Ad

Ad

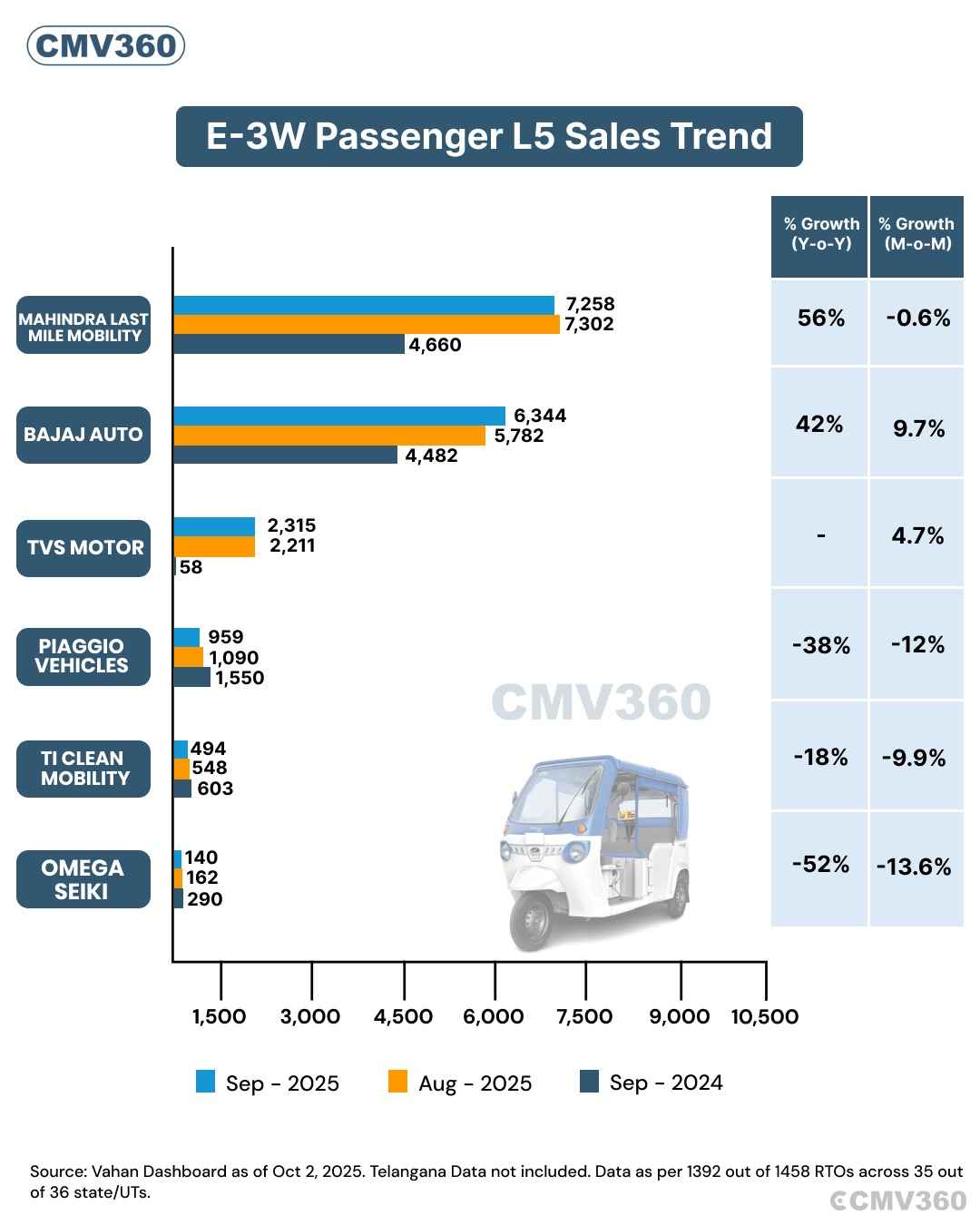

Electric Three-Wheeler Passenger Sales Report September 2025 Trends by OEM

Key Highlights

Mahindra Last Mile Mobility tops with 7,258 units, up 56% YoY.

Bajaj Auto follows with 6,344 units, registering 42% YoY growth.

TVS Motor continues a steady rise with 2,315 units and 4.7% MoM growth.

Piaggio Vehicles and TI Clean Mobility report sales declines.

Omega Seiki faces the biggest drop with -52% YoY and -13.6% MoM.

In September 2025, India’s electric passenger three-wheeler (E-3W) segment saw steady growth led by Mahindra Last Mile Mobility, Bajaj Auto, and TVS Motor. According to data from the Vahan Dashboard (as of October 2, 2025), Mahindra maintained its leadership position with 7,258 electric passenger vehicles registered, showcasing a strong 56% year-on-year increase despite a slight 0.6% monthly drop.

Electric Three-Wheeler Passenger Sales Data (September 2025)

OEM | Sep-25 Sales | Aug-25 Sales | Sep-24 Sales | YoY Growth | MoM Growth |

Mahindra Last Mile Mobility | 7,258 | 7,302 | 4,660 | +56% | -0.6% |

Bajaj Auto | 6,344 | 5,782 | 4,482 | +42% | +9.7% |

TVS Motor | 2,315 | 2,211 | 58 | - | +4.7% |

Piaggio Vehicles | 959 | 1,090 | 1,550 | -38% | -12% |

TI Clean Mobility | 494 | 548 | 603 | -18% | -9.9% |

Omega Seiki | 140 | 162 | 290 | -52% | -13.6% |

OEM-Wise Performance Breakdown

Mahindra Last Mile Mobility (MLMM)

Mahindra Last Mile Mobility continued its dominance with 7,258 units sold in September 2025, slightly lower than August’s 7,302 units. Despite the small month-on-month drop of 0.6%, the brand’s year-on-year performance surged by an impressive 56%, cementing its stronghold in India’s E-3W passenger segment.

Bajaj Auto

Bajaj Auto followed closely with 6,344 units sold in September 2025, up from 5,782 in August 2025. This marks a 9.7% month-on-month and 42% year-on-year growth. The company’s consistent upward trend highlights its growing consumer trust and expanding footprint in the electric mobility space.

TVS Motor

TVS Motor recorded 2,315 units in September 2025, up 4.7% from 2,211 units in August. While year-on-year growth data wasn’t available, the steady rise in monthly sales shows increasing acceptance of TVS’s electric passenger models in urban and semi-urban markets.

Piaggio Vehicles

Piaggio Vehicles registered 959 units in September 2025, down from 1,090 in August and 1,550 in September 2024. This reflects a 38% year-on-year and 12% month-on-month decline, indicating ongoing challenges in retaining market share amid rising competition.

TI Clean Mobility

TI Clean Mobility posted 494 units in September 2025 compared to 548 in August and 603 in the same month last year. The figures show an 18% year-on-year drop and a 9.9% month-on-month decline, signaling a need for renewed product and marketing strategies.

Omega Seiki

Omega Seiki faced the steepest fall, registering only 140 units in September 2025 compared to 162 in August and 290 last year. This translates to a 52% year-on-year and 13.6% month-on-month decline, highlighting significant pressure in the passenger E-3W market.

Also Read: Electric Three-Wheeler Goods Sales: September 2025 Trends by OEM

CMV360 Says

The E-3W passenger segment continues to expand with strong performances from Mahindra Last Mile Mobility and Bajaj Auto. TVS Motor’s consistent monthly rise adds to the competitive momentum, while Piaggio, TI Clean Mobility, and Omega Seiki face challenges amid the rapid market evolution. Overall, September 2025 showcased a clear growth trend for established players and rising opportunities in India’s electric passenger mobility sector.

News

Ashok Leyland Revives TAURUS and HIPPO with Next-Generation Heavy-Duty Technology

Ashok Leyland brings back TAURUS and HIPPO trucks with next-gen technology, powerful engines, and improved durability to meet India’s growing mining and infrastructure tr...

22-Jan-26 12:26 PM

Read Full NewsFinnfund Invests $15 Million in Transvolt Mobility to Boost Electric Heavy Vehicles in India

Finnfund invests USD 15 million in Transvolt Mobility to expand electric buses and trucks in India, supporting clean transport, job creation, and India’s sustainable mobi...

22-Jan-26 04:52 AM

Read Full NewsMahindra Launches Refreshed Bolero Camper and Bolero Pik-Up with New Features and Comfort Upgrades

Mahindra refreshes Bolero Camper and Pik-Up with bold styling, iMAXX telematics, air conditioning, and improved comfort, reinforcing its leadership in India’s pickup segm...

21-Jan-26 01:01 PM

Read Full NewsFresh Bus and Exponent Energy Partner to Deploy Rapid-Charging Electric Intercity Buses in India

Fresh Bus and Exponent Energy partner to deploy rapid-charging electric intercity buses, enabling long-distance travel with 15-minute charging and high-power infrastructu...

21-Jan-26 10:07 AM

Read Full NewsGreenCell Mobility Secures $89 Million to Rapidly Expand Electric Bus Network Across India

GreenCell Mobility raises $89 million to expand its electric bus fleet across India, boosting clean public transport, charging infrastructure, and zero-emission mobility ...

21-Jan-26 07:12 AM

Read Full NewsIndia Launches First Indigenous Runway Cleaning Machines to Boost Airport Safety

India delivers its first indigenous runway cleaning machines to Noida Airport, enhancing aviation safety, reducing imports, and bolstering 'Make in India' manufacturing i...

21-Jan-26 05:45 AM

Read Full NewsAd

Ad

Latest Articles

Top 10 Electric Trucks in India 2026: Price, Range, & Payload

22-Jan-2026

Diesel vs CNG vs Electric Trucks in India 2026: Choosing the Right Truck for Your Business Needs

21-Jan-2026

Electric Commercial Vehicles in India 2026: Complete Guide to Electric Trucks, Buses, and Three Wheelers with Prices

19-Jan-2026

Top 5 High-Mileage Trucks in India 2026

16-Jan-2026

Top 10 CNG Trucks in India 2026: Best CNG Models

12-Jan-2026

Popular Bus Brands in India 2026

08-Jan-2026

View All articles