Ad

Ad

Commercial Vehicle Industry Growth to Slow Down in 2025, Says ICRA

Key Highlights:

- ICRA predicts a 4-7% drop in domestic CV wholesale volumes in FY2025.

- FY2024 saw 1% wholesale and 3% retail sales growth.

- The slowdown is due to the Model Code of Conduct and reduced infrastructure activities before the General Elections.

- OEMs' profit margins are expected to fall to 8.5%-9.5% in FY2025.

- Medium and heavy CV volumes may decline by 4-7%, and light CV volumes by 5-8% in FY2025.

The rating agency ICRA predicts that the domestic commercial vehicle (CV) industry in India will face a downturn in fiscal year 2025. Wholesale volumes are expected to drop by 4-7%. This forecast comes after a modest growth of 1% in wholesale and 3% in retail sales for fiscal year 2024.

Mixed Performance in FY2024

The industry saw strong growth in the first half of FY2024, but this was counterbalanced by a slower fourth quarter, which saw a 4% decrease in wholesale volumes. Contributing factors include the implementation of the Model Code of Conduct and slower infrastructure activities ahead of the General Elections.

Kinjal Shah, Senior Vice President and Co-Group Head at ICRA Ratings, noted that while there was significant growth in FY2022 and FY2023, the momentum slowed in FY2024. Shah expects a dip in FY2025 due to temporary economic slowdowns in certain sectors during the General Elections. However, replacement demand is expected to remain strong due to the aging fleet of vehicles.

Shah highlighted that conventional fuels, primarily diesel, dominate the CV industry, with over 90% penetration. Alternate fuels, including CNG, LNG, and electricity, make up 9%. Notably, electric vehicles have a higher penetration in buses and light commercial vehicles.

Long-Term Outlook

Despite the short-term decline, the long-term prospects for the CV industry are positive. Continued investment in infrastructure development, increased mining activities, and improved road connectivity are expected to drive future growth.

Financial Impact on Manufacturers

ICRA also forecasts a decrease in operating profit margins for CV manufacturers, projecting them to be 8.5%-9.5% in FY2025. This is due to lower volumes and increased pricing competition. FY2024 saw an improvement in profit margins due to high industry volumes, reduced discounting, and favorable commodity prices.

Capital expenditures are expected to rise to Rs 59 billion in FY2025, from Rs 37 billion in FY2024, mainly for product development and technology upgrades.

Segment-wise Trends

Medium and Heavy Commercial Vehicles (M&HCVs): Volumes are expected to decline by 4-7% in FY2025, influenced by a high base effect and election-related impacts. FY2024 saw a 4% growth in this segment.

Light Commercial Vehicles (LCVs): A decline of 5-8% is projected for FY2025 due to competition from electric three-wheelers and a slowdown in e-commerce. The segment saw a 3% decline in FY2024.

Bus Segment: Replacement demand for buses is expected to boost growth by 2-5% in FY2025, following significant traction in FY2024, surpassing pre-COVID levels.

Also Read: SUN Mobility and IndianOil Join Hands for Battery Swapping Network

CMV360 Says

The predicted slowdown in the commercial vehicle industry for 2025 reflects the sector's sensitivity to broader economic and political factors. While the short-term outlook appears challenging, the industry's long-term growth potential remains robust due to ongoing infrastructure development and technological advancements.

News

ElectriGo Launches Electric Bus Leasing in India, Partners with GEMS for 50 E-Buses

ElectriGo launches electric bus leasing platform and signs MoU with GEMS for 50 buses, boosting clean and cost-effective public transport adoption across India....

17-Dec-25 09:20 AM

Read Full NewsPM EDRIVE Delivers 1.13 Million EVs with Lower Subsidies, Shows Market Maturity

PM EDRIVE delivers 1.13 million electric vehicles with lower subsidies, showing India’s EV market maturity, rising adoption, regional trends, infrastructure push, and a s...

17-Dec-25 06:49 AM

Read Full NewsVolkswagen Starts E-Volksbus Electric Bus Deliveries in Brazil

Volkswagen begins delivering the e-Volksbus electric bus in Brazil, starting with São Paulo, offering 250 km range, high capacity, and full support for public transport o...

17-Dec-25 05:48 AM

Read Full NewsVolvo Adds 14-Tonne Variant to FL Electric Range with LFP Batteries

Volvo Trucks adds a 14-tonne FL Electric with LFP batteries, 200 km range, fast charging, and city-friendly design, strengthening its medium-duty electric truck lineup....

16-Dec-25 09:05 AM

Read Full NewsSwitch Mobility Tests Electric Double-Decker Buses on City Roads

Switch Mobility begins testing electric double-decker buses as MTC plans to reintroduce them under a pilot project with 20 e-buses, promoting clean urban transport....

15-Dec-25 09:35 AM

Read Full NewsCMV360 Weekly Wrap-Up | 8th–13th Dec 2025: CV & Tractor Sales Surge, EV Trucks & Electric Tractors Shine, EXCON 2025 Highlights, Three-Wheeler Growth & Kisan Mela Buzz

Weekly wrap-up highlights strong CV and tractor sales, EV momentum, major EXCON 2025 launches, rising rural demand, and India’s steady shift toward sustainable mobility a...

14-Dec-25 06:25 AM

Read Full NewsAd

Ad

Latest Articles

Ashok Leyland 1920 vs 2820 Tipper Comparison: 6-Wheeler or 10-Wheeler – Which Is Better for Construction & Mining?

17-Dec-2025

Tata Starbus Buses in India 2025: City, Suburban, Ultra & Staff Buses Models Explained in Detail

15-Dec-2025

Top 5 Tata Trucks for Business in India 2025: Prices, Payload, Features, Full Details & Complete Buying Guide

11-Dec-2025

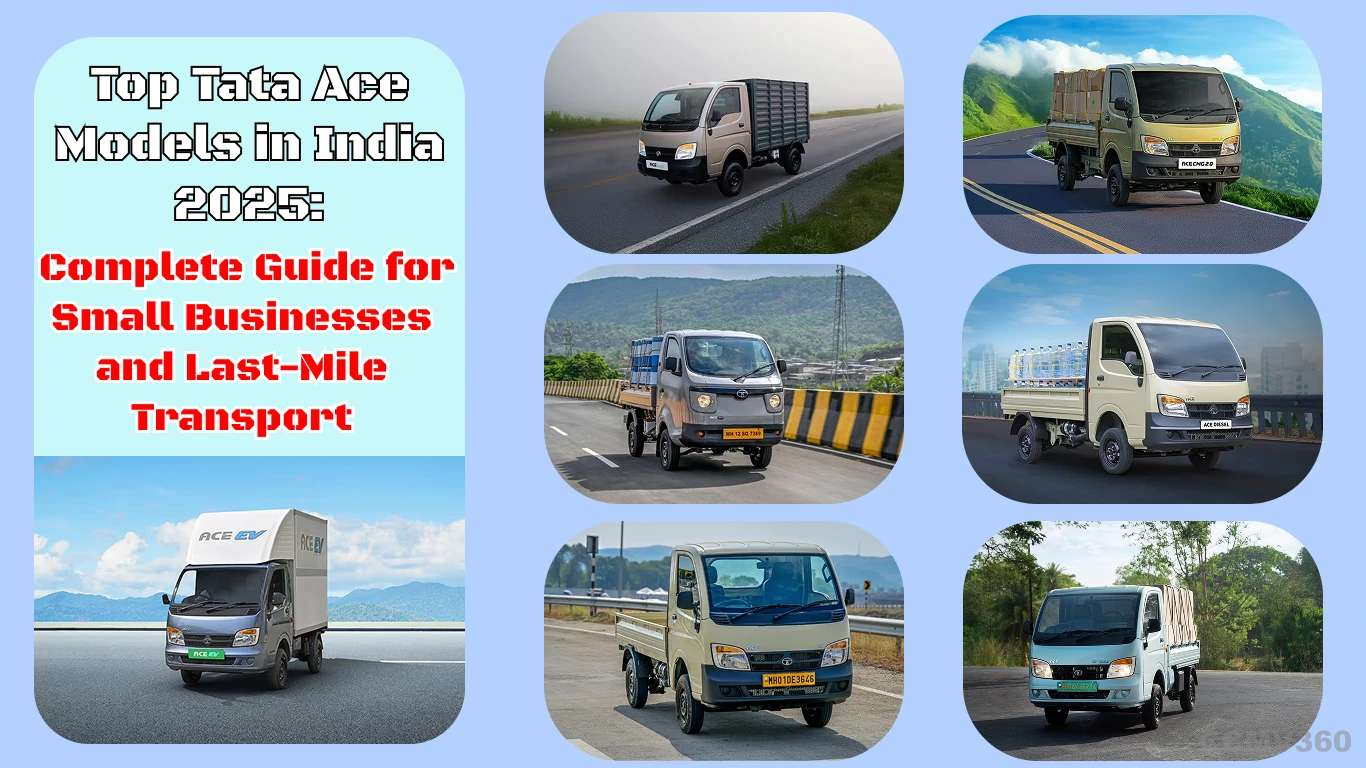

Top Tata Ace Models in India 2025: Complete Guide for Small Businesses and Last-Mile Transport

19-Nov-2025

Tata Ace Pro vs Tata Ace Gold: Which Mini Truck is Better for Your Business in 2025?

13-Nov-2025

Top 5 Buses in India 2025: Most Popular and Advanced Models for Comfortable Travel

06-Nov-2025

View All articles