Ad

Ad

Electric 3W L5 Sales Report August 2025: Bajaj and Mahindra Lead

Key Highlights

Passenger E3W L5 sales reached over 19,600 units in August 2025.

Mahindra Last Mile Mobility topped passenger sales with 8,494 units.

Bajaj Auto followed closely with 7,238 units, while TVS Motor crossed 2,200 units.

Goods E3W L5 sales touched around 1,900 units in August 2025.

Bajaj Auto, Mahindra Last Mile Mobility, and Omega Seiki led the goods segment.

Electric three-wheelers (E3W) play a vital role in India’s EV sector by offering affordable, eco-friendly mobility solutions for both passengers and goods. In August 2025, the E3W passenger segment saw strong momentum, while the goods segment showed mixed trends with some brands facing declines.

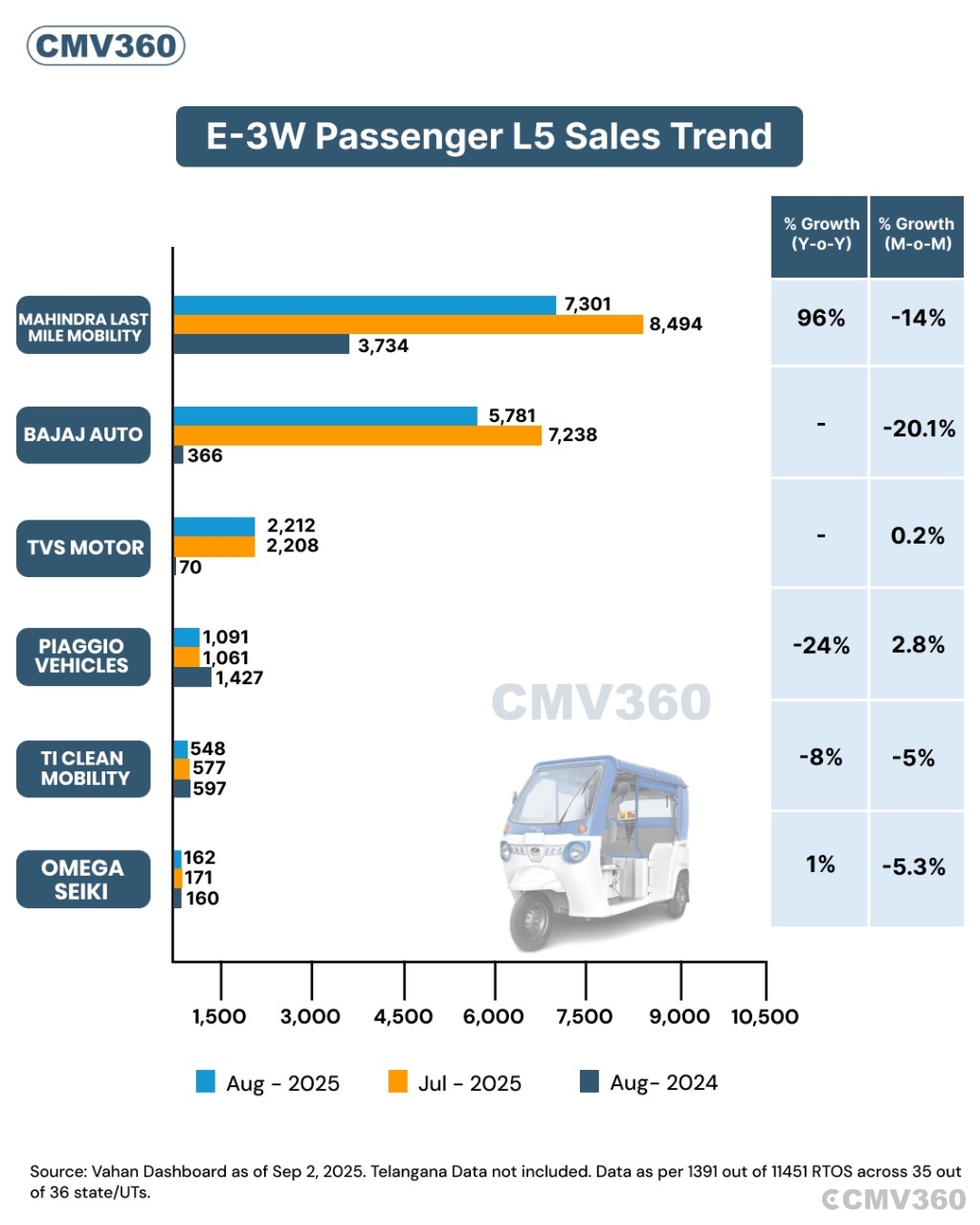

E-3W Passenger L5 Sales Trend

According to Vahan Dashboard data, the E-3W L5 passenger category sold more than 19,600 units in August 2025, showing steady demand despite monthly fluctuations.

OEM-wise Electric Three-Wheeler Passenger L5 Sales Performance

Mahindra Last Mile Mobility (MLMM): Registered 8,494 units in Aug 2025, up from 7,301 units in Jul 2025. Compared to 3,734 units in Aug 2024, MLMM saw a 96% YoY growth, though MoM sales dipped by 14%.

Bajaj Auto: Reported 7,238 units in Aug 2025, down from 7,581 units in Jul 2025. Despite a 20.1% MoM drop, Bajaj remained a strong player in the segment.

TVS Motor: Sold 2,212 units in Aug 2025, showing marginal MoM growth of 0.2% compared to 2,208 in Jul 2025.

Piaggio Vehicles: Registered 1,091 units in Aug 2025, slightly higher than Jul 2025 sales of 1,061 units. However, YoY sales dropped by 24%.

TI Clean Mobility: Recorded 548 units in Aug 2025, compared to 577 units in Jul 2025 and 597 units in Aug 2024. This indicates an 8% YoY decline and a 5% MoM drop.

Omega Seiki: Managed 162 units in Aug 2025, compared to 171 in Jul 2025 and 160 in Aug 2024. Sales showed 1% YoY growth but 5.3% MoM decline.

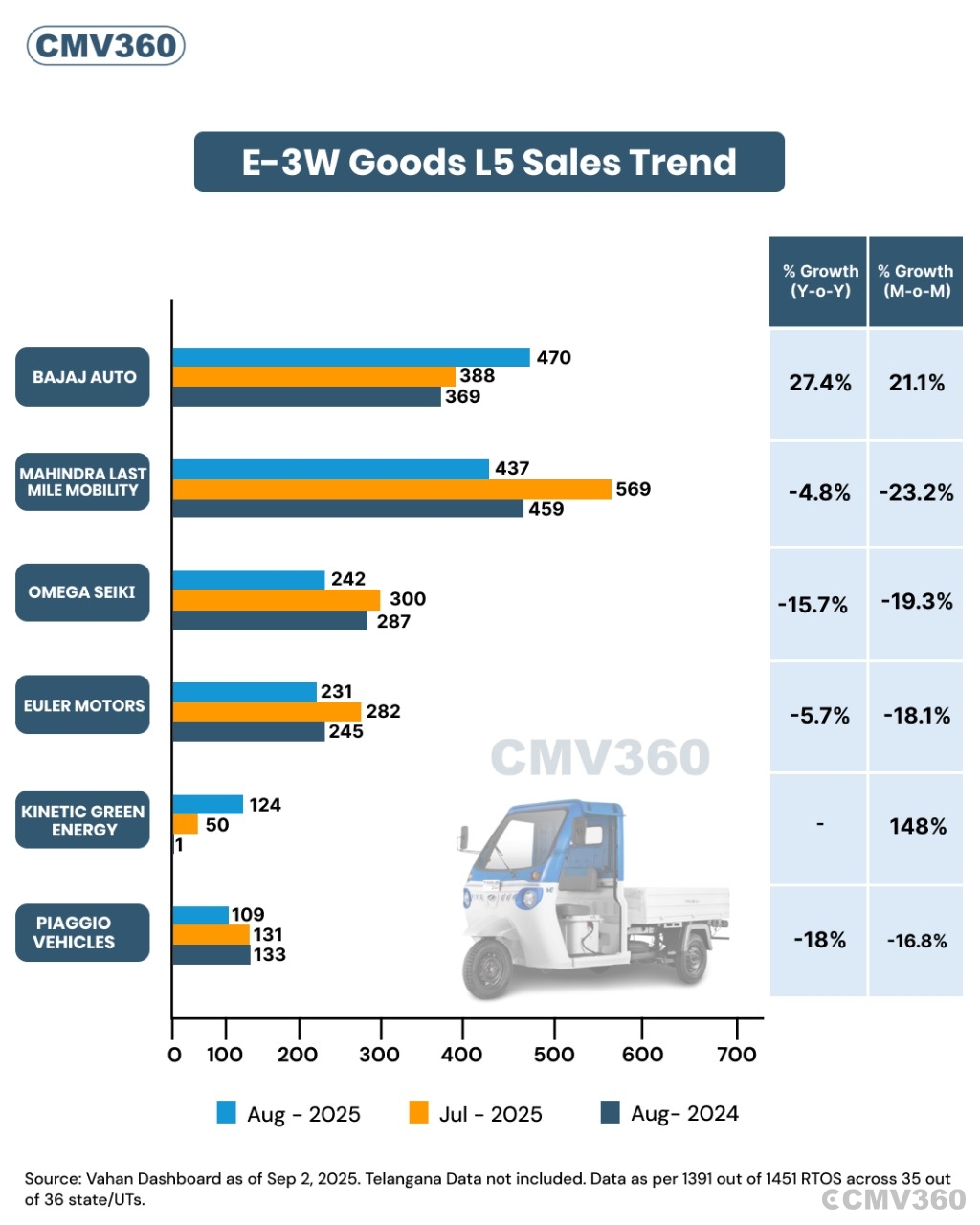

E-3W Goods L5 Sales Trend

According to Vahan Dashboard data, the total number of E3Ws sold in the L5 Goods category was around 1,900 units in Aug 2025, showing slight YoY variations with notable MoM declines across key players.

OEM-wise E-3W Goods L5 Sales Performance

Bajaj Auto: Registered 470 units in Aug 2025, up from 388 units in Jul 2025. Sales grew 27.4% YoY and 21.1% MoM, making Bajaj the leader in the goods segment.

Mahindra Last Mile Mobility (MLMM): Sold 437 units in Aug 2025, compared to 569 units in Jul 2025. Sales declined 4.8% YoY and 23.2% MoM.

Omega Seiki: Achieved 242 units in Aug 2025, down from 300 units in Jul 2025 and 287 units in Aug 2024. Sales declined 15.7% YoY and 19.3% MoM.

Euler Motors: Recorded 231 units in Aug 2025, compared to 282 units in Jul 2025. Sales fell 5.7% YoY and 18.1% MoM.

Kinetic Green Energy & Power Solutions: Registered 124 units in Aug 2025, a sharp rise compared to 50 in Jul 2025 and just 1 in Aug 2024, marking a 148% MoM growth.

Piaggio Vehicles: Sold 109 units in Aug 2025, compared to 131 units in Jul 2025 and 133 units in Aug 2024. This reflected a 16.8% MoM drop and an 18% YoY decline.

Also Read: VECV and Jio-bp Pulse Partner to Expand EV Charging Network for Commercial Vehicles

CMV360 Says

The rise in passenger E3W sales highlights growing adoption of electric mobility for daily commutes, with MLMM and Bajaj Auto leading the charge. Meanwhile, the goods segment showed mixed results, with Bajaj gaining strong momentum while Mahindra and Omega Seiki witnessed declines. For cargo applications, supportive infrastructure and incentives could help improve stability in future sales trends.

News

Ashok Leyland Revives TAURUS and HIPPO with Next-Generation Heavy-Duty Technology

Ashok Leyland brings back TAURUS and HIPPO trucks with next-gen technology, powerful engines, and improved durability to meet India’s growing mining and infrastructure tr...

22-Jan-26 12:26 PM

Read Full NewsFinnfund Invests $15 Million in Transvolt Mobility to Boost Electric Heavy Vehicles in India

Finnfund invests USD 15 million in Transvolt Mobility to expand electric buses and trucks in India, supporting clean transport, job creation, and India’s sustainable mobi...

22-Jan-26 04:52 AM

Read Full NewsMahindra Launches Refreshed Bolero Camper and Bolero Pik-Up with New Features and Comfort Upgrades

Mahindra refreshes Bolero Camper and Pik-Up with bold styling, iMAXX telematics, air conditioning, and improved comfort, reinforcing its leadership in India’s pickup segm...

21-Jan-26 01:01 PM

Read Full NewsFresh Bus and Exponent Energy Partner to Deploy Rapid-Charging Electric Intercity Buses in India

Fresh Bus and Exponent Energy partner to deploy rapid-charging electric intercity buses, enabling long-distance travel with 15-minute charging and high-power infrastructu...

21-Jan-26 10:07 AM

Read Full NewsGreenCell Mobility Secures $89 Million to Rapidly Expand Electric Bus Network Across India

GreenCell Mobility raises $89 million to expand its electric bus fleet across India, boosting clean public transport, charging infrastructure, and zero-emission mobility ...

21-Jan-26 07:12 AM

Read Full NewsIndia Launches First Indigenous Runway Cleaning Machines to Boost Airport Safety

India delivers its first indigenous runway cleaning machines to Noida Airport, enhancing aviation safety, reducing imports, and bolstering 'Make in India' manufacturing i...

21-Jan-26 05:45 AM

Read Full NewsAd

Ad

Latest Articles

Top 10 Electric Trucks in India 2026: Price, Range, & Payload

22-Jan-2026

Diesel vs CNG vs Electric Trucks in India 2026: Choosing the Right Truck for Your Business Needs

21-Jan-2026

Electric Commercial Vehicles in India 2026: Complete Guide to Electric Trucks, Buses, and Three Wheelers with Prices

19-Jan-2026

Top 5 High-Mileage Trucks in India 2026

16-Jan-2026

Top 10 CNG Trucks in India 2026: Best CNG Models

12-Jan-2026

Popular Bus Brands in India 2026

08-Jan-2026

View All articles