Ad

Ad

Unified Package Insurance Scheme (UPIS) – An Overview

The UPIS aims to financially protect citizens in the agriculture sector for food security, crop diversity, and sector growth and competitiveness, as well as safeguard farmers from financial risks. The scheme was tested in 45 chosen districts during the 2016 Kharif season. Coverage lasts for a full year, with the exception of bi-annual crop insurance for Kharif and Rabi seasons. Loanee farmers will be covered through banks/financial institutions, and nonloanee farmers through banks and/or insurance intermediaries.

Policy Design and Suitability

- The policy is designed for the insurance needs of farmers in agriculture activities.

- It offers yield-based crop insurance based on the farmer's land ownership and crop.

- It covers the farmer's personal assets (dwelling and contents, agricultural pump sets, and agriculture tractor) as well as protection in case of accidental death/disablement and education fee provision for children in case of parent's death.

- Life insurance protection for the farmer and their family is also included.

- The policy is issued for a period of up to 1 year.

Salient Features and Benefits of Unified Package Insurance Scheme

Underwriting: The farmers package policy will be underwritten by either General Insurance Companies designated by the Department of Agriculture, Cooperation, and Farmers Welfare, or through General Insurance Companies having a tie-up with a financial institution/bank for non-crop sections of the policy.

Policy Coverage: The policy contains 7 sections, with crop insurance being mandatory. Farmers have to choose at least two other sections to avail the applicable subsidy under the crop insurance section.

Premium Payment: For crop insurance, the farmer's share of premium ranging from 1.5% to 5% (based on the insured crops) is payable by the farmer. If the actuary premium is higher, the government will provide a subsidy equivalent to the difference between the actuary premium and the premium paid by the farmer. The crop insurance is based on the area approach, while all other sections are on an individual basis.

Exemption: If the farmer has already availed an insurance policy of similar nature with a sum insured not less than as mentioned in the policy, they will be exempt from taking that section(s). The details of such a policy would be provided in the proposal form.

Indicative Premium Rates: The premium rates mentioned above are indicative and subject to the concurrence of the insurers.

Provisional Premium Rates: The sum insured and premium rates are provisionally taken and may change according to the risk(s).

Service Tax: The premium rates mentioned above are without service tax, which is likely to be exempt.

Unified Package Insurance Scheme (UPIS) - Operational Guidelines

Exemption: If the farmer has already availed an insurance policy covering any of the sections and the sum insured is not less than as mentioned in the UPIS, they will be exempt from taking such section(s). The details of such a policy would be provided in the proposal form.

Proposal Form: Farmers are required to fill out and sign the proposal cum declaration form with all the required details in the relevant sections that they wish to avail. The proposal form should be submitted along with the premium to the bank/intermediary/insurance company, who will issue a stamped/signed receipt for the same. The proposal form is mandatory for both loanee and non-loanee farmers.

Unique Reference Number: After accepting the proposal forms from farmers, banks will provide a unique reference number to such proposal forms. An acknowledgement will be provided by the banks to the farmers, with the same unique reference number.

Change in Particulars: No changes in the particulars furnished in the proposal form will be admissible unless specifically agreed in writing by the insurance company.

Insurance Companies Ties-Up: The bank will continue to have an existing tie-up with the same insurance companies, except for the PMFBY. If the existing tied-up company does not agree with the terms and conditions of UPIS (Section 2 to 7), the implementing crop insurance company will arrange insurance for other sections.

The policy covers the following sections

- Crop Insurance (PMFBY/WBCIS)

- Building and Contents Insurance (Fire and Allied Perils)

- Personal Accident Insurance (as per Pradhan Mantri Suraksha Bima Yojana)

- Agriculture Pumpset Insurance (up to 10 Horse Power)

- Agricultural Tractor Insurance (as per standard Motor Policy)

- Student Safety Insurance (coversing accidental death or disability of students)

- Life Insurance (as per Pradhan Mantri Jeevan Jyoti Bima Yojana)

Section 1: Crop Insurance

(Pradhan Mantri Fasal Bima Yojna (PMFBY) / Weather Based Crop Insurance Scheme (WBCIS)

Section 2: Personal Accident Insurance

(Coverage as per Pradhan Mantri Suraksha Bima Yojana - PMSBY)

The Pradhan Mantri Suraksha Bima Yojana (PMSBY) is a one-year personal accident insurance scheme, renewable from year to year. This scheme provides coverage for accidental death and disability, and it does not alter the existing relationship between the bank and insurance company for PMSBY. If a farmer has already availed the PMSBY insurance, they do not need to choose this section again, but they must provide the details of their policy when filling out the proposal cum declaration form under PMFBY.

All farmers eligible for crop insurance under PMFBY/WBCIS between the ages of 18 and 70 years are eligible to join the scheme. If an individual holds multiple savings bank accounts, they can only join the scheme through one account, and their Aadhaar card will serve as their primary KYC for the bank account.

The benefits of the scheme are as follows

Table of Benefits (any one will be applicable) | Sum Insured

- Sum insured after death is Rs. 2 Lakh

- Sum insured for total and irrecoverable loss of both eyes or loss of use of both hands or feet or loss of sight of one eye and loss of use of hand or foot is Rs. 2 Lakh

- Sum insured for total and irrecoverable loss of sight of one eye or loss of use of one hand or foot is Rs. 1 Lakh.

The premium for the scheme is Rs. 12/- per annum per member and is deducted from the account holder's savings bank account through an "auto-debit" facility within the cut-off dates specified under PMFBY. The participating bank will serve as the master policy holder on behalf of the participating subscribers, as outlined in PMSBY.

The accident cover for the member will terminate under certain circumstances, such as when they reach the age of 70 years (on their nearest birthday), if they close their account with the bank or if their account balance is insufficient to keep the insurance in force. If a member is covered through more than one account and the insurance company receives the premium for both, the cover will be restricted to one account only and the premium for the other account will be forfeited. If the insurance cover is ceased due to technical reasons such as insufficient balance for renewal or administrative issues, the cover can be reinstated upon receipt of the full annual premium, subject to conditions laid down by the insurance company. During this period, the risk cover will be suspended, and the reinstatement of risk cover will be at the sole discretion of the insurance company.

Section - 3: Life Insurance

(as per Pradhan Mantri Jeevan Jyoti Bima Yojna (PMJJBY)

The Pradhan Mantri Jeevan Jyoti Bima Yojna (PMJJBY) is a government-sponsored life insurance scheme aimed at providing financial security to Indian citizens. The scheme offers a death cover of Rs. 2,00,000 per member and is provided by life insurance companies.

To be eligible for this scheme, an individual must be a savings bank account holder of one of the participating banks and must be aged between 18 years (completed) and 50 years (nearest birthday). The individual must also give their consent to join the scheme during the enrollment period. The age of the applicant will be recorded by the bank based on the age proof submitted by the savings bank account holder.

The insurance company may require satisfactory evidence of health from the eligible member at the time of entry into the scheme, which will be furnished in the "Consent-cum-Declaration Form." The premium for the scheme is Rs. 330/- plus Service Tax (if payable) and will be deducted from the member's savings bank account. The premium is subject to change on an annual basis and is chargeable on annual renewal dates.

The enrollment modality and period for the scheme are as follows: For new enrolments, the cover will be provided for one year starting from the date of enrolment or 1st June (whichever is later) and will end on the next 31st May. New applicants and currently eligible individuals who did not join earlier will be able to join in future years while the scheme is ongoing.

Individuals who have already availed this section in the form of PMJJY do not need to choose this section again. However, they are required to provide details of their existing policy in the proposal cum declaration form under PMFBY.

Upon the death of the insured member, an assurance of Rs. 2,00,000 will be payable to the nominee. The assurance will terminate on an annual renewal date due to any of the following events: attaining the age of 55 years, closure of the bank account, or insufficiency of balance to keep the insurance in force.

If the insurance cover is ceased due to technical reasons such as insufficient balance for payment of premium, it can be reinstated after the grace period upon receipt of premium and a satisfactory statement of good health.

Section 4: Building and Contents Insurance (Fire & Allied Perils)

This section of the insurance policy covers loss or damage to the insured building and contents due to a specified list of perils, including fire, lightning, gas explosions, water damage, damage from aircraft or articles dropped from aircraft, riot or strike, malicious damage, earthquake, subsidence, landslide, flood, storm, tempest, typhoon, tornado, cyclone, impact damage, and bush fire. The coverage provided is based on a fixed sum insured basis, meaning the maximum liability of the insurer will be the sum insured or the actual loss, whichever is less.

Enrollment of Farmers: To enroll in this insurance program, farmers will need to provide basic details of their home and dwelling in the proposal form, including the complete address of the house. The sum insured has been capped at Rs.50,000 for the building and Rs.20,000 for contents.

Claim Process Methodology: In the event of damage due to any of the covered perils, farmers must inform the insurance company either by phone or in writing within 72 hours. The farmer may choose to contact the insurance company directly or through the financial institution/intermediary channel through which they obtained the insurance. The unique reference number of the proposal cum declaration form must be provided when making the claim. No repairs or reinstatement should be carried out until the loss assessment procedure is completed.

The claim is only admissible if the premium has been paid within the cut-off dates as specified in section 1 of PMFBY/WBCIS. The farmer will be required to cooperate fully with the surveyor appointed by the insurance company and provide all necessary documents to support the loss. A claim form issued by the company must also be submitted. The basis for the claim settlement will be the market value of the property on the date of loss. The insurance company will carry out a survey of the site within 3 days of receiving the claim, and the farmer will need to submit the claim forms and relevant documents to the surveyor/insurance company within 10 days of the date of the survey. Claims will be paid on an assessment basis only, within 20 days of the survey and submission of all required documents, and will be directly deposited into the farmer's bank account via NEFT.

Special Exclusions: The insurance company will not be liable for losses or damages resulting from burglary and/or housebreaking or theft involving members of the insured's family as principal or accessory, loss or damage to consumable items, loss or damage to money, securities, stamps, bullion, livestock, motor vehicles and pedal cycles, loss or damage to deeds, bonds, bills of exchange, promissory notes, shares and stock certificates, business books, manuscripts, documents of any kind, unset precious stones and jewelry and valuables, wilful act or gross negligence of the insured or their representatives, or terrorism.

Section 5: Agriculture Pumpset Insurance (Upto 10 Horse Power)

- This insurance covers Centrifugal pump sets with a capacity of up to 10 Horsepower that are used solely for agricultural purposes. This can be either an electrical or diesel pump set. The coverage provided by this insurance is for the following perils:

- Fire and lightning

- Burglary, provided the pump set is kept in a locked enclosure and there was a violent and forcible entry

- Mechanical and electrical breakdown

- Riot, strike, and malicious damage

Enrollment of Farmers:To enroll in this insurance, farmers must provide the electrical and mechanical specifications of their pump set in the proposal form. This should include the serial number, make, model, and other important details about the pump set. The maximum sum insured for this coverage is capped at Rs. 25,000. Agricultural pump sets that are up to 7 years old can be insured under this section.

Claim Process Methodology:In the event of damage due to any of the perils mentioned above, farmers must inform the insurance company either via phone or in writing within 72 hours of the incident. They may choose to do this directly or through financial institutions or the same intermediary channel they used to avail the insurance. No repairs or reinstatements should be carried out until the loss assessment process has been completed.

The claim will only be admissible if the premium has been paid within the cut-off dates as specified in section 1 of PMFBY/WBCIS. The farmer must extend full cooperation to the surveyor appointed by the insurance company and provide all necessary documents to support the claim. A claim form issued by the company must also be submitted.

The damaged or defective parts must be preserved and made available for inspection by an official or surveyor of the company. The insurance company will carry out a survey of the site within 3 days of receiving the report of damage. The farmer must submit the claim form and other relevant documents to the surveyor or insurance company within 10 days of the date of the survey. Claims will only be paid on the assessment basis and within 20 days of the survey and submission of all required documents. Payments will be directly made to the farmer's bank account via NEFT.

Claims for repair of the pump set will be on the reinstatement value basis, while claims for total loss of the pump will be on the market value basis. In case of burglary claims, an FIR should be lodged immediately, and its copy should be made available to the surveyor.

The liability of the company in relation to any item of property that sustains damage, for which indemnity is provided, will cease if the item is used without being repaired to the satisfaction of the company.

Note: Submersible pumps will be added to the coverage subsequently.

Special Exclusions to Agricultural Pump Set Insurance:

- Normal wear and tear, gradual deterioration due to atmospheric conditions or otherwise

- Wilful acts or gross negligence of the insured or their representatives

- Faults existing at the time of commencement of insurance that are known to the insured or their representatives

- Loss or damage for which the manufacturer or supplier of the pump set is responsible by law or under contract

- Costs of dismantling, transport to the workshop, and back, as well as the cost of re-erection

- Loss due to floods

Section 6: Student Safety Insurance

This section outlines the details of the student safety insurance policy, including the benefits that are available to the parents/students and the schedule of compensation in case of various contingencies.

Summary of Benefits

The policy provides the following benefits in case of accidental injury or death:

- Part A. Accidental death: Rs. 50000 (for parent/student)

- Part B. Permanent total disablement: Rs. 50000 (for student)

- Part C. Loss of one limb/eye: Rs. 25000 (for student)

- Part D. Accidental hospitalization: Rs. 5000 (for student)

In case of the death of the father or mother, the claim amount will be converted into a fixed deposit in the name of the student until they reach the age of 18.

Part A

In case of accidental death or total and irrecoverable loss of two limbs, two eyes, or 100% Permanent Total Disablement of the parent/guardian as a result of a violent and visible accident, the company will pay the capital sum insured stated in the schedule to either the insured student or the parent/guardian.

Part B

In case of accidental death or total and irrecoverable loss of two limbs, two eyes, or 100% Permanent Total Disablement of the insured student as a result of a violent and visible accident, the company will pay the capital sum insured stated in the schedule of benefits to either the parent/guardian or the insured student.

Part C

If the insured student sustains a bodily injury resulting from a violent and visible accident, resulting in the irrecoverable loss of one limb or one eye, the company will pay 50% of the capital sum insured stated in the schedule of benefits to either the parent/guardian or the insured student. If the injury results in death within six months, the remaining 50% of the capital sum insured will be payable to the parent/guardian.

In case of the death of both the student and parent/guardian as a result of the same violent and visible accident, the company will pay the legal heir of the parent/guardian the sums stated in the schedule.

Part D

If the insured student sustains a bodily injury through an accident and seeks treatment as an inpatient in a nursing home/hospital in India, the company will reimburse the reasonable and necessary expenses incurred for treatment, up to the limit prescribed and not exceeding the sum insured, upon submission of supporting documents and bills.

Age Limit:

- Students: 5-25 years

- Parents: 18-70 years

Exclusions

The policy does not provide compensation in the following cases:

- Death or injury as a direct consequence of committing or attempting suicide or intentional self-injury

- Death or injury while under the influence of intoxicating liquor or drugs

- Engaging in aviation other than traveling as a bona fide passenger in a licensed standard type of aircraft

- Pregnancy or child birth

- Venereal disease or insanity

- Contracting any illness directly or indirectly arising from or attributable to HIV, AIDS, or any mutant derivative or variation of HIV or AIDS

- Committing any breach of law with criminal intent

Documents Required for Settlement of Claims:

- Claim Form

- Doctor's report, prescriptions, and certificate confirming the nature and degree of disability

- Police Report and Postmortem Report in case of accidental death

- Bills, receipts, and prescriptions of the doctor for reimbursement of hospitalization expenses

- Medical Practitioner's Certificate

Section 7: Agricultural Tractor Insurance

This section of the insurance policy provides coverage for agricultural tractors and trailers. The provisions, terms, exceptions, conditions, and endorsements of the standard Motor Insurance Policy apply to this coverage.

The policy covers the insured against loss or damage to the agriculture tractor due to various events, such as fire, explosion, theft, natural disasters, and terrorism activity while in transit by road, rail, or inland waterway. It also provides coverage for the death or permanent disablement of the driver due to an accident while driving the tractor during any one policy period.

Depreciation is applied to parts that are replaced, with different rates for different materials. For example, rubber, nylon, plastic parts, tires, tubes, batteries, and airbags have a 50% depreciation rate, while fiberglass components have a 30% rate, and all glass parts have no depreciation. The depreciation rate for all other parts, including wooden parts, is determined by a schedule.

The sum insured and premium amount vary depending on the age of the tractor, with younger tractors having higher sum insured and premium amounts. The rates are subject to change based on IRDAI regulations, and the table provided is for illustration purposes only.

The policy also includes legal liability coverage for third-party death or bodily injury in the event of an accident involving the tractor, as per the provisions of the Motor Vehicles Act, 1988.

Farmers have the option to choose between comprehensive cover or third-party cover. For comprehensive cover, a pre-insurance inspection is required, and the farmer must submit their existing policy and registration certificate to receive the benefit of no claim bonus. For third-party cover, only a registration certificate is needed. Banks are responsible for submitting the necessary documents, including the previous insurance policy, to the insurance company while submitting the proposal form.

Tractor trailers can only be covered with third-party coverage, and the premium for this coverage will be separate from the premium for the tractor. Only one trailer can be covered per policy.

The insurance company will provide a separate Certificate of Insurance for this section, and the claim process requires the farmer to notify the insurance company of the loss or damage within 48 hours, either by phone or in writing. The claim is only admissible if the premium is paid within the cut-off dates, and the farmer must cooperate with the surveyor appointed by the insurance company and provide necessary documents to support the claim. The damaged or defective parts must be preserved and made available for inspection, and the claim settlement is based on the market value of the vehicle on the date of loss. The survey is typically completed within 3 days of the loss, and the farmer must submit the claim form and other relevant documents within 15 days of the survey.

Features & Articles

Ashok Leyland 1920 vs 2820 Tipper Comparison: 6-Wheeler or 10-Wheeler – Which Is Better for Construction & Mining?

Compare Ashok Leyland 6 wheeler vs 10 wheeler tipper trucks. Detailed 1920 vs 2820 comparison covering price, specs, GVW, performance, usage, and buying guidance for cons...

17-Dec-25 12:29 PM

Read Full NewsTata Starbus Buses in India 2025: City, Suburban, Ultra & Staff Buses Models Explained in Detail

Explore the Tata Starbus 2025 range in India, including City, Sub Urban, Ultra, and Staff Contract buses with prices, features, seating capacity, and performance details....

15-Dec-25 12:16 PM

Read Full NewsTop 5 Tata Trucks for Business in India 2025: Prices, Payload, Features, Full Details & Complete Buying Guide

Discover the top 5 Tata trucks in India 2025 with prices, payload, engine details, features, pros and cons. Simple, easy-to-read buying guide to help you choose the best ...

11-Dec-25 05:34 AM

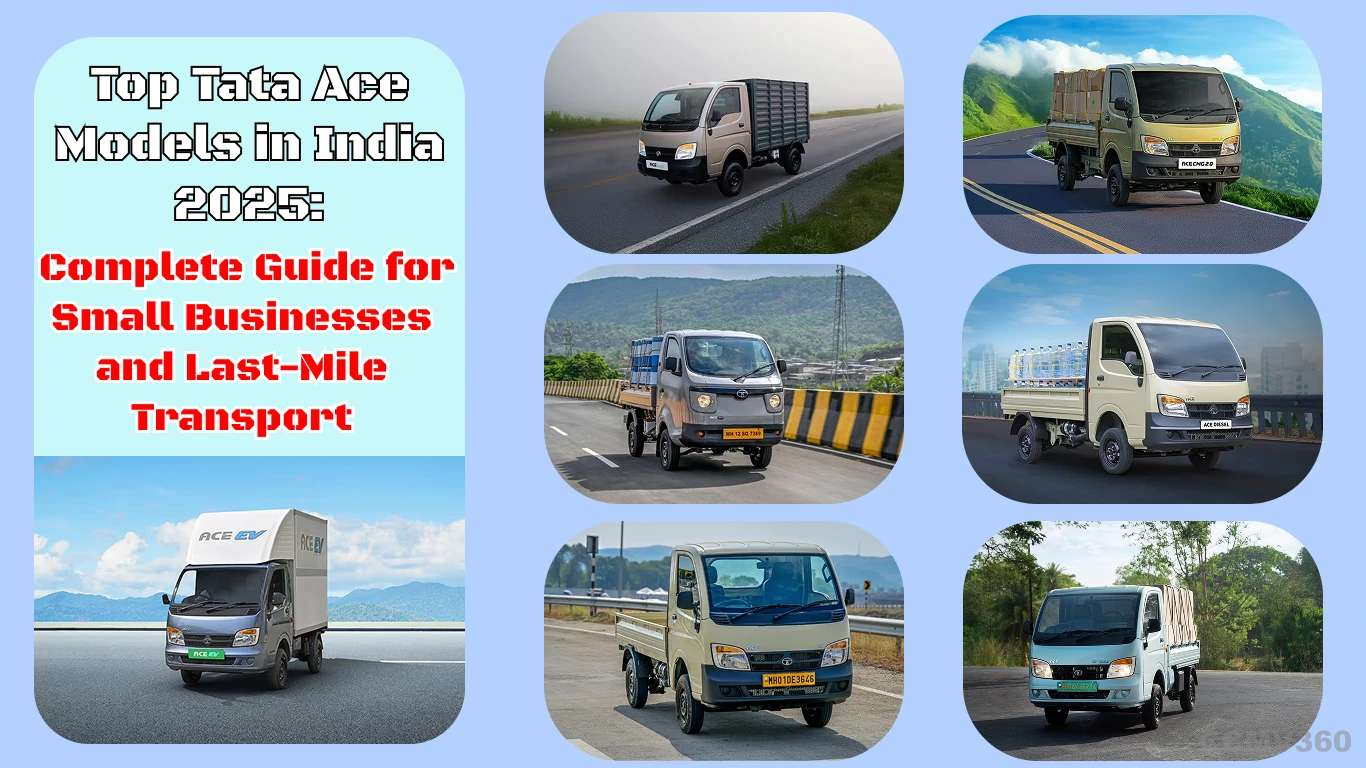

Read Full NewsTop Tata Ace Models in India 2025: Complete Guide for Small Businesses and Last-Mile Transport

Explore all Tata Ace models in India 2025 with prices, features, payload, mileage, and benefits. A simple and complete guide for small businesses and last-mile delivery b...

19-Nov-25 12:01 PM

Read Full NewsTata Ace Pro vs Tata Ace Gold: Which Mini Truck is Better for Your Business in 2025?

Compare Tata Ace Pro and Tata Ace Gold in detail. Know their price, specs, performance, and features to choose the best mini truck for your business in 2025....

13-Nov-25 12:36 PM

Read Full NewsTop 5 Buses in India 2025: Most Popular and Advanced Models for Comfortable Travel

Discover India’s top buses in 2025. Compare features, prices, and uses of the best models from Volvo, Tata, Ashok Leyland, SML Isuzu, and Force Motors....

06-Nov-25 10:46 AM

Read Full NewsAd

Ad