Ad

Ad

Electric Passenger Three-Wheeler (E-3W L5) Sales Rise in January 2026, Bajaj Auto Leads the Market

Key Highlights

Bajaj Auto leads the E-3W passenger segment with strong annual and monthly growth.

Mahindra Last Mile Mobility records healthy YoY expansion despite MoM decline.

TVS Motor maintains a stable third position in the market.

Omega Seiki posts the highest YoY growth among all OEMs.

The overall market shows long-term growth with short-term monthly corrections.

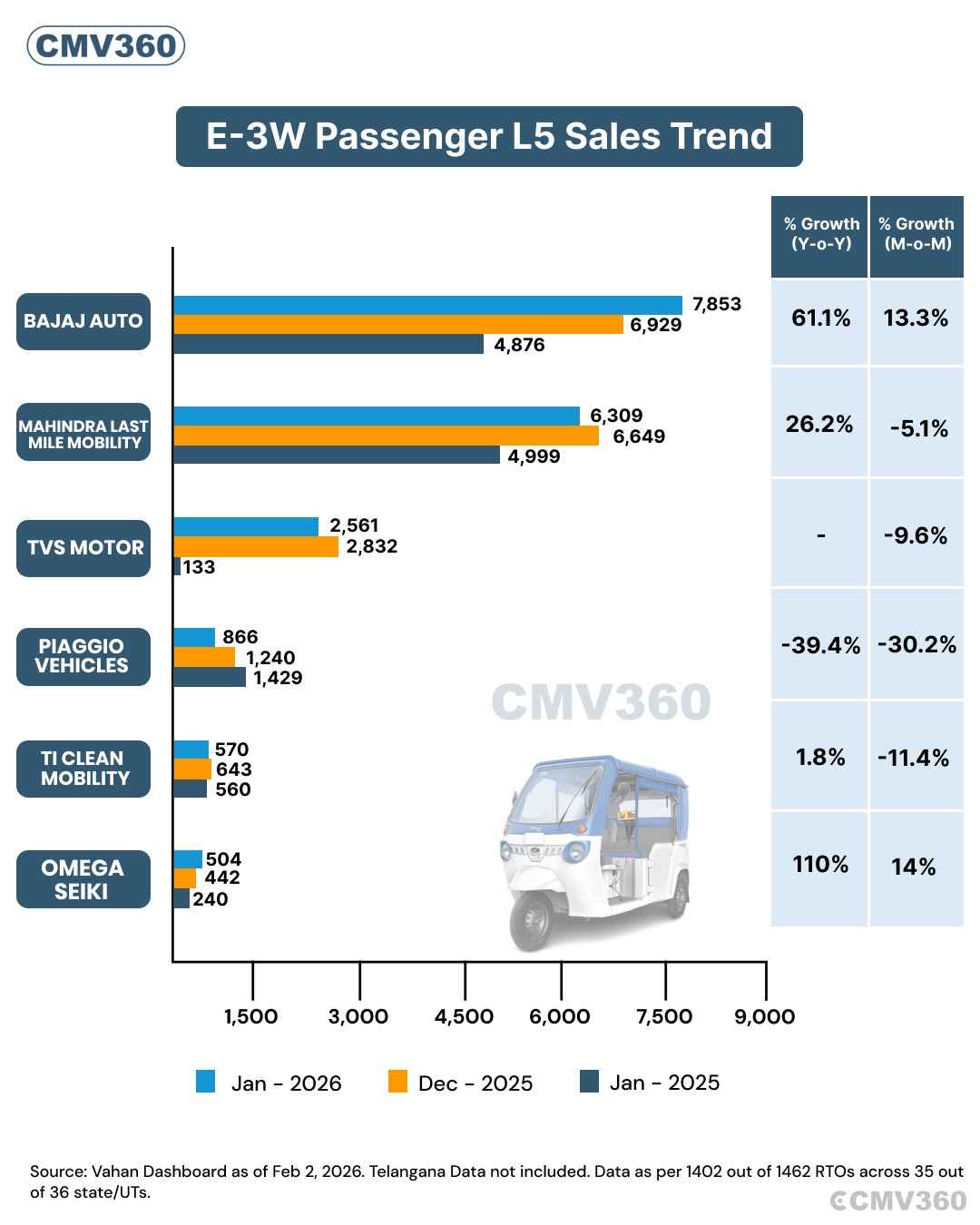

India’s electric passenger three-wheeler (E-3W L5) segment recorded strong year-on-year growth in January 2026, even as month-on-month performance remained mixed across manufacturers. According to the latest Vahan Dashboard data, Bajaj Auto, Mahindra Last Mile Mobility, and TVS Motor emerged as the top three OEMs in terms of registrations.

The data reflects registrations from 1,402 out of 1,462 RTOs, covering 35 of 36 states and Union Territories. Telangana data is not included.

Overall E-3W Passenger Market Trend – January 2026

The electric passenger three-wheeler market showed healthy annual expansion, highlighting growing EV adoption across urban and semi-urban areas. However, several OEMs experienced short-term monthly corrections, indicating demand normalization after higher registrations in the previous month.

Electric Passenger Three-Wheeler (E-3W L5) Sales – January 2026

OEM / Brand | Jan 2026 Sales (Units) | Dec 2025 Sales (Units) | Jan 2025 Sales (Units) | YoY Growth (%) | MoM Growth (%) |

Bajaj Auto | 7,853 | 6,929 | 4,876 | 61.1% | 13.3% |

Mahindra Last Mile Mobility | 6,309 | 6,649 | 4,999 | 26.2% | -5.1% |

TVS Motor | 2,561 | 2,832 | 133 | – | -9.6% |

Piaggio Vehicles | 866 | 1,240 | 1,429 | -39.4% | -30.2% |

Ti Clean Mobility | 570 | 643 | 560 | 1.8% | -11.4% |

Omega Seiki | 504 | 442 | 240 | 110% | 14% |

Brand-Wise Electric Passenger 3W Performance

Bajaj Auto

Bajaj Auto remained the largest electric passenger three-wheeler manufacturer in January 2026 with 7,853 registrations. The company posted a strong 61.1% year-on-year growth, reinforcing its leadership position. On a month-on-month basis, Bajaj recorded a 13.3% increase, reflecting renewed demand momentum.

Mahindra Last Mile Mobility

Mahindra Last Mile Mobility registered 6,309 units during the month. The company achieved a solid 26.2% YoY growth, underlining steady annual performance. However, registrations declined 5.1% MoM, indicating a slight monthly slowdown.

TVS Motor

TVS Motor secured the third position with 2,561 registrations in January 2026. While the company does not have a comparable YoY base, it recorded a 9.6% month-on-month decline, suggesting stable but cautious market movement.

Piaggio Vehicles

Piaggio Vehicles registered 866 units in January. The brand reported a 39.4% YoY drop and a 30.2% MoM decline, reflecting pressure on its electric passenger three-wheeler portfolio.

Ti Clean Mobility

Ti Clean Mobility posted 570 registrations, showing a 1.8% year-on-year increase. However, sales slipped 11.4% month-on-month, indicating uneven short-term demand.

Omega Seiki

Omega Seiki emerged as the fastest-growing OEM in the segment. With 504 registrations, the company recorded a massive 110% YoY growth and a 14% MoM increase, highlighting strong traction and expanding market presence.

Market Outlook

January 2026 data confirms that India’s electric passenger three-wheeler market continues on a positive long-term growth path. While monthly fluctuations persist, rising registrations, expanding OEM participation, and increasing acceptance of electric mobility solutions are strengthening the segment’s foundation.

Also Read: India’s Electric Bus Sales Decline in January 2026: OEM-wise Performance and Market Share

CMV360 Says

India’s electric passenger three-wheeler market showed strong annual growth in January 2026, despite some month-on-month corrections. Bajaj Auto continued to lead the segment, followed by Mahindra Last Mile Mobility and TVS Motor. Omega Seiki stood out with the highest growth rate, indicating rising competition. Overall, increasing EV adoption and demand for affordable last-mile mobility solutions keep the E-3W passenger segment on a steady growth path.

News

Electric Three-Wheeler Sales Report – January 2026: Zeniak Innovation, J.S. Auto & YC Electric Drive Market Momentum

January 2026 electric three-wheeler sales show mixed trends, with strong YoY growth for select OEMs and MoM pressure across e-rickshaw and e-cart segments in India....

04-Feb-26 11:11 AM

Read Full NewsIndia’s Electric Bus Sales Decline in January 2026: OEM-wise Performance and Market Share

India’s electric bus sales fell to 391 units in January 2026. JBM Electric led the market, followed by Switch Mobility, as selective OEMs showed monthly growth....

03-Feb-26 12:32 PM

Read Full NewsE-3W Goods L5 Sales Trend: Mahindra, Bajaj, and Omega Seiki Lead Market Momentum

India’s E-3W goods L5 sales in January 2026 show Mahindra leading, Bajaj recovering, and Omega Seiki gaining momentum, reflecting steady demand and rising competition....

03-Feb-26 12:19 PM

Read Full NewsBudget 2026–27 May Strongly Support Trucks and Commercial Vehicles Through Infrastructure Push

Budget 2026–27 supports commercial vehicles through higher infrastructure spending, freight corridors, mining growth, and electric bus deployment, creating strong long-te...

02-Feb-26 01:09 PM

Read Full NewsBudget 2026-27: 4,000 Electric Buses Planned for East India to Boost Industry and Tourism

Union Budget 2026-27 proposes 4,000 electric buses for eastern states under Purvodaya, linking clean transport with industrial growth, tourism development, and improved p...

02-Feb-26 11:10 AM

Read Full NewsAshok Leyland January Sales Report 2026: 38% YoY Growth, 19,500 Units Sold

Ashok Leyland reports strong CV sales in January 2026 with 19,500 units sold, driven by robust domestic demand and steady export growth across M&HCV and LCV segments....

02-Feb-26 10:06 AM

Read Full NewsAd

Ad

Latest Articles

Tata Trucks Price & Best Models 2026

03-Feb-2026

Top 5 Electric Buses Leading India’s Green Revolution in 2026

30-Jan-2026

ICV vs HCV Trucks: Which Is More Profitable in 2026?

27-Jan-2026

Top 10 Electric Trucks in India 2026: Price, Range, & Payload

22-Jan-2026

Diesel vs CNG vs Electric Trucks in India 2026: Choosing the Right Truck for Your Business Needs

21-Jan-2026

Electric Commercial Vehicles in India 2026: Complete Guide to Electric Trucks, Buses, and Three Wheelers with Prices

19-Jan-2026

View All articles