Ad

Ad

FADA Sales Report January 2025: Three-wheeler (3W) sales increased by 6.8% YoY

Key Highlights:

- FADA reported a 6.8% year-on-year growth in three-wheeler retail sales for January 2025.

- E-rickshaw (passenger) sales declined by 4.21% year-on-year, while e-rickshaw (goods) sales increased by 53.85%.

- The three-wheeler (goods) segment saw strong demand, recording a 31.94% month-on-month growth in sales.

- Bajaj Auto Ltd retained its lead in the three-wheeler market with 39,488 units sold, capturing a 36.89% market share.

- Mahindra & Mahindra, along with its Last Mile Mobility division, showed a strong increase in sales.

The Federation of Automobile Dealers Associations (FADA) has shared its vehicle retail data for January 2025, showing a 6.6% increase compared to last year. This matches FADA’s earlier prediction of a stable or slightly positive month. While cities saw steady growth, rural areas faced challenges due to weak cash flow, higher loan costs, and slow economic recovery.

The three-wheeler segment sales grew by 6.8%, driven by strong demand for last-mile transport and passenger vehicles. However, electric rickshaw sales dropped by 4.21%, showing a slower adoption rate despite receiving government support.

Category-Wise Three-Wheeler Sales Performance in January 2025

In January 2025, total three-wheeler sales stood at 1,07,033 units, which is a 14% increase compared to 93,892 units in December 2024. When compared to January 2024, which had 1,00,160 units sold, the sales grew by 6.86% year-on-year.

E-Rickshaw (Passenger)

The sales of E-Rickshaws for passengers in January 2025 were 38,830 units, slightly lower than 40,845 units in December 2024. This represents a 4.93% decline on a month-on-month basis. Compared to January 2024, when 40,537 units were sold, the sales decreased by 4.21% year-on-year.

E-Rickshaw with Cart (Goods)

The sales of E-Rickshaws were 5,760 units in January 2025, a slight drop of 1.13% from 5,826 units in December 2024. However, compared to January 2024, when only 3,744 units were sold, the sales increased by 53.85% year-on-year.

Three-Wheeler (Goods)

The three-wheeler goods segment saw strong growth in January 2025, with 12,036 units sold. This was a 31.94% increase compared to 9,122 units in December 2024. When compared to January 2024, sales improved by 12.32% from 10,716 units.

Three-Wheeler (Passenger)

Passenger three-wheeler sales were 50,322 units in January 2025, reflecting a 32.32% increase from 38,031 units in December 2024. Compared to January 2024, when 45,113 units were sold, this segment saw an 11.55% year-on-year growth.

Three-Wheeler (Personal)

The personal three-wheeler segment recorded a sale of 85 units in January 2025, an increase of 25% from 68 units in December 2024. This category recorded the highest year-on-year growth of 70%, as only 50 units were sold in January 2024.

Overall, the three-wheeler segment showed positive growth, with strong demand for passenger and goods three-wheelers, while the E-Rickshaw segment witnessed a slight decline.

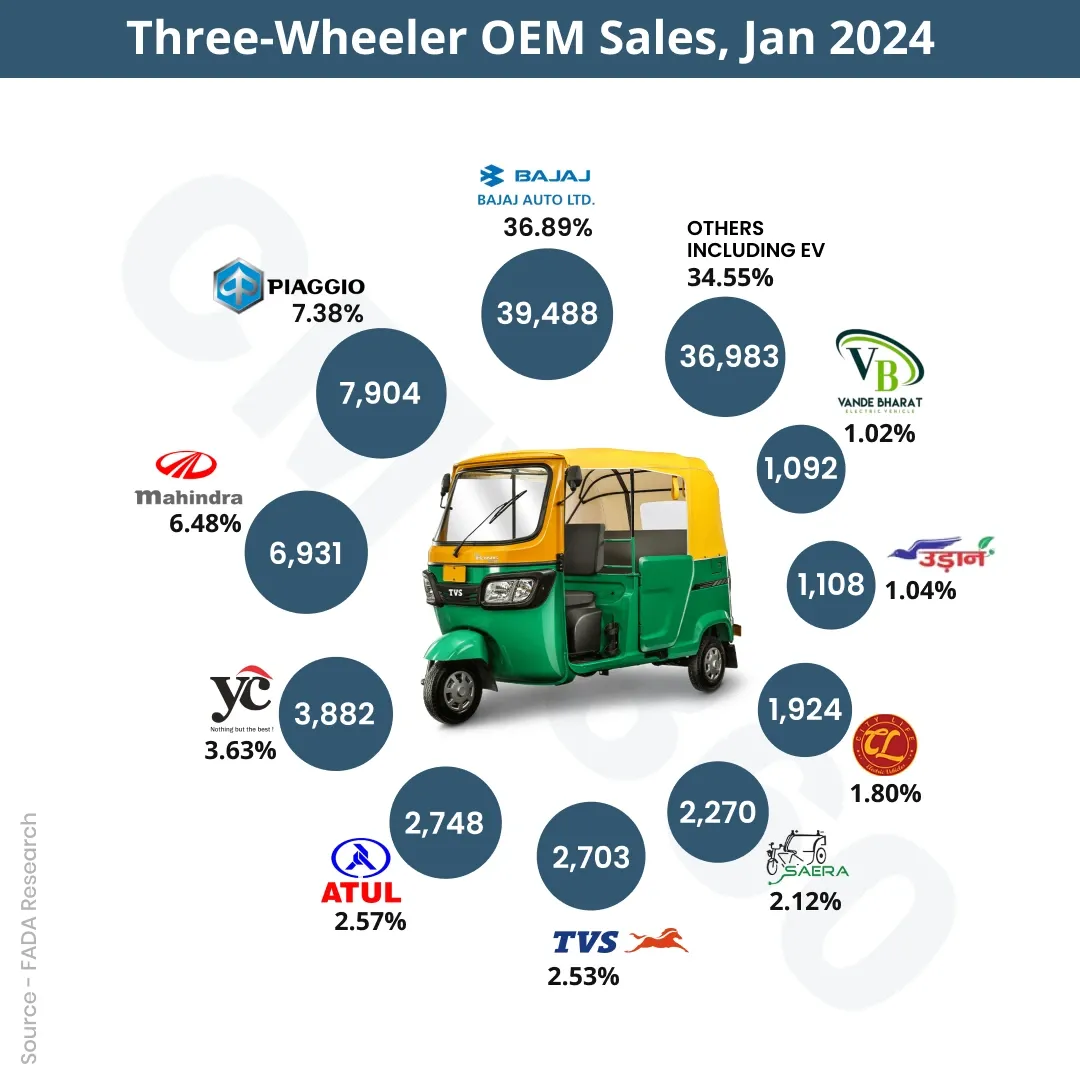

Three-Wheeler FADA Sales Report: OEM-wise Sales Analysis

In January 2025, the total three-wheeler sales reached 1,07,033 units, compared to 1,00,160 units in January 2024, showing a steady growth in the market.

OEMs-wise sales performance

Bajaj Auto Ltd remains the market leader with 39,488 units sold, capturing a 36.89% market share. Compared to January 2024, when it sold 37,148 units, Bajaj saw a rise in sales.

Piaggio Vehicles Pvt Ltd recorded a sale of 7,904 units, holding a 7.38% market share. However, its sales dropped from 8,271 units in January 2024.

Mahindra & Mahindra Limited sold 6,931 units, securing a 6.48% market share, showing growth from 5,316 units in January 2024.

YC Electric Vehicle sold 3,882 units in January 2025, holding a 3.63% market share, an increase from 3,375 units in January 2024.

Atul Auto Ltd improved its sales in January 2025, reaching 2,748 units, capturing 2.57% market share, compared to 2,078 units last year.

TVS Motor Company Ltd also showed growth with 2,703 units sold in January 2025, securing a 2.53% market share, rising from 1,840 units in January 2024.

Saera Electric Auto Pvt Ltd recorded a sale of 2,270 units in January 2025, with a 2.12% market share, slightly lower than 2,361 units in January 2024.

Dilli Electric Auto Pvt Ltd reported sales of 1,924 units in January 2025, holding a 1.80% market share, compared to 2,007 units sold in January 2024.

Unique International remained stable with 1,108 units sold in January 2025, having a 1.04% market share, similar to 1,114 units in January 2024.

Sahnianand E Vehicles Pvt Ltd saw an increase in sales, selling 1,092 units in January 2025, capturing 1.02% market share, up from 713 units in January 2024.

Others including EVs accounted for 36,983 units in January 2025, holding a 34.55% market share, compared to 35,937 units last year.

Also Read: FADA Sales Report December 2024: Three-wheeler (3W) sales decreased by 4.57% YoY

CMV360 Says

The three-wheeler market in India is growing well, especially in passenger and goods vehicles. Bajaj Auto is still the top seller, and Mahindra & Mahindra is also doing better. But e-rickshaw sales are going down, even with government support. Companies may need to make their vehicles more affordable and offer better loan options to attract more buyers.

News

Montra Electric Delivers India’s First PM E-DRIVE Certified Electric Heavy Truck

Montra Electric delivers India’s first PM E-DRIVE-certified electric heavy truck, Rhino 5538 EV, unlocking incentives up to ₹9.6 lakh and boosting clean freight adoption....

28-Jan-26 01:26 PM

Read Full NewsEicher Pro X EV Makes History by Completing Kashmir to Kanyakumari Journey, Sets Four National Records

Eicher Pro X EV completes the Kashmir to Kanyakumari journey under full load, setting four national records and proving electric trucks are ready for long-haul logistics ...

28-Jan-26 11:19 AM

Read Full NewsEKA Mobility and Chartered Speed to Deploy 1,750 Electric Buses in Bengaluru Under PM E-Drive Scheme

EKA Mobility and Chartered Speed will deploy 1,750 electric buses in Bengaluru under PM E-Drive Scheme, boosting clean public transport and supporting India’s urban elect...

28-Jan-26 10:19 AM

Read Full NewsVolvo Trucks Retains Europe’s Heavy-Duty Truck Market Leadership for 2nd Consecutive Year

Volvo Trucks retained its European heavy-duty market leadership in 2025 with 19% share, strong FH Aero demand, and a clear net-zero strategy for future growth....

27-Jan-26 09:47 AM

Read Full NewsAnand Kumar Appointed Head of Brand and Communications at Olectra Greentech

Olectra Greentech appoints Anand Kumar as Head of Brand, Marketing, Digital, and Communications to strengthen its position in India’s fast-growing electric mobility and c...

27-Jan-26 07:10 AM

Read Full NewsCMV360 Weekly Wrap-Up | 19–23 Jan 2026: Tata’s Biggest Truck Launch, Electric Bus Expansion, Clean Mobility Push, Farm Policy Changes & Market Relief

Key highlights from 19–23 Jan 2026: major truck launches, electric bus expansion, clean mobility progress, new tractor introductions, farmer policy changes, and market tr...

24-Jan-26 08:56 AM

Read Full NewsAd

Ad

Latest Articles

ICV vs HCV Trucks: Which Is More Profitable in 2026?

27-Jan-2026

Top 10 Electric Trucks in India 2026: Price, Range, & Payload

22-Jan-2026

Diesel vs CNG vs Electric Trucks in India 2026: Choosing the Right Truck for Your Business Needs

21-Jan-2026

Electric Commercial Vehicles in India 2026: Complete Guide to Electric Trucks, Buses, and Three Wheelers with Prices

19-Jan-2026

Top 5 High-Mileage Trucks in India 2026

16-Jan-2026

Top 10 CNG Trucks in India 2026: Best CNG Models

12-Jan-2026

View All articles