata Motors Ltd hold a 33.88% market share with 24,817 units sold, down from 36.17% in August 2023 when they sold 28,198 units.

Mahindra & Mahindra Limited achieved a 25.21% market share. In august 2024, the company sold 18,466 units, compared to 19216 units sold in August 2023.

Ashok Leyland Ltd secured a 16.32% market share. In August 2024, the company sold 11,955 units, compared to 12,136 units in August 2023.

VE Commercial Vehicles Ltd improved its market share to 8.43% with 6,173 units sold, compared to 7.33% and 5,717 units in August 2023.

Maruti Suzuki India Ltd experienced market share increase to 4.70% with 3,441 units sold, up from 4.20% and 3,277 units in August 2023.

Daimler India Commercial Vehicles Pvt. Ltd also saw a rise in market share to 2.02%, selling 1,482 units compared to 1.93% and 1,503 units last year.

Force Motors Limited’s market share decreased slightly to 1.88% with 1,379 units sold, down from 1.96% and 1,527 units in August 2023.

SML Isuzu Ltd experienced a small increase in market share to 1.23%, with 900 units sold compared to 1.15% and 895 units last year.

The ‘Others’ category saw its market share fall to 6.33% with 4,640 units sold, down from 7.05% and 5,498 units in August 2023.

Overall, the total commercial vehicle market in August 2024 consisted of 73,253 units, reflecting a decline from 77,967 units sold in August 2023.

Also Read: FADA Sales Report July 2024: CV Segment Experienced growth of 5.93% YOY.

CMV360 Says

The drop in commercial vehicle sales for August 2024 reflects a tough market environment for the industry. Tata Motors' decline in market share indicates increased competition, while Mahindra & Mahindra and Ashok Leyland have made modest gains. This situation emphasizes the need for manufacturers to stay agile and responsive to market shifts to remain competitive.

News

Electric Three-Wheeler Sales Report – January 2026: Zeniak Innovation, J.S. Auto & YC Electric Drive Market Momentum

January 2026 electric three-wheeler sales show mixed trends, with strong YoY growth for select OEMs and MoM pressure across e-rickshaw and e-cart segments in India....

04-Feb-26 11:11 AM

Read Full NewsElectric Passenger Three-Wheeler (E-3W L5) Sales Rise in January 2026, Bajaj Auto Leads the Market

Electric passenger three-wheeler sales grew strongly in January 2026. Bajaj Auto led the market, followed by Mahindra and TVS, while Omega Seiki recorded the highest grow...

04-Feb-26 10:02 AM

Read Full NewsIndia’s Electric Bus Sales Decline in January 2026: OEM-wise Performance and Market Share

India’s electric bus sales fell to 391 units in January 2026. JBM Electric led the market, followed by Switch Mobility, as selective OEMs showed monthly growth....

03-Feb-26 12:32 PM

Read Full NewsE-3W Goods L5 Sales Trend: Mahindra, Bajaj, and Omega Seiki Lead Market Momentum

India’s E-3W goods L5 sales in January 2026 show Mahindra leading, Bajaj recovering, and Omega Seiki gaining momentum, reflecting steady demand and rising competition....

03-Feb-26 12:19 PM

Read Full NewsBudget 2026–27 May Strongly Support Trucks and Commercial Vehicles Through Infrastructure Push

Budget 2026–27 supports commercial vehicles through higher infrastructure spending, freight corridors, mining growth, and electric bus deployment, creating strong long-te...

02-Feb-26 01:09 PM

Read Full NewsBudget 2026-27: 4,000 Electric Buses Planned for East India to Boost Industry and Tourism

Union Budget 2026-27 proposes 4,000 electric buses for eastern states under Purvodaya, linking clean transport with industrial growth, tourism development, and improved p...

02-Feb-26 11:10 AM

Read Full NewsAd

Ad

Latest Articles

Tata Trucks Price & Best Models 2026

03-Feb-2026

Top 5 Electric Buses Leading India’s Green Revolution in 2026

30-Jan-2026

ICV vs HCV Trucks: Which Is More Profitable in 2026?

27-Jan-2026

Top 10 Electric Trucks in India 2026: Price, Range, & Payload

22-Jan-2026

Diesel vs CNG vs Electric Trucks in India 2026: Choosing the Right Truck for Your Business Needs

21-Jan-2026

Electric Commercial Vehicles in India 2026: Complete Guide to Electric Trucks, Buses, and Three Wheelers with Prices

19-Jan-2026

View All articles