Ad

Ad

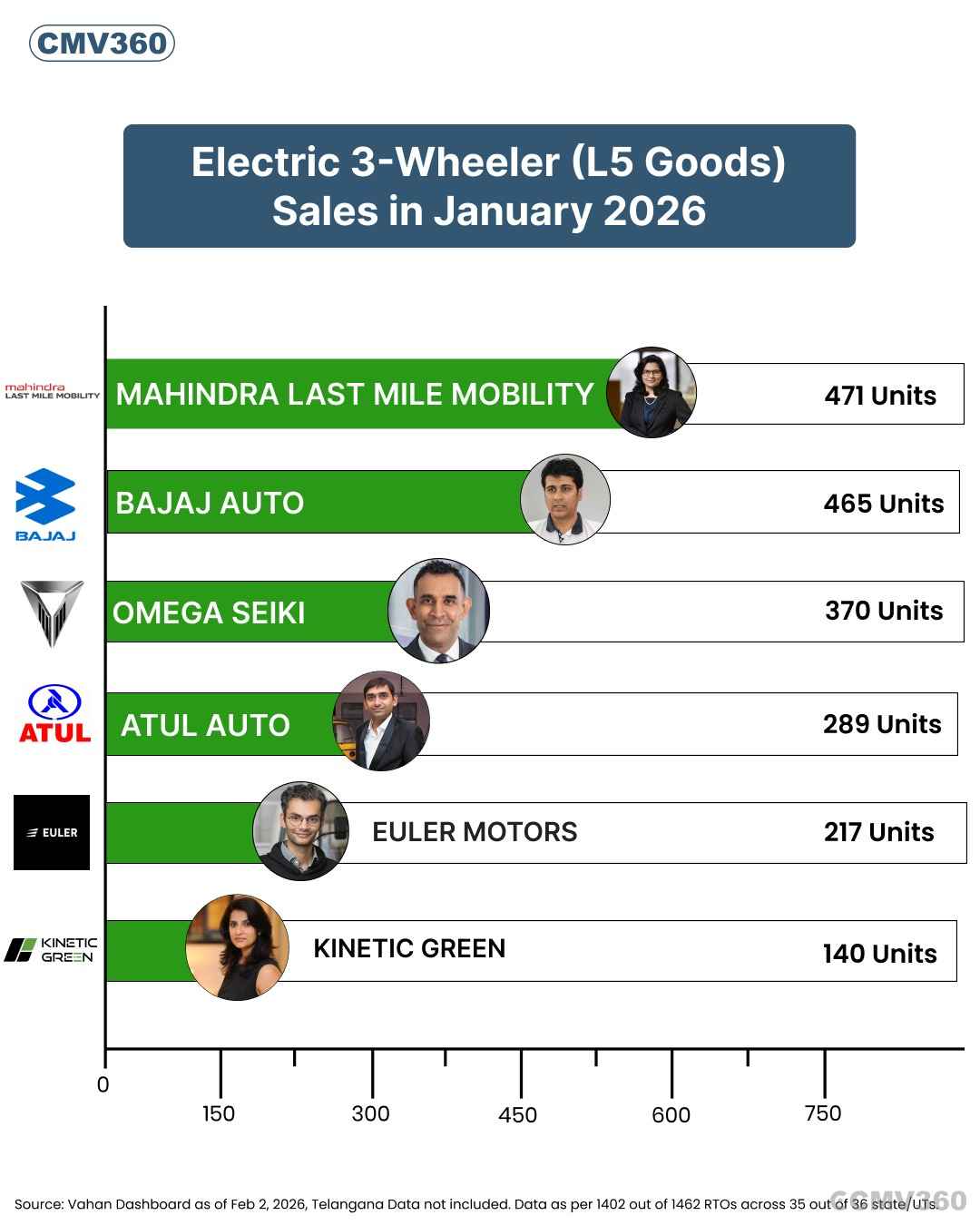

E-3W Goods L5 Sales Trend: Mahindra, Bajaj, and Omega Seiki Lead Market Momentum

Key Highlights

Mahindra Last Mile Mobility leads E-3W goods sales in January 2026.

Bajaj Auto shows month-on-month recovery despite YoY dip.

Omega Seiki records strong MoM growth, gaining market momentum.

Atul Auto and Green Evolve post healthy monthly growth trends.

Overall, E-3W goods L5 demand remains stable across key OEMs.

India’s electric three-wheeler (E-3W) goods L5 segment continued to show steady demand, as reflected in the latest OEM-wise sales trend. The data highlights registrations for January 2026, compared with December 2025 and January 2025, offering a clear picture of month-on-month (MoM) and year-on-year (YoY) performance across major manufacturers.

The segment remains dominated by established players such as Mahindra Last Mile Mobility, Bajaj Auto, and Omega Seiki, while emerging brands continue to improve their market presence.

Also Read: Electric Three-Wheeler Goods Sales Report (December 2025): Mahindra, Bajaj, Omega Lead

E-3W Goods L5 OEM Sales Table

OEM Name | Jan 2026 Units | Dec 2025 Units | Jan 2025 Units | YoY Growth | MoM Growth |

Mahindra Last Mile Mobility | 471 | 542 | 455 | 3.5% | -13.1% |

Bajaj Auto | 465 | 450 | 481 | -3.3% | 3.3% |

Omega Seiki | 370 | 317 | 368 | 0.5% | 16.7% |

Atul Auto | 289 | 236 | 57 | – | 22.5% |

Euler Motors | 217 | 251 | 273 | -20.5% | -13.5% |

Green Evolve | 140 | 125 | 20 | – | 12.0% |

E-3W Goods L5 OEM Sales Performance – January 2026

Mahindra Last Mile Mobility

Mahindra Last Mile Mobility emerged as the top OEM in January 2026 with 471 units registered. Compared to January 2025, the company recorded 3.5% YoY growth, showing stable long-term demand. However, sales declined 13.1% MoM from December 2025, indicating a short-term slowdown after strong year-end volumes.

Bajaj Auto

Bajaj Auto registered 465 units in January 2026. While the brand saw a 3.3% decline YoY, it achieved a 3.3% MoM growth, reflecting a recovery in monthly demand and continued strength in the electric cargo three-wheeler space.

Omega Seiki

Omega Seiki recorded 370 units in January 2026. The company posted a modest 0.5% YoY growth, but stood out with a strong 16.7% MoM increase, highlighting rising traction and improving monthly performance.

Atul Auto

Atul Auto registered 289 units during the month. While YoY growth data was not available, the company delivered an impressive 22.5% MoM growth, indicating renewed demand and expanding adoption.

Euler Motors

Euler Motors reported 217 units in January 2026. The brand experienced a 20.5% YoY decline and a 13.5% MoM drop, pointing to softer demand compared to both last year and the previous month.

Green Evolve

Green Evolve recorded 140 units, registering a healthy 12% MoM growth. Although YoY comparison was not specified, the brand continued to show gradual improvement in registrations.

Market Overview and Industry Insight

In January 2026, the electric three-wheeler goods market remained largely driven by Mahindra Last Mile Mobility, Bajaj Auto, and Omega Seiki. While Mahindra maintained leadership in overall volumes, Omega Seiki and Atul Auto showed strong month-on-month momentum. Bajaj Auto’s recovery also reflects stable fleet demand in last-mile logistics.

Despite mixed growth trends across OEMs, the overall E-3W goods L5 segment continues to demonstrate resilience, supported by increasing adoption of electric cargo vehicles across urban and semi-urban markets.

Also Read: Budget 2026–27 May Strongly Support Trucks and Commercial Vehicles Through Infrastructure Push

CMV360 Says

The January 2026 sales trend highlights a stable yet competitive E-3W goods market. While market leaders continue to dominate volumes, rising MoM growth among mid-tier players signals increasing competition. With expanding EV infrastructure and sustained demand for last-mile delivery solutions, the electric three-wheeler goods segment is expected to remain active in the coming months.

News

India’s Electric Bus Sales Decline in January 2026: OEM-wise Performance and Market Share

India’s electric bus sales fell to 391 units in January 2026. JBM Electric led the market, followed by Switch Mobility, as selective OEMs showed monthly growth....

03-Feb-26 12:32 PM

Read Full NewsBudget 2026–27 May Strongly Support Trucks and Commercial Vehicles Through Infrastructure Push

Budget 2026–27 supports commercial vehicles through higher infrastructure spending, freight corridors, mining growth, and electric bus deployment, creating strong long-te...

02-Feb-26 01:09 PM

Read Full NewsBudget 2026-27: 4,000 Electric Buses Planned for East India to Boost Industry and Tourism

Union Budget 2026-27 proposes 4,000 electric buses for eastern states under Purvodaya, linking clean transport with industrial growth, tourism development, and improved p...

02-Feb-26 11:10 AM

Read Full NewsAshok Leyland January Sales Report 2026: 38% YoY Growth, 19,500 Units Sold

Ashok Leyland reports strong CV sales in January 2026 with 19,500 units sold, driven by robust domestic demand and steady export growth across M&HCV and LCV segments....

02-Feb-26 10:06 AM

Read Full NewsTata Motors CV Sales Rise 30% YoY in January 2026, Total Sales Reach 41,549 Units

Tata Motors reports 41,549 commercial vehicle sales in January 2026, marking nearly 30% YoY growth driven by strong domestic demand and rising exports....

02-Feb-26 06:50 AM

Read Full NewsMahindra Records 37,222 Domestic CV & 3-Wheeler Sales in January 2026, Reports 23% Growth

Mahindra reports 23% growth in domestic CV and three-wheeler sales in January 2026, led by strong LCV and 3W demand, with exports also showing steady improvement....

01-Feb-26 07:24 AM

Read Full NewsAd

Ad

Latest Articles

Tata Trucks Price & Best Models 2026

03-Feb-2026

Top 5 Electric Buses Leading India’s Green Revolution in 2026

30-Jan-2026

ICV vs HCV Trucks: Which Is More Profitable in 2026?

27-Jan-2026

Top 10 Electric Trucks in India 2026: Price, Range, & Payload

22-Jan-2026

Diesel vs CNG vs Electric Trucks in India 2026: Choosing the Right Truck for Your Business Needs

21-Jan-2026

Electric Commercial Vehicles in India 2026: Complete Guide to Electric Trucks, Buses, and Three Wheelers with Prices

19-Jan-2026

View All articles